How Susceptible is the United States to the Asian Flu?

The financial straits that many East Asian countries find themselves in have received an extraordinary amount of attention lately. Because the roots of these developments run deep and intertwine, any explanation will inevitably fail to fully explain what transpired. Still, it appears that a significant part of this situation can be attributed to a flight of financial capital spurred by a crisis of investor confidence in the ability of these nations to implement needed domestic financial and political reforms. Although the situation is still evolving, and in some ways improving, many economists believe that the forces unleashed by these developments will adversely affect the U.S. economy. But is this necessarily so?

Diagnosis

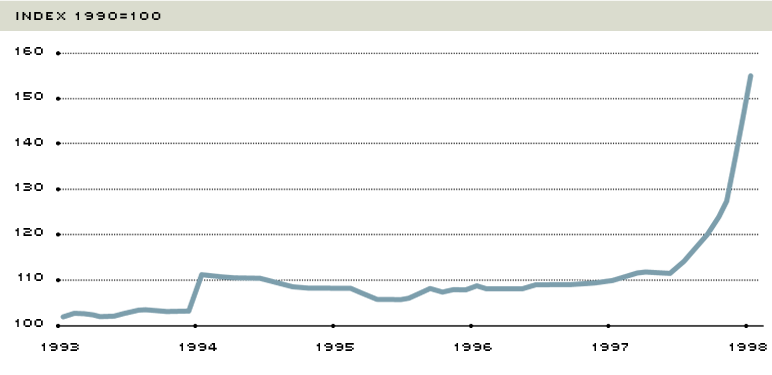

Events in Asia began to make headlines last year when Thailand's currency—called the baht—lost about a quarter of its value against the U.S. dollar between late June and the middle of July.1 Eventually, this loss of confidence—if it may be called that—extended to the currencies of several other East Asian nations, including the Malaysian ringgit, the Philippine peso and the South Korean won. Incredibly, between late July 1997 and early February 1998, the Indonesian rupiah had lost more than 80 percent of its value against the dollar. As the accompanying chart shows, over the last half of 1997, the dollar rose by almost 28 percent against a basket of selected Asian currencies; against a larger basket of 131 currencies, the dollar rose by about a third as much—9.5 percent.

The Value of the U.S. Dollar Against Selected Asian Currencies*

*China, Hong Kong, Indonesia, Korea, Malaysia, SIngapore, Taiwan and Thailand

SOURCE: Federal Reserve Bank of Dallas

Currency movements of these magnitudes are usually the byproduct of unsound domestic policies. In many Asian countries, several observers have remarked that "crony capitalism" is what lies at the heart of the problem, meaning that a considerable percentage of the foreign financial capital that flowed into Asia was directed at the behest of state bureaucrats, rather than market forces. The situation was further exacerbated by lax oversight of the financial system—oversight that failed to deal promptly with bad loans.2

Because most of these countries are heavily dependent on international trade, a sharp decline in the price of their traded goods ultimately means a loss of purchasing power. In other words, less income (from exports) is available to purchase imported goods, which are now also more expensive because of their depreciating currencies. Thus, many of these countries expect to see their real consumption cut substantially.

There are myriad other avenues through which the Asian currency crisis can affect the U.S. economy. Of these, two effects have received the most attention. The first, not surprisingly, is through international trade; the second is through the U.S. price level. The prevailing view seems to be that the former will be detrimental to the United States, while the latter will be beneficial. Conventional wisdom, however, suggests that the net effect will be negative.

Trade Influenza?

Americans buy a considerable amount of goods from Asia—everything from cars to clothes to computer chips. At the same time, U.S. firms ship a large amount of merchandise to Asia, including airplanes, chemicals, machinery and agricultural products. Altogether, U.S. merchandise trade with Asia accounts for about a third of total U.S. trade (exports plus imports). Japan is the region's largest U.S. trading partner, making up about 13 percent of total trade, with China (at about 5 percent) and South Korea (at 3 percent) farther back in terms of importance. Clearly, then, economic stresses in Asia have the potential to disrupt economic activity in the United States. But by how much?

The flow of goods and services across countries depends on several factors. The most important of these factors is the price of goods, which is influenced by foreign-exchange movements.3 To see this, consider how a change in the value of the dollar-won exchange rate would affect the dollar price of a personal computer made in South Korea and sold to a U.S. retailer for 1 million won. If the prevailing exchange rate is 750 won to the dollar—which is about where it was at the beginning of 1996—then the initial price of the computer to the retailer would be about $1,300 (1 million divided by 750). If the dollar appreciates (or the won depreciates) to 1,700 won—which is roughly where it stood in early 1998—then the cost of the computer falls to about $600 (1 million divided by 1,700).

But a change in the dollar's value also affects the prices of U.S. goods that are shipped to South Korea. In this case, U.S.-produced computers sold in Korea would now be roughly twice as expensive as before.4 In addition, the stronger dollar may result in fewer exports of U.S.-made computers to countries in which both countries' computers are sold—say, in Europe. The expected result of a dollar appreciation is lower U.S. net exports (meaning more imports and fewer exports).5 In an accounting sense, then, the Asian currency crisis is expected to reduce the growth of real GDP—perhaps by as much as half a percentage point or more this year, according to several forecasts.6

This estimate, however, should be viewed cautiously for several reasons. For starters, if the U.S. dollar was depreciating against the Canadian dollar and the Mexican peso at the same time it was appreciating against the won, we would expect to see lower U.S. net exports to South Korea, but increased net exports to Canada and Mexico. Thus, declines in the dollar against the currencies of other important trading partners may potentially offset the dollar's recent strength against Asian currencies. Furthermore, many firms minimize risk through binding trade contracts, which may prevent them from seeking out cheaper alternatives in the short run. In light of all these considerations, it seems reasonable to assume that predicting future trade flows in the face of considerable uncertainty is a risky endeavor.

Is a Strong Dollar Bad Medicine?

Because of its potentially adverse effect on a nation's trade balance—and thus employment in those industries that either produce for the international market or compete with imports—many analysts believe that a stronger dollar bodes ill for the United States. But a strong currency suggests that the monetary and fiscal authorities are following reasonably sound macroeconomic policies, leading to rates of return on investment goods and financial assets that exceed those of other countries. Conversely, a weak currency is usually the byproduct of an anemic economy wracked with high and rising inflation. Moreover, a strong dollar acts as a control on costs, forcing exporting firms to boost sales through efficiency gains and product innovations, rather than simply through lower prices.

The outcome of a strong dollar that has received the most attention, though, is its effect on the prices of goods and services consumed by U.S. residents. Specifically, many analysts assert that the stronger dollar will lower the U.S. inflation rate, thereby enhancing the purchasing power of U.S. citizens. In fact, some analysts go so far as to insist that, with inflation already at fairly low rates, outright deflation is possible. That outcome is exceedingly unlikely.

For several reasons, a flood of cheap imports will probably cut the U.S. inflation rate very little—if at all. First, more than half (about 60 percent) of the consumer price index—the basket of goods and services used to measure the inflation rate—is made up of non-traded items (largely services). This means that, while currency movements will have some effect on the prices of goods like camcorders and automobiles, they will have virtually no effect on housing prices—the largest CPI component—or the prices of medical services, for example. In any event, with imports of consumer goods and services accounting for only 8 percent or so of total consumption expenditures, the inflation effect is likely to be small.

Second, unless the dollar continually appreciates, these price declines are one-time events. Moreover, if these Asian currencies begin to retrace part of their initial declines as their economies recover and their financial markets stabilize, the effects could begin to work in the opposite direction. Finally, and most important, it's crucial to remember that inflation ultimately is a monetary phenomenon determined by domestic factors. This means that today's inflation rate is largely a function of past money growth rates. It follows, then, that tomorrow's inflation rate will mostly be determined by today's monetary policy; exchange rate movements can have only small, temporary effects on it.

Prognosis

It's not entirely clear to what extent—if any—the evolving situation in Asia will harm prospects for U.S. economic growth this year. Although there will probably be some impact on U.S. trade flows and on the prices of imported goods, the magnitude of that impact is uncertain at this time. Clearly, it is unwise to ignore the effects produced by events that have the potential to inflict some economic harm. That said, judging the effects of events that are still unfolding is difficult to say the least.

Endnotes

- At the time, Thailand was operating a dollar peg by keeping the value of the baht tied to the U.S. dollar. When the dollar rose to a level that the Thais could no longer feasibly support, they were forced to abandon the peg and thus let their currency "float," meaning the day-to-day value was determined in the foreign exchange markets. [back to text]

- See Krugman (1997). [back to text]

- Other factors also come into play, including how sensitive firms and individuals are to changes in the price of the good and what, if any, deterioration in overall economic growth is expected. [back to text]

- In reality, the change in the price would be more complicated than this because the Korean computer maker might use parts imported from the United States. If so, then the decline in the price of the computer would not be as much because the U.S.-made components would now be more expensive to the Korean producer. [back to text]

- It is possible that the trade balance will not worsen in the short run because the United States is buying the same goods at a cheaper price in dollars. In other words, the total value (price times quantity) purchased may be less than before the appreciation. [back to text]

- In the National Income and Product Accounts (NIPA) system, increased exports (U.S. production) increases GDP growth, whereas increased imports (foreign production) reduces GDP growth. [back to text]

References

Federal Reserve Board. "Testimony of Chairman Alan Greenspan Before the Committee on Banking and Financial Services, U.S. House of Representatives," January 30, 1998.

International Monetary Fund. World Economic Outlook: Interim Assessment, World Economic and Financial Surveys (December 1997).

Krugman, Paul. "What Ever Happened to the Asian Miracle?" Fortune (August 18, 1997), p. 26.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us