Community Profile: Doing Business in Texarkana Sometimes Means Going Over the Line

Photo Gallery | Article

Photo Gallery

.

.

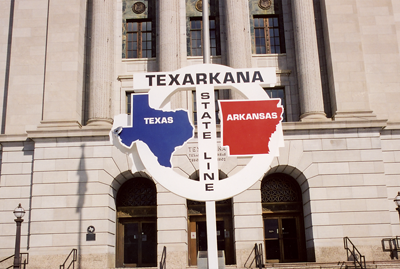

The Federal Building in downtown Texarkana straddles State Line Avenue. Half of the building is in Texas, the other half in Arkansas.

A close up of the sign that stands in front of the Federal Building in downtown Texarkana. Half of the building is in Texas, the other half in Arkansas.

If Minneapolis and St. Paul are the Twin Cities, then Texarkana, Ark., and Texarkana, Texas, can be dubbed the Siamese twin cities. Conjoined by a road running squarely through the heart of town, the cities are fused in a way that makes crossing between them nearly imperceptible to their combined 60,000 residents.

"In other twin-city situations, you see something like a river that provides separation, or maybe the cities are at least in the same state," says Robert Wright, city manager for Texarkana, Ark. "Here, it's different. As far as our residents are concerned, it is one place. At the same time, we operate under two sets of state laws, which sometimes makes things complicated."

Complicated, to say the least. In this community of two mayors, two city governments, two police departments and two fire departments, consider just some of the differences you face depending on which side of State Line Avenue you live on:

- If you want to pick up a case of beer, you can do so only in Arkansas. The Texas side is dry.

- Your personal property and real estate taxes are typically about 50 percent lower in Arkansas than in Texas.

- Looking for a job in manufacturing? You'll have better luck on the Arkansas side, which has a greater industrial presence. But for employment in a retail or service establishment, the opportunities in Texas dwarf those in Arkansas.

In general, the majority of Texarkana's economic development in recent years has occurred on the Texas side. But Texarkana, Ark., is hoping that a recent federally mandated change in the state's usury law will eventually enable it to claim a larger piece of the retail pie.

No Use for Usury

Forty years ago, most of the car dealerships in Texarkana were in Arkansas. Today, every one of them operates on the Texas side. Twenty-five years ago, Central Mall was slated to be built on the Arkansas side. But the anchor tenants were reluctant to locate in Arkansas; so, shoppers and mall rats can now be found in Texas. What caused these events to happen?

"It had to do with state laws that made it more attractive to do business in Texas than in Arkansas," said Robert E. "Swede" Lee, president and CEO of the Texarkana Chamber of Commerce, which serves both cities. "Those differences forced a migration to Texas."

The primary law Lee is referring to is Arkansas' long-standing usury law. Part of the Arkansas Constitution, this law was billed as protection for consumers. It put a cap on the interest rate that Arkansas-chartered banks and all finance companies in the state can charge. The cap is five percentage points above the Federal Reserve discount rate (the rate Reserve banks charge banks for short-term loans). Because of the cap, it is more difficult for these businesses to offer credit to people with blips in their credit history because the businesses can't afford the risk of default. To be able to offer higher-interest financing to a wider range of people, some Arkansas banks moved their home office to Texas, where no such usury restrictions exist. All of the car dealerships also packed up and moved across the border.

Recently, banks have been given relief from the usury law, thanks to the Gramm-Leach-Bliley Financial Modernization Act of 1999, which includes a provision permitting in-state banks to charge the same rate of interest as the home state of any out-of-state bank that has a branch in that state. For Arkansas banks, the change enables them to offer a greater number of customers access to credit.

"It allows for extension of credit for people with marginal credit histories who probably would have been declined a loan in the past," says Dennis Huffman, president of Commercial National Bank of Texarkana.

It is important to note that finance companies that maintain any kind of physical presence within Arkansas--whether headquartered or even with just a branch office--are still subject to the state's usury law. With the discount rate currently at its lowest level in more than 50 years, these companies are, in Lee's words, "dead in the water."

"Even if they eliminated the usury law completely in Arkansas, it would still be more beneficial to be in Texas versus Arkansas," says Todd Shores, president of McLarty Auto Mall. "Texas is just more of a progressive state. There are a lot of benefits to being here." For example, Texas has no corporate state income tax; Arkansas does.

Even though Lee estimates that retail sales in Texas triple the amounts on the Arkansas side, Arkansas is not completely bereft of major retail tenants or prospects. Wal-Mart considered closing its Texarkana, Ark., store after opening a supercenter in Texas. Instead, the company recently put the finishing touches on an expansion of its Arkansas store, turning it into a supercenter as well.

"I think that speaks pretty highly to the fact that there is some retail trade that's being captured in Arkansas," Huffman says. "Whether other significant retail develops there, who knows?"

If it does develop, landowners at the intersection of Interstate 30 and Jefferson Avenue hope it happens there. They have formed a partnership and are actively working to lure retailers to this last Arkansas exit before the state line.

Beyond Retail

An advantage Texarkana, Ark., holds over its like-named neighbor to the west is its enterprise-zone designation and the tax breaks associated with it. This is one reason why the area's three largest manufacturers are located on the Arkansas side, led by Cooper Tire and Rubber, which employs 2,000 people in Arkansas near the Maxwell Industrial Park. The company rolls out an average of 44,000 tires each day and has expanded the plant six times since opening in 1964.

Recently, it has been a challenge to lure new industries to town. Linda Crawford, vice president of economic development at the chamber, therefore concentrates on keeping close ties with employers, like Cooper, that already are here.

"Like most people, we've experienced a slowdown of projects and leads, and I don't know how long the recovery will take," she says. "So what we want to do is continue to work with our existing industries to make sure that if they plan to expand, they will do so in this area."

In the housing sector, things have been looking up in Texarkana, Ark., where large homes have sprung up throughout wooded acres on the northern edge of town. To be sure, there are advantages to living on the Arkansas side. Besides enjoying lower property taxes, residents of this area do not pay state income taxes.

This controversial exemption was passed in 1979 in order to level the playing field with the other side. As with corporations, Texas residents pay no state income taxes. Periodic attempts in the Arkansas Legislature to repeal the exemption have failed over the past two decades.

"I think that major residential growth is happening in Arkansas because people are finally getting comfortable that the income tax exemption is here to stay," Lee says.

Lee is one of several officials working to achieve another critical component to Texarkana's continued economic growth: the completion of Interstate 49 between Texarkana, Ark., and Fort Smith, Ark., 150 miles to the north. When completed, the interstate will run from Shreveport, La., to Kansas City, Mo., and connect with other interstates at each end to form a north-south route from the Canadian to Mexican borders. The Texarkana-to-Fort Smith stretch is the only piece that is not yet approved. Lee wants that part of the highway to be built as a toll road to help pay for costs, but the Arkansas Highway Commission opposes such a move and talks are, he says, at an impasse.

"The impact this highway would have on Texarkana will be dynamic," Lee says. "But to have a 150-mile gap in the middle of a highway means that you don't have a highway."

The Texarkanas' quirky geographical relationship has caused periods of cooperation and competition over the years. But sibling rivalry aside, these twin towns know the importance of supporting each other's interests in order to create economic opportunities.

"If you look at it on a balance sheet as a banker would, we have the assets of two communities," Huffman says. "But we also have the liabilities of two communities. There are times when it's a favorable atmosphere, and times when it is not. These days, I think everyone has the attitude of working together to move the community forward."

Texarkana, Ark., and Texarkana, Texas, both sides by the numbers

| Population as of 2000 | |

| Arkansas | 26,448 |

| Texas | 34,782 |

| Labor Force Dec. 2001 | |

| Arkansas |

17,400

|

| Texas | 38,313 |

| Unemployment Rate Dec. 2001 | |

| Arkansas | 4.1% |

| Texas | 4.3% |

| Per Capita Personal Income 1999 | |

| Arkansas | $19,305 |

| Texas | $22,992 |

| Top FIve Employers | |

| Red River Army Depot |

2,500

|

| Cooper Tire and Rubber Co. |

2,000

|

| Christus St. Michael Health System |

1,600

|

| Georgia Pacific Inc. (Maker of fine finished papers) | 1,400 |

| Wadley Regional Medical Center |

1,400

|

NOTE: Figures for labor force, unemployment rate and per capita personal income include all of Miller County, Ark., and Bowie County, Texas.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us