Community Ties: Does "Relationship Lending" Protect Small Banks When the Local Economy Stumbles?

Despite the bank-merger trend that continues to create ever-larger banking organizations, the vast majority of U.S. banks remain community banks. Although the precise definition is elusive, a community bank differs from larger regional and money-center banks in numerous ways. The primary difference is the community bank's focus on local businesses and depositors. Community banks are typically smaller banks; most have fewer than $500 million in assets. They are more prevalent in rural areas than urban areas, and they typically have simple organizational structures and limited branching operations.

Community banks are important intermediaries that fulfill different functions in the banking system than their larger counterparts do. Community banks, for example, provide important access to credit for small businesses. Such loans require more costly evaluation and monitoring than do loans to larger firms because access to information on the borrowing firms is limited. This so-called relationship lending is less costly at community banks because of the bankers' ability to assess credit quality through the intangible dimensions of a borrower, such as his or her reputation in the community.

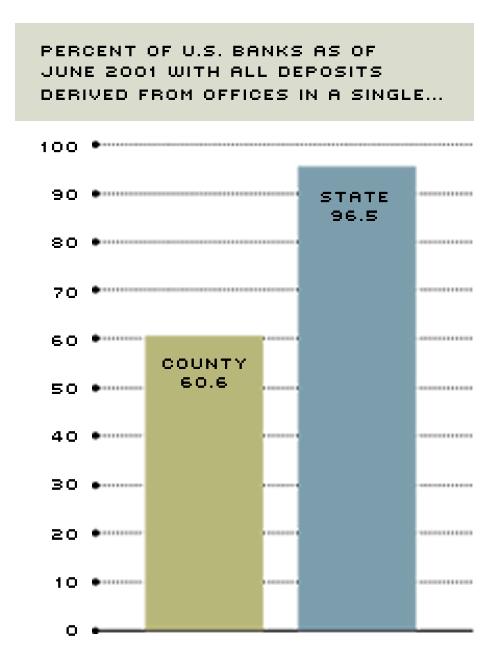

This very same aspect of community banking, however, creates the potential for increased risk. Banks that draw loans and deposits from their local markets may be vulnerable to local economic slowdowns precisely because they have locally concentrated loan and deposit customers. Though the concentration of loans is more difficult to measure, local concentration of deposits is prevalent. Indeed, as of June 2001, 61 percent of U.S. banks derived all of their deposits from offices in a single county, and 97 percent of banks derived all of their deposits from offices in a single state. (See Figure 1.) When local economic conditions weaken, many customers at small community banks are likely to be affected similarly, thus impairing the credit quality of many loans simultaneously. Additionally, these banks may suffer more-severe deposit runoffs than do banks with geographically diverse customers because of the local banks' reliance on concentrated sets of depositors.

The degree to which a local bank's performance is related to local economic performance is an important question for bank managers and supervisors. If geographic concentration leaves banks vulnerable to local economic swings, then bank managers may need to take steps to diversify their banks' exposures. Similarly, regulators may need to direct supervisory resources differently to focus more on the concentrated banks. Supervisors may also wish to focus on local economic data to help identify which banks might be in trouble or headed for trouble.

The Merit of County Data

A recent study by two economists at the St. Louis Federal Reserve, Andrew P. Meyer and Timothy J. Yeager, sought to address the degree to which county economic activity affects community bank performance.1 The authors selected a sample of more than 800 rural banks with $300 million or less in assets; all of the banks are headquartered in the Federal Reserve's Eighth District. Performance at these banks is more likely to be correlated with county economic data than at other banks because rural banks tend to lend to a relatively high percentage of firms and residents in their own counties.

To assess the degree of dependence between local economic activity and bank performance, the authors focused on the statistical correlation between four measures of bank performance and four measures of economic activity. The bank performance measures included adjusted return on assets (ROA), or net income plus provision expense divided by total assets; non-performing loans (90 days or more past due plus non-accruing loans) to total loans; net loan losses (losses less recoveries) to total loans; and other real estate owned (OREO) to total assets. OREO represents short-term holdings of real estate due to foreclosure. Lower values of ROA and higher values of each of the other performance ratios indicate deterioration in the bank's performance. The four measures of economic activity were the unemployment rate, employment growth rate, per capita income growth and personal income growth, both for the county and the state where the bank is headquartered.

The results were somewhat surprising. County economic data had little influence on bank performance, but state economic data exhibited strong relationships to the performance measures. For example, a one percentage point increase in the state unemployment rate increased non-performing loans by 17 basis points, whereas a one percentage point increase in the county unemployment rate had no effect on non-performing loans.2 These results suggested that small rural banks are not particularly vulnerable to local economic downturns. Additionally, the results suggested that county data are not helpful to supervisors in analyzing community bank performance. Banks in counties with rising unemployment rates, for example, will not necessarily experience deteriorating performance.

The weak relationship of bank performance to county-level data suggested the need to dig deeper. Perhaps some of the sample banks were already somewhat geographically diversified, operating in more than one county. We would expect performance at such banks to be less-correlated with local economic data. Excluding such banks from the sample yielded the same results. Perhaps many sample banks were owned and controlled by larger holding companies, which could make them less vulnerable to local measures. Again, excluding such banks from the sample yielded similar results.

Two criticisms, however, are more difficult to dismiss. First, banks may indeed be vulnerable to local downturns, but the county-level economic data are measured with large errors, masking the correlation between bank performance and local economic performance. If bad local economic data are responsible for the lack of correlation, bank managers and supervisors may erroneously overlook the real risks involved in operating a bank with geographically concentrated operations. In any case, the results of this study suggest that supervisors should not place much emphasis on county economic data to decide which banks to supervise more closely. A second criticism is that the Meyer-Yeager study looks at the average correlation between bank performance and economic data without regard for the intensity of the economic downturns. Perhaps community banks can weather small local economic downturns, but large shocks cause more serious problems.

What about Economic Shocks?

Does the lack of sensitivity of geographically concentrated banks to local economic data hold up for banks exposed to large local economic shocks? Preliminary research by Yeager suggests that it does. His study tracks the performance of a national sample of geographically concentrated banks operating in counties that experienced large negative local economic shocks. He measured an economic shock two ways, both using changes in the county's unemployment rate. Both measures are designed to recognize that equal-size changes are not equally significant. That is, an increase of two percentage points in the unemployment rate to 10 percent from 8 percent might be more severe than an increase to 6 percent from 4 percent. By choosing only counties with large and sudden changes in unemployment rates, this study avoids the criticism that noisy economic data are driving the results.

After identifying the quarter in which the economic shock first occurred in a given county, the author examined each bank's performance two years after the shock and compared that with performance of the bank one year before the economic shock. To control for regional and national business cycle trends, local bank performance is always measured relative to performance at comparable peer banks. About 20 percent of the banks showed significant erosion as a result of the local shocks.

A 20 percent response rate is quite high and seems to contradict the previous results, but this is not the end of the story. Yeager matched each bank that suffered an economic shock with a similar geographically concentrated community bank that was not exposed to local economic shocks, and he used the same shock dates as in the original sample to compare pre- and post-shock bank performance. Presumably, these matched banks should not suffer significant deterioration before and after the "no-shock" date. Yet, about 15 percent of the banks that did not have operations in counties that suffered economic shocks performed significantly worse two years after the "no-shock" date relative to one year prior to the "no-shock" date. Additional statistical tests cannot distinguish the "shock" and "no-shock" banks. This result suggests that the performance of geographically concentrated banks exposed to large local economic shocks is no different from the performance of geographically concentrated banks not exposed to such shocks. Why might this be?

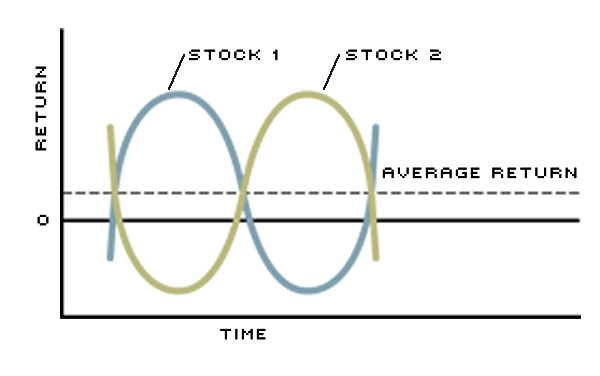

At any given time, banks' loan portfolios are exposed to both idiosyncratic and market risk. (More on portfolio theory.) "Idiosyncratic risk" is unique to each borrower. Factors include the quality of the firm's management, domestic and international competition, and so on. A default by a manufacturing firm because of a labor strike is an example of idiosyncratic risk. "Market risk" is the risk that the condition of the economy will negatively affect the firm's ability to repay the loan. Market risk can result from downturns in international, national, regional or local economies. A manufacturing firm that defaults on its loan because its income slows from the recession is an example of market risk. Because Yeager's bank performance measures control for national and regional market risk, fluctuations in community bank performance must be driven either by idiosyncratic risk or local market risk.

If local market risk were significant, performance of the community banks exposed to economic shocks would be systematically worse than performance of community banks not exposed to local economic shocks. We do not observe this pattern. On the other hand, if idiosyncratic risk were significant, the performance of some community banks would deteriorate, but the deterioration would not be linked specifically to local economic shocks. Indeed, this is the pattern that we observe.

Why Aren't Local Banks Locally Risky?

U.S. history has demonstrated that bank performance and the condition of national and regional economies are inextricably linked. The Great Depression, for example, wiped out thousands of banks. More recently, the collapse of real estate values in New England led to severe distress and numerous bank failures in that region of the United States. It appears, however, that community banks are not particularly sensitive to fluctuations in county economic performance.

Perhaps community banks were vulnerable to local economic shocks several decades ago, but advances in financial diversification reduced this vulnerability. Financial diversification occurs when a bank acquires loans or securities from outside its market area. Improved efficiency in credit markets means that almost any bank can engage in loan participations and sales. Additionally, collateralized mortgage obligations (CMOs), which are securities backed by a pool of mortgages, offer banks opportunities to diversify credit risk without altering their markets served. Community banks have become more active in these financial diversification strategies over the last several decades.

Another factor that may have reduced bank exposure to local economic markets is the broadening geographical scope of bank lending. When banks lend to borrowers outside their county boundaries, the banks are less vulnerable to county economic shocks. Economists Mitchell A. Petersen and Raghuram G. Rajan provide evidence in a 2000 paper that banks are lending to more-distant borrowers. Specifically, the distance between small firms and their banks grew from an average of 16 miles in the 1970s to 68 miles in the early 1990s. The authors attribute the change to reduced monitoring costs from advances in information and communication technology. Banks today can quickly obtain, store and retrieve information about a borrower's creditworthiness from third-party vendors. In addition, the quality of firms' internal financial statements have improved with time.

A third factor that may account for the insensitivity of bank performance to local economic conditions is the increased diversification of county economies. The Midwest, for example, no longer relies as heavily on manufacturing production as it did before the 1980s; the retail and service sectors have become increasingly important. Indeed, economists Jeffery W. Gunther and Kenneth J. Robinson argue in a 1999 article that increased industry diversification at the state level between 1985 and 1996 has led to a more stable lending environment for banks. Rural counties are also more diversified than they used to be. Such diversification reduces credit risk at local banks. Even if some of the firms in the county suffer financial distress, the local community bank may have enough other customers in strong financial condition such that the exposure to the distressed firm is small.

Conclusion: Sinking Is a Solo Performance

Despite relaxation of branching restrictions, most U.S. community banks are not well-diversified geographically. Surprisingly, such concentration of operations does not seem to pose large risks to these institutions. Community bankers typically know their customers better than bankers at larger organizations, and perhaps this knowledge of local people and local businesses offsets the exposure to local economic downturns. As a consequence, community banks seem to hang tight through the choppy waters of local economic downturns.

Though the vulnerability of community banks to local markets is low now, it is likely to decrease even further over time. As banks expand into other economic markets--either through mergers and acquisitions, by making loans to distant borrowers or by engaging in financial diversification--they will become even less dependent on local economic con-ditions. Credit risk, however, will remain in the form of idiosyncratic risk and regional and national market risk. As a consequence, successful community banks will continue to be those that make sound lending decisions regardless of where their loan customers reside.

Endnotes

- Meyer and Yeager (2001). [back to text]

- Meyer and Yeager, Table 3, p. 30. [back to text]

- In practice, one would compute geometric averages. We use arithmetic averages for simplicity. [back to text]

References

Gunther, Jeffery W., and Robinson, Kenneth J. "Industry Mix and Lending Environment Variability: What Does the Average Bank Face?" Federal Reserve Bank of Dallas Economic and Financial Review, Second Quarter 1999, pp. 24-31.

Meyer, Andrew P. and Yeager, Timothy J. "Are Small Rural Banks Vulnerable to Local Economic Downturns?" Federal Reserve Bank of St. Louis Review, March/April 2001, Vol. 82, No. 2, pp. 25-38.

Petersen, Mitchell A. and Rajan, Raghuram G. "Does Distance Still Matter? The Information Revolution in Small Business Lending." Working Paper 7685, National Bureau of Economic Research, May 2000.

Yeager, Timothy J. "Community Bank Performance in the Presence of County Economic Shocks." Working Paper, Federal Reserve Bank of St. Louis, January 2002.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us