How Healthy is the Banking System? Funneling Financial Data into Failure Probabilities

Along with most of the rest of us, U.S. commercial banks enjoyed the good economic times of the 1990s. Since 1992, the banking sector's average return on assets has easily topped the 1 percent benchmark that banking analysts apply to individual institutions as an indicator of healthy earnings. Recently, however, several indicators have pointed toward emerging weakness. For example, Standard & Poor's composite index of bank stocks has not kept pace with the S&P 500, meaning that publicly traded banks have not been performing as well as other publicly traded businesses. In addition, the yields on bank subordinated debt have risen relative to the yields on similarly rated corporate bonds, meaning that holders of sub debt perceive an increase in the likelihood of default. Finally, the business press has begun to note loan quality problems at large banks.1

Problems in the banking sector are not just a concern for bankers. Healthy banks are essential to the smooth operation of the economy. Commercial banks enhance economic efficiency by channeling surplus funds from household savers to business investors. Banks also serve as a key link in the chain that runs from the Federal Reserve to the macroeconomy. The Fed changes the level of bank reserves by buying and selling Treasury securities in the open market. Banks respond to changes in the level of their reserves by expanding or contracting their loan portfolios. A weak banking sector can limit the impact of monetary policy actions on the supply of credit and hamper the ability of bank-dependent firms to get credit. Indeed, in the early 1930s, nearly 9,000 banks failed, leading to a sharp contraction of the money supply and to a virtual dry-up of bank credit.2

Getting a Handle on Banking Conditions

Measuring the overall condition of the banking sector can be tricky. Because only large banks issue stock or subordinated debt that is actively traded in financial markets, trends in the prices of bank securities say little about the condition of small banks. Moreover, looking at accounting ratios—such as returns on assets or loan delinquency rates—can sometimes provide misleading signals because of the trade-off between bank risk and return. For example, a bank may choose to specialize in making high risk loans, meaning that it will suffer from a high number of bad loans, but will also enjoy high interest income. Looking at interest income or delinquencies in isolation does not, therefore, provide a complete picture of the bank's condition. To gauge the overall condition of the bank, it is necessary to combine various measures of risk and profitability into one measure. Summarizing these measures across the entire banking sector would then shed some light on overall banking conditions.

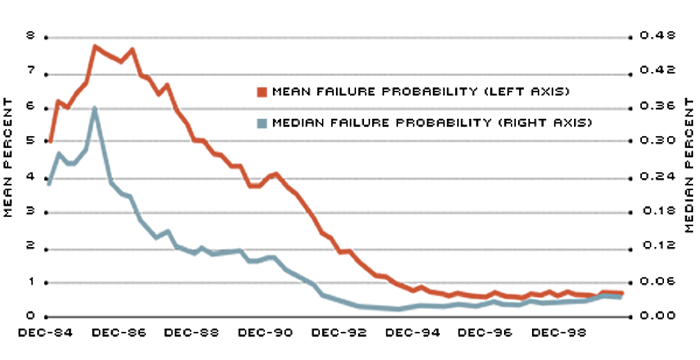

Statistical models are typically used in bank supervision to generate measures of overall bank conditions. Bank supervisors use these models to monitor the condition of individual banks between visits by bank examiners. The typical model incorporates accounting measures of credit risk, liquidity risk, capital protection and earnings strength to estimate the likelihood that a bank will fail in the coming years. Because failure prediction models have such a strong track record of detecting emerging problems, supervisors use them to increase exam frequency at selected banks and to plan regularly scheduled exams.3 Failure probabilities from these models can be summarized either by taking the average of all individual bank failure probabilities—the mean probability—or by selecting the middle number from a rank ordering of individual bank failure probabilities—the median probability. The accompanying chart tracks the mean and median failure probabilities since 1984.

Looking Back

The trends in mean and median failure probabilities suggest that banking conditions have been quite good for several years now. The mean failure probability rose to almost 8 percent in 1986 but has remained below 1 percent since 1994. In 1986, the median failure probability reached 0.36 percent but has stayed below 0.05 percent since 1992. The improvement in banking conditions since the early 1990s can be traced to several factors. For one thing, the U.S. economy enjoyed a long, robust expansion during the 1990s. Record economic growth and low unemployment kept mean and median failure probabilities down by boosting loan demand and interest income without increasing nonperforming loans. Another factor behind the low failure probabilities is the major shake-out that took place in the banking industry during the last decade when thousands of inefficient or poorly performing banks either exited the market or merged with larger, healthier institutions. In fact, the total number of U.S. commercial banks dropped steadily from 14,426 at year-end 1983 to 8,302 banks in the third quarter of 2000.

Where Do We Go from Here?

Although banking conditions appear strong by historical standards, the banking sector is still not immune to the effects of a weakening economy. If the economy continues to soften—as many forecasters predict—the downward trend in bank risk could easily reverse itself. During the 1990-91 recession, for example, the mean failure probability rose from 3.73 percent in the second quarter of 1990 to 4.08 percent in the first quarter of 1991. That said, banking conditions today are much stronger than they were prior to the 1990-91 recession. Indeed, the same 35 basis point increase in failure probabilities would bump today's mean probability to only 1.00 percent, which is still quite low by historical standards.

In short, despite some evidence of emerging weakness in banks and the prospect of an economic slow-down or outright recession, the banking sector as a whole seems much better equipped to weather adverse shocks than at almost any time in recent history.

How Has the Safety of the Banking System Evolved?

This graph charts the mean and median failure probability for all U.S. banks from 1984 to 2000. By these measures, the risk of failure peaked in the first quarter of 1986 and has fallen dramatically since then.

SOURCE: Board of Governors, System for the Estimation of Examination Ratings (SEER).

Endnotes

- See Kwan (2000) for more details on recent trends in bank performance and Matthews (2000) for an example of concerns about loan quality in the business press. [back to text]

- Bernanke (1983) describes the impact of the banking crises of the 1930s on access to credit. Friedman and Schwartz (1963) chronicle the link between bank failures and the contraction of the money supply between 1930 and 1933. [back to text]

- See Gilbert, Meyer, and Vaughan (1999) for a detailed comparison of econometric models and individual measures of bank risk and profitability. [back to text]

References

Bernanke, Ben S. “Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression,” American Economic Review (June 1983), 73(3), pp. 257-76.

Friedman, Milton and Anna Jacobson Schwartz. A Monetary History of the United States, 1867-1960 (Princeton: Princeton University Press, 1963).

Gilbert, R. Alton, Andrew P. Meyer and Mark D. Vaughan. “The Role of Supervisory Screens and Econometric Models in Off-Site Surveillance,” Review, Federal Reserve Bank of St. Louis (November/December 1999), 81(6), pp. 31-56.

Kwan, Simon. “Has Bank Performance Peaked?” Economic Letter, Federal Reserve Bank of San Francisco, 2000-32 (October 27, 2000).

Matthews, Gordon. “Specter of Another Rate Hike Stirs Credit-Quality Worries,” American Banker, (January 11, 2000), p.22.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us