Bubble, Bubble Toil and Trouble: Asset Prices and Market Speculation

In July of last year, the Dow Jones Industrial Average hit a then all-time high of 9,337. About eight weeks later, it had fallen to a low of 7,615 before again turning around. By the end of 1998, the DJIA had rebounded to 9,181, a 16 percent year-over-year rise that capped eight consecutive years of gains—a phenomenal record. This stretch of gains is the longest in the DJIA's 103-year history. Moreover, these have been strong gains, averaging about 17 percent a year since 1991.

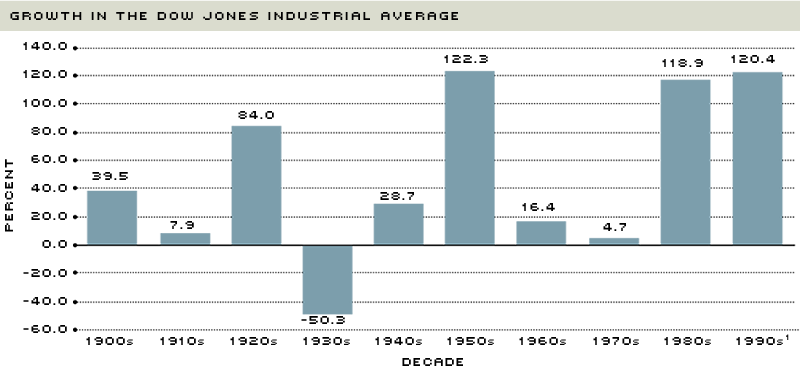

This run-up in the market has left many investors wondering whether the good times will continue. Some can't even remember what a bear market is, believing it to be a myth of generations gone by. Indeed, the DJIA has not posted two consecutive years of annual decline since the late 1970s. In the 1980s, the DJIA declined in only 1981 and 1984. Even the stock market crash of 1987 failed to stop the DJIA from ending the year up more than 2 percent, despite losing almost 25 percent of its value in one day. In fact, the last annual decline was in 1990, and that year involved a military buildup in the Persian Gulf region and a recession. From any perspective, the U.S. stock market has shown amazing resilience over time (see Chart 1).

The Running of the Bulls

Except for the 1930s (the peak of The Great Depression), the Dow Jones Industrial Average has grown each decade this century, sometimes robustly. The 1980s and 1990s have been exceptionally strong, with three quarters of a year still to go. This recent history has led many to wonder whether the surge will continue and whether the current economy is operating differently than preceding ones.

1Through year-end 1998

SOURCE: Dow Jones

The cause of this seemingly unending rise in stock prices is also of keen interest, especially to economists. Although several explanations have been proffered, the underlying controversy basically splits economists into two groups: those who believe the rise is justified by market fundamentals and those who do not. Clearly separating the two groups, though, is easier said than done, as much research has shown.1 To illustrate the argument, some background is needed.

There Really Is No Free Lunch

The term "assets" encompasses a huge array of tangible items of value that provide current and future economic benefits. When discussing assets, ordinary investors usually are referring to equities (stocks) and real estate. And often, it's the asset's price that is most discussed. Pricing real estate is probably the more straightforward of the two, as anyone who has ever bought or sold a house knows. The price of the house depends on the value of the land it sits on and the cost of building the structure. The price also depends on market conditions at, or near, the time of sale: Real estate agents and appraisers often examine "comps"—recent sales of similar houses in the neighborhood—to help them gauge current market conditions. The same could be said of buying and selling automobiles: People check "book" (resale pricing guides) values and scan newspapers to see what similar vehicles are selling for.

Other economic factors can also influence housing prices, including local amenities, school system caliber and relative proximity to the business district, for example. Improvements in any of these factors will raise real estate prices. Price increases that can be attributed to factors like these are said to be caused by market fundamentals since, according to economic theory, they directly affect market supply and demand.

Pricing equities is more difficult because stocks are really just claims for shares in the equity of the issuing firm. In other words, they entitle their holders to ownership rights in the firm, which allow stockholders to share in the profits (and losses) of the firm. This sharing in the equity of the firm is an important concept because it is the determinant of the stock's value.

Because stockholders know they will share in the firm's current and future profits, and because the profits constitute the firm's income, the stockholders must have expectations about how large (or small) these profits will be. These expectations will greatly shape the stock's price. In fact, the value today of all the current and future profits expected from a share of stock—where future profits are reduced (or discounted) to a current value—is its market price.2 This manner of calculating the share's price is known as its market fundamental. Any new information that becomes available about the company's current or future prospects for profits (or earnings) will change expectations and, hence, the stock price.

The interest rate used to reduce (or discount) the future profit stream can also affect the fundamental value of a stock. Future profits are discounted to current values because the stockholder has some expectation about how much income she will forfeit by purchasing this asset instead of another. The value of her next best investment alternative is known as her opportunity cost and is represented by the interest rate used to calculate the discounted value of the profit stream. Suppose, for example, that market interest rates increase. The potential income our investor is foregoing has now gone up—that certificate of deposit is paying more now than it was before, for instance. Accordingly, her opportunity cost has increased, implying that the interest rate she uses to discount the future profit stream is higher. This translates into a lower stock price because tomorrow's profits are worth less to her today.

Calculating asset values from market fundamentals is a method that's well-grounded in economic theory. The theory relies on two assumptions: 1) that individual agents act rationally; and 2) that markets operate efficiently. Agents acting rationally implies that stockholders will adjust their expectations in response to new information; markets operating efficiently implies that they will immediately incorporate new information into market prices. Suppose, for instance, that an investor learns a company's quarterly earnings were far below earlier projections. This news would lower her profit expectations, resulting in a lower current stock price. She has acted rationally. The investor would also know that the market would have already incorporated the news into the stock's price; that is, the market operated efficiently.

The concept of efficient markets also implies another principle, namely, that arbitrage opportunities do not exist. Arbitrage opportunities occur when assets that are perfect substitutes, or portfolios of assets that are perfect substitutes, are priced differently, which leads to riskless profit opportunities. For example, suppose a sandwich shop sells a bag of potato chips for 50 cents that a vending machine in the building across the street sells for 35 cents. An opportunistic person could buy bags of chips from the vending machine and sell them to sandwich shop patrons for, say, 45 cents each, pocketing the dime difference. This is an arbitrage opportunity.

The same situation can exist in asset markets. If a security has a perfect substitute—perhaps a portfolio of other securities that yields the same return—the two should be priced the same. If not, then an arbitrageur (the opportunistic person) will buy the lower-priced one and sell the higher-priced one (pocketing the profit) until the two prices are equalized. If markets are efficient, however, such opportunities will not exist. As recently stated in The Economist, "The deepest insight of financial economics is that markets are fairly 'efficient,' meaning that you can earn high returns only by taking big risks. There really is no free lunch."

What Goes Up, Must Come Down?

As many researchers have noted, asset prices are generally too volatile to be guided by fundamentals alone. In a 1981 article, for example, economist Robert Shiller argued that over the past century, U.S. stock prices have been five to 13 times more volatile than could be justified by new information about future dividends. Indeed, many economists believe that asset prices do move away from fundamentals sometimes. When this occurs, asset prices are believed to be driven by speculation, which is thought to cause speculative (or asset price) bubbles.

Examples of speculative bubbles abound in the literature, but two of the most famous are the stock market crashes of 1929 and 1987.3 Even today, some economists maintain that the strong performance of the U.S. stock market in recent years is being caused by a bubble, rather than changing fundamentals. Federal Reserve Chairman Alan Greenspan is arguably the most prominent of those contributing to the discussion. In a now-famous speech he made in December 1996, Greenspan mused, "But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions...?" Rising markets immediately hesitated on this remark, mulled it over for a week or two, and then promptly disregarded it. The DJIA closed the year up 28 percent in 1996 and 20 percent in 1997.

It was up another 16 percent in 1998, even after Greenspan again suggested in September that the market likely contained a bubble. At that time, he commented that wavering confidence due to uncertainty about the future occasionally leads to "less-disciplined evaluations, which foster price volatility and, in some cases, what we term market bubbles—that is, asset values inflated more on the expectation that others will pay higher prices than on a knowledgeable judgment of true value."

Terminology can be loaded, though. The term "bubble" necessarily implies a negative outcome since it conjures up images of, well, bubbles, which inevitably burst. This image is exactly what some economists want to avoid because it foreshadows ominous consequences. To others, though, it's precisely the image they intend, and probably the reason the term was chosen. Economists Stephen LeRoy and Christian Gilles found that the term "bubble" originally applied to a stock of "unsound commercial undertakings, the shares of which were 'blown up by the air of great words.' The companies typically offered nothing for sale but the prospect of future dividends, sometimes not easily distinguished from hot air."

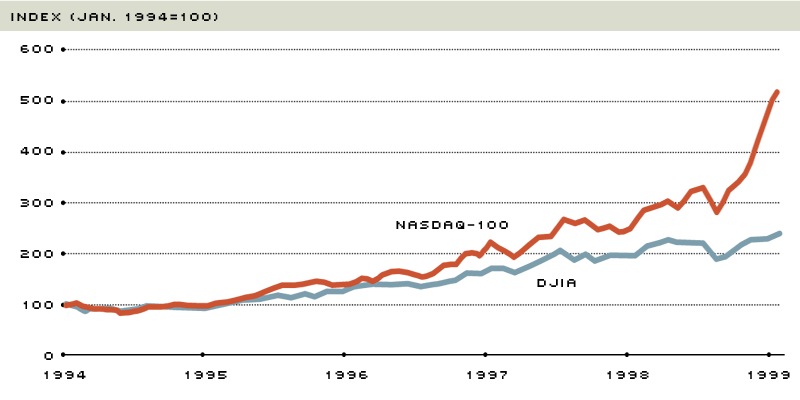

These words ring as true today as they did more than a hundred years ago, when they were first uttered. Referring to the recent run-up in the stock prices of several Internet-based companies, the Jan. 25, 1999 cover of U.S. News and World Report exclaimed: "The Internet Stock Bubble: When Will It Pop?" One company's stock, for example, which sold for $18 a share in its initial offering in July 1998, soared to $285 a share in mid-January before falling to about $140 a share about a week later. Similar stories for other Internet-based companies abound (see Chart 2). The common denominator is that all but one of the companies has yet to earn a profit. In other words, the fundamentals don't support the stock prices.4

Are Technology Stocks Entering the Cybersphere?

As Internet and computer/technology companies have taken off, so have their stock prices. The NASDAQ-100 Index, which includes many such companies, reflects this. This index is now more than five times its level in early 1994 and has recently pulled well ahead of the Dow Jones Industrial Average. Some believe, though, that this growth spurt will be short-lived if it's truly a bubble.

SOURCE: Dow Jones and NASDAQ

A sharp drop in an asset's price, though, doesn't always mean that a bubble burst. Some asset prices might already have a degree of speculation built into them. Today's price of oil, for instance, depends mildly on the chance that a petroleum substitute that would noticeably reduce the scarcity value of oil will be developed. A sharp decline in the price of oil could, therefore, be related to new information about the development of such an alternative. But without any such new information, economist Joseph Stiglitz has argued, it seems reasonable to interpret marked price declines as the breaking of a bubble.

Smoke and Mirrors?

In their effort to explain the existence of market bubbles, some economists have proposed that bubbles may, in fact, be rational. Suppose, for example, that investors discern that stock prices are diverging from their fundamentals and are instead being driven by factors unrelated to fundamentals. Investors thus realize that a bubble exists and that it will burst, but don't know when it will burst, only that it could burst today. Accordingly, investors are accepting a higher-than-normal risk by holding the stock another day and, consequently, demand a higher return—a rational response. That said, there is no compelling evidence in the literature that rational bubbles exist. Even if they do, however, there is still an important weakness in the theory: It doesn't explain what circumstances give rise to the bubbles in the first place, or what events lead to their eventual collapse.5

More often than not, bubbles seem to form because a group psychology overcomes investors, who start making decisions based on a perceived frenzy, rather than changes in fundamentals. And when people start making investment decisions on "hot" tips or the prognostications of Wall Street gurus, something other than fundamentals is likely driving the market. Economists Andrei Schleifer and Larry Summers refer to these types of traders as "noise" traders. At times, though, it's not a "hot" tip, but rather a "popular model" that drives these noise traders.

In a 1990 article, Robert Shiller detailed the results of regional surveys he and several colleagues conducted after the stock market crash of 1987, and during the real estate booms of the late 1980s. In almost all cases, respondents reported that they believed the markets were overpriced, and often said that they acted on intuition or gut feelings. When describing their behavior before the stock market crash, respondents said they reacted to what they believed other investors were likely to do. Thus, a "popular model"—doing what others are doing just because they are doing it—was guiding investors. For example, 75 percent of California respondents agreed with the statement: "Housing prices are booming. Unless I buy now, I won't be able to afford a home later." (Housing prices increased roughly 20 percent between 1987 and 1988 in many California cities.) Only 28 percent of Milwaukee respondents agreed with the same statement. (Housing prices were unchanged there.) What seems to matter, then, is not whether "hot" markets are actually fads, but instead whether investors think they are fads, thus contradicting economists' assumption of rational agents. In such cases, prices are high today only because investors believe that prices will be high tomorrow, not because the fundamentals support these levels.

When confronted with such evidence, defenders of the rational agents hypothesis face an intriguing dilemma because they presume investors must be reacting to new revelations for such price movements to occur, even though investors themselves assert they are reacting to gut feelings. The defenders further argue that the revelations, while subtle and not easily discerned by economists or other outside observers, are recognized by market participants. Given the magnitude of price changes that occur in a given day, however, it seems unlikely that they could all be caused by reactions to new information. One is hard-pressed to imagine what news could have caused the stock market crash of 1987, for example.

Another interpretation of rationality has been proposed, however. In a 1993 article, economist David Romer suggested that market agents do not have complete information about fundamentals, but instead have only useful pieces of information. They would have a complete picture collectively, but have trouble reliably informing other investors about one's own tidbits. Romer therefore argues that, at times, the price changes themselves act as the messengers of this information. He writes: "Asset prices can change because initially the market does an imperfect job of revealing the relevant information possessed by different investors and because developments within the market can then somehow cause more of that information to be revealed." Thus, changes in investors' opinions about market conditions are rational to act upon because they, too, reveal objective information previously unknown to other market participants. In a nutshell, Romer's interpretation suggests that, when investors claim to be reacting to "intuition" or a "popular model," they are in fact acquiring important, objective information from others' behavior that is relevant to their own investment decisions.

The All-Elusive Proof

Despite numerous attempts to explain movements of asset prices, economists have had an extremely difficult time proving to a statistical certainty that sudden, sharp drops in asset prices are the upshot of bursting bubbles. Although there appears to be consensus that bubbles have existed, the controversy centers on whether market participants were aware of them at the time. Hindsight is admittedly 20/20, but it's the expectations and perceptions during an episode that ultimately drive investment decisions.

Part of the problem in testing data for evidence of bubbles is that the tests are not always specific enough, forcing researchers to carefully rule out alternative explanations of rapid price changes to prove that a bubble existed. This is exactly what economists Peter Rappoport and Eugene White did to assert that the crash of 1929 resulted from a bubble.6 The two even found evidence suggesting that, prior to the crash, market participants knew a collapse was in the offing. Other economists, like Robert Flood and Peter Garber, charge that such evidence is suspect because the statistical tests used cannot distinguish between a bubble and a change in the way market fundamentals might affect asset prices.

The issue is not easily resolved. Perhaps what's most important, though, is that investors are aware of when fundamentals are no longer driving asset prices. Anecdotal evidence seems to suggest that currently they are not—at least in some market sectors. For researchers, though, anecdotes aren't enough. To those economists persuaded of their presence, bubbles challenge the foundations of economic theory because they contradict the underlying assumption of rational agents, upon which economic models are based. To those not persuaded of their presence, market phenomena like the Great Depression, the stock market crash of October 1987, and other apparent bubbles demand and await persuasive explanations.

Endnotes

- Much of this research is focused on the possible causes of stock and real estate market crashes. The volume edited by Eugene White (1996) contains an excellent collection of articles on this issue. [back to text]

- Because most people would rather receive a dollar today than tomorrow, tomorrow's dollar is not worth as much to them today. In fact, rather than wait for the dollar tomorrow, they might be willing to accept instead, say, 90 cents today. The 90 cents is known as the current (or discounted) value of tomorrow's dollar; the 10 percent given up is known as the discount rate. [back to text]

- There is another branch of the literature that argues these crashes and other supposed bubbles were not bubbles at all, but simply the result of investors' rational reactions to news about changes in market fundamentals at the time. The volume edited by Robert Flood and Peter Garber contains several articles supporting this view. [back to text]

- Shareholders, though, clearly have very high expectations for the firms' profit prospects. [back to text]

- See Weller (1992) for a more detailed (and technical) explanation of rational bubbles. [back to text]

- The articles by Rappoport and White can be found in White's edited volume. [back to text]

References

Flood, Robert P., and Peter M. Garber, eds. Speculative Bubbles, Speculative Attacks, and Policy Switching (Cambridge, Mass: The MIT Press, 1994).

Greenspan, Alan. "Question: Is There a New Economy?" remarks at the University of California, Berkeley (September 4, 1998).

__________. "The Challenge of Central Banking in a Democratic Society," remarks at the American Enterprise Institute for Public Policy Research, Washington, D.C. (December 5, 1996).

Holstein, William J., and Jack Egan. "Pop?" U.S. News and World Report (January 25, 1999), pp. 42-8.

LeRoy, Stephen F., and Christian Gilles. "Asset Price Bubbles," entry in New Palgrave Dictionary of Money and Finance (1992), pp. 74-6.

Romer, David. "Rational Asset-Price Movements Without News," American Economic Review (December 1993), pp. 1112-30.

Shiller, Robert J. "Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?" American Economic Review (June 1981), pp. 421-36.

__________. "Speculative Prices and Popular Models," Journal of Economic Perspectives (Spring 1990), pp. 55-65.

Shleifer, Andrei, and Lawrence H. Summers. "The Noise Trader Approach to Finance," Journal of Economic Perspectives (Spring 1990), pp. 19-33.

Stiglitz, Joseph E. "Symposium on Bubbles," Journal of Economic Perspectives (Spring 1990), pp. 13-18.

"The Unbearable Lightness of Finance," The Economist (December 5, 1998), pp. 83-4.

Weller, Paul A. "Rational Bubbles," entry in New Palgrave Dictionary of Money and Finance (1992), pp. 271-73.

White, Eugene N., ed. Stock Market Crashes and Speculative Manias. The International Library of Macroeconomic and Financial History, no. 13 (Brookfield, Vt: Edward Elgar Publishing, 1996).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us