The U.S. Trade Deficit: Sideshow To The "New Economy"?

The performance of the U.S. economy during the past decade has been universally hailed as stellar. Economic growth has been strong, unemployment has reached its lowest rate in over a generation, and inflation has remained relatively low. Many have gone so far as to declare that current conditions and future prospects represent a "new economy," in which these favorable trends might continue indefinitely.

One economic indicator that is often viewed with alarm, however, is the nation's growing trade deficit. In 1999, the U.S. trade deficit reached a record level. More important, it has been increasing as a share of the economy's total output. The broadest measure of the nation's trade balance, known as the current account, rose from 1.4 percent of GDP in 1990 to 3.7 percent in 1999.1

In both the media and popular opinion, trade deficits are often portrayed negatively, being blamed on either the unfair trading practices of our trading partners or a lack of U.S. competitiveness in world markets. Some have even suggested that the growing deficit of the late 1990s is so threatening that it forebodes the ultimate demise of the current economic expansion.

Under certain circumstances, growing trade imbalances might indeed be cause for concern. In the context of current economic conditions, however, there is reason to be more sanguine—the underlying causes of recent increases in the U.S. trade deficit can be traced to developments in technology and productivity trends that otherwise bode well for the future.

In fact, far from being a bellwether of doom, recent trade deficits can be interpreted as part of an important transition phase of the new economy.

The Determinants of Deficits

Deficits often are cited as either a cause or a symptom of economic weakness. The underlying implication of such a position is that selling is good, while buying is bad. When stated this starkly, the assumption loses much of its common-sense appeal.

In truth, deficits are neither causes nor symptoms of weakness, but are among the many economic indicators that are determined jointly by the decisions and interactions of households, firms and governments in the United States and abroad.

In fact, one of the fundamental forces behind the recent widening of our trade deficit has been the strength of the U.S. expansion compared with the growth rates of our major trading partners. As U.S. income growth outpaces growth abroad, our demand for both domestic goods and imports rises, while foreign demand for our exports languishes. This is one way in which a current account deficit reflects underlying strength in the U.S. economy.

Even more fundamentally, the trade balance reflects the outcome of the collective saving and investment decisions in an economy. When the residents of one country are buying more from abroad than they are selling, then they must also be borrowing to finance the shortfall. This basic accounting relationship means that a country's trade deficit is equal to its accumulation of debt to foreigners. In other words, a trade deficit emerges when there is an excess of domestic investment demand over available national savings.

To understand this relationship more intuitively, it is helpful to bear in mind that a trade deficit reflects an excess of purchases over sales. Just as is the case for a household or business that has current expenses that exceed current income, the difference must be financed through borrowing. Whether this borrowing is wise depends on what is being purchased. For example, a household that is continually running up credit card debt to finance current consumption, or a firm that is accumulating debt to cover operating losses, might well be following an unwise and unsustainable practice. On the other hand, when borrowing is undertaken to finance investments that will yield a flow of profits or services into the future, it can be a perfectly sound policy. The question of whether our trade deficit is good or bad similarly hinges on the questions of why we are borrowing from the rest of the world and what we are doing with the resources we are borrowing.

Deficits and the New Economy

With this analysis in mind, what can we say about the relationship between the widening trade deficit of the 1990s and the new economy?

Most explanations of the new economy are attributed, at least in part, to recent advances in technology. The notion is that these advances will yield productivity gains far into the future, raising the rate of economic growth.

As these new technologies are adopted and integrated into production processes, we would expect a period of increased investment spending. This is particularly true when the technological improvement is embodied in new types of capital goods, as is the case with many of the recent advances in computer and communications technology. This type of technological advance is likely to be associated with a sustained increase in investment as new equipment replaces old.

On the other side of the equation, the anticipation of continued strong economic growth might be expected to lower aggregate national savings. That is, higher growth prospects for the future create a wealth effect that boosts consumption demand at the expense of savings. After all, with the outlook so bright, there is less of an incentive to set aside a portion of income for the future.

These two implications of technological advance—a period of booming investment spending and sluggish savings—are consistent with the present situation in the U.S. economy. The rising trade deficit of the past decade has been accompanied by a sharp decline in savings and a surge in investment spending. Between 1992 and 1999, personal savings as a share of GDP fell from 8.7 percent to only 2.4 percent. Over the same period, real investment spending as a percent of GDP surged to an unprecedented rate of more than 18 percent, far exceeding the scale of previous investment booms.

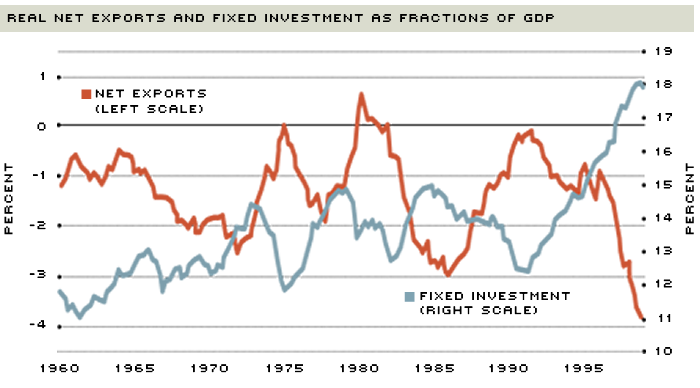

As shown in Figure 1, there is a clear tendency for large upswings in investment to be associated with widening trade deficits, and for troughs to be associated with surpluses, or at least smaller deficits. This is particularly true for the 1990s.

Borrowing from the Rest of the World to Finance Investment for the Future

Investment spending and the trade balance (measured here as net exports and fixed investment from the U.S. National Income Accounts) tend to move in opposite directions over time. As was particularly true during the 1990s, periods of rapid investment are associated with widening trade deficits. Larger trade deficits represent a source of financing for investment.

SOURCE: U.S. Department of Commerce, Bureau of Economic Analysis

The change in the composition of investment has also been remarkable: The share of investment in information processing equipment as a fraction of total equipment investment has been rising steadily since the mid-1970s and has increased dramatically during the latter half of the 1990s. By the end of the decade, this ratio was more than 40 percent.

Where Will It Lead?

A rising U.S. trade deficit is perfectly compatible with the notion that strong investment spending on new technologies is raising future growth prospects, suppressing domestic saving. The resulting "weakness" of the U.S. current account balance is, therefore, a reflection of an economy that is strong, but in transition.

The rising share of the U.S. deficit in the overall economy will eventually be reversed. The question of whether that reversal takes place as an orderly adjustment, or as a "crash and burn" scenario is crucial in evaluating the prospects for a continuing economic expansion.

Recalling the analogy to individual households or businesses, borrowing to finance frivolous consumption is a recipe for disaster, while borrowing to invest in assets that will pay off in the future is more likely to be a prudent course. The decline in the U.S. savings rate suggests that consumers are quite optimistic about the future, presumably because they expect that current investment will, in fact, pay off.

The ultimate benefits of adopting new technologies will become apparent only over the long term. Once the initial surge in investment demand subsides, it is likely that the rising U.S. trade deficit will show signs of reversal, suggesting that the economic expansion related to this transition has reached a more mature stage.

If these investments do pay off in future higher productivity and output growth, we will no doubt look back on this period as one in which the stage was set for a truly new economy.

Endnotes

- The current account includes the balance of trade in goods and services, net interest payments and unilateral transfer payments, such as foreign aid. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us