Will That Be...Cash, Check, Charge or Smart Card?

"We're about to see another revolution similar to the Industrial Revolution."

—James G. Cosgrove, vice president, AT&T

"Do not get caught up in the PR hype in the press."

—Scott Cook, chairman, Intuit Inc.

The quotes above represent just two of the many divergent views about electronic currency. Using "money" stored electronically on a microchip embedded in an ATM-like card is supposed to change the way consumers and merchants carry out transactions. No longer will a person have to fumble for change at the bottom of a purse or find that a dollar bill is too ratty for a vending machine to accept it. The new "smart cards," as they are known, will purportedly replace cash and coins for small transactions, while offering more security than cash.1 One card can act as a credit card, debit card, ATM card and "cash." The multi-function convenience is the advantage of this technology, smart card proponents report.

There are many questions, however, that these proponents do not address. What happens if the card is lost? How and when does settlement of the transaction occur? Is the transaction anonymous like using cash? Who will issue the cards? Are the cards really different from the forms of payment used today? These are questions most potential card users are likely to want answered before deciding whether this technology is really a useful innovation or just a marketing gimmick.

A New Wrinkle on an Old Idea

Transit systems and universities have used prepaid cards for years. More recently, telephone and telecommunication companies have been selling them, too. Single-purpose prepaid cards, like those used for telephone calls and mass transit fares, can be used only at specific locations for certain products. The consumer exchanges cash for a card that has an equivalent value stored on a magnetic stripe. This value can then be used to purchase the services for which the card is designed. When the value has been depleted, the card is usually discarded. In some instances, though, the value on the card can be replenished.

Multi-purpose prepaid cards are more commonly found at universities and corporate offices. In these cases, the university or employer collects cash from students or employees and issues them cards with stored value. The cards can then be used to make purchases at a variety of sites on campus—for example, the bookstore, cafeteria or other food outlet. University or corporate merchants accept the value from the card as payment, knowing that the university or corporation will convert these balances back into cash. Thus, the university or corporation acts like a bank because it collects funds and then disburses them to the various in-house merchants to settle transactions. Although these prepaid cards can usually be reloaded with additional value, their use is limited to specific regions or merchants. The emerging smart cards with stored value (hereafter, stored-value cards) will act like multi-purpose prepaid cards, but be even broader in scope because they will not be limited to specific regions or merchants. This anticipated widespread acceptance by merchants and consumers is why pundits place these cards on par with cash.

A Cash Equivalent?

Are stored-value cards really a form of cash? No, they are not, and this is a fundamental difference between the two. Yet, potential issuers of these cards argue that they are.2

The confusion centers on the perceived similarities in the way ATM and stored-value cards work. Today, a consumer inserts an automated teller card into an ATM and can withdraw cash, which the machine dispenses, from his bank account. The withdrawal either is immediately posted to the account if the ATM belongs to the bank with the account, or is posted a day or two later if the ATM belongs to a different bank. Cash has moved from the bank to the consumer. (See chart.)

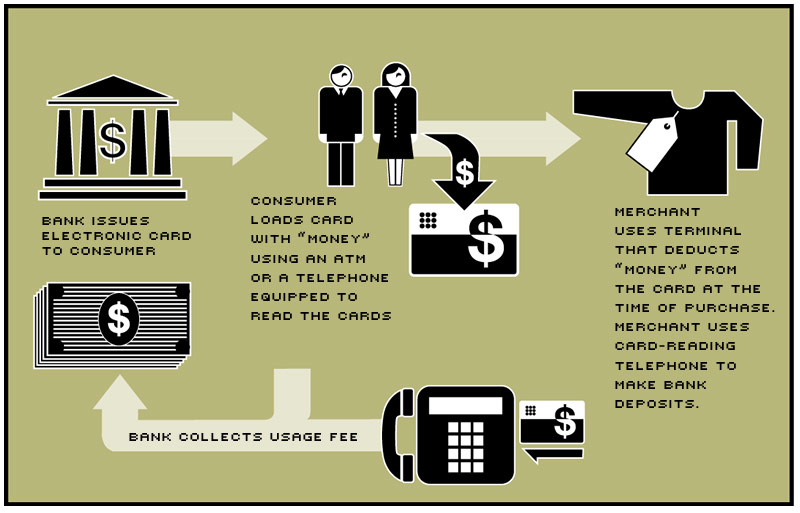

How Stored-Value Cards Work

Consumers transfer "money" from their bank accounts on to cards embedded with computer chips and then use them to make purchases. Using these cards is faster than using credit or debit cards, but there are risks.

Reprinted with permission from The New York Times.

With a stored-value card, a similar transaction occurs. The consumer inserts the stored-value card into an ATM-like machine and makes a withdrawal from his bank account. "It really is no different than if [the ATM] had dispensed cash," said David Van Lear, president of Electronic Payment Services Inc., to Congress.3 But there is a difference. The consumer might believe he has received "cash," but he has instead received only a balance of monetary value from the bank. This monetary value is in the form of a promise the bank makes to pay the debts the consumer incurs by using the stored-value card up to its available balance. Thus, the customer has "funds" on the card with which to conduct transactions, but, in fact, no cash has left the bank.

The bank actually moves the withdrawn funds from the customer's account into its own account, from which it will settle transactions its customers make with stored-value cards. These funds, which could have been earning interest for the customer, can now earn interest for the bank while awaiting a payment order.4 In addition, float—the balance that remains in an account while a check or other debit instrument is in process of collection—has been transferred from the consumer to the bank.

Settling a Transaction

When a purchase is made using currency, final settlement occurs on the spot because currency is legal tender. No third-party involvement is necessary. If the purchase is made using a stored-value card, however, final settlement does not occur at the point of sale because payment has not been made in legal tender. In fact, all the stored-value card does is inform the merchant that the bank that issued the card has the funds to pay the merchant upon presentation of the liability. Thus, a third party, like a bank, must be involved in discharging the debt. A similar process—a wire transfer—illustrates the point.

For years, Western Union has been wiring money around the country and world. Western Union, of course, does not actually send money to the designated destinations. Instead, the company sends only an authorization to the office at the receiving end to issue funds to a particular party. Final settlement of the debt occurs a day or two later, when the issuing office's bank transfers the funds into the receiving office's bank account. The same is true for the stored-value card transaction. The card's microchip does not actually transfer "funds" from the card to the merchant, but only gives the merchant the right to claim these funds from the bank. In other words, the stored-value card verifies that the funds to honor the liability are available from the card-issuing institution. Settlement takes place afterward, when the customer's bank transfers the funds to the merchant's bank.

Uh-oh, the Card's Gone!

Like cash, the risks from loss, damage or theft also exist with stored-value cards. But unlike cash, the "funds" on a stored-value card cannot actually be "lost" because they are still at the card-issuing institution in its account. Thus, whether a lost, damaged or stolen card will mean the stored balances are gone for good—like losing a $20 bill—is still unclear. Even the use of personal identification numbers (PINs), like those used with ATM cards, will not guarantee the consumer reimbursement. They can, however, prevent others from accessing the value stored on the card. That individuals would be reimbursed for losses seems unlikely, though, because—like trying to pay interest—determining the exact balance on any card at any given time would be costly and impractical. Moreover, if the issuer wants to make this determination, it would also need to match individuals to particular cards, which would require tracking consumers' purchases through merchants, thus destroying anonymity. Merchants, on the other hand, might benefit because accepting stored-value card balances could presumably reduce the security costs associated with safeguarding cash in the store until it is deposited. The risk of employee embezzlement and the costs of secured storage and transportation could be reduced or eliminated if the volume of cash at an establishment were to drop dramatically. The additional costs incurred to install and operate the technology necessary to accept stored-value cards, however, will probably offset many of these potential savings, at least in the short run.

Off-Line Convenience

One major convenience of stored-value cards is that their transactions occur off-line. This means that no real-time contact with a central computer for verification of identity or funds is necessary. The off-line capability is a fundamental difference between stored-value card payments and credit, debit or ATM card payments. Essentially, the "computer" on the stored-value card serves as its own balance verification mechanism. Rather than the merchant confirming identity and availability of funds through a central computer, the chip on the stored-value card verifies this information instead.

With credit cards, each time one is used, the cashier swipes it through the register, which then calls the credit card company's central computer, transfers the account number and purchase amount to it and awaits authorization. Authorization means there is enough available credit in the identified account for the transaction to occur. When a purchase is made with an ATM or debit card, the firm's register or terminal is connected with the issuer's computer network, which verifies the funds in the customer's account. The PIN serves as an electronic signature that authorizes the bank to transfer funds from the customer's account to the merchant's account.

A stored-value card requires no connection to a central or authorizing computer because the availability of funds is encoded on it. There is no need to identify or verify a particular account because there is no account to verify; the funds are in the bank's general pool, rather than an individual's account. These features make a stored-value card more like a check than a debit card. A check is nothing more than a customer's written authorization to the bank to pay the specified bearer a particular dollar amount. It is essentially an off-line debit instrument because there is usually no verification of availability of funds at the point of sale. Likewise, a stored-value card acts as an off-line, electronic authorization for the bank to pay the bearer. In this case, the bank need not even know who paid the merchant because it doesn't have to identify an individual's account to debit.

The Issuing Issue

So far, this analysis has assumed that only banks will be issuing stored-value cards. This assumption need not be true; nondepository institutions may also get involved. A potential problem, however, is that these firms might then begin acting like banks, while not being subject to banking regulations. Former Federal Reserve Board Vice Chairman Alan Blinder and others have expressed the concern that in this situation banks and nonbanks would be treated differently.5 According to Blinder, under current regulations, "Stored-value balances issued by depository institutions would be treated as transaction accounts and hence subjected to reserve requirements." The Federal Reserve, however, does not have the authority to impose reserve requirements on nondepository institutions.

Other disparities can occur because banks are subjected to strict capital and portfolio restrictions, while nondepository institutions are not.6 Conceivably, nondepository institutions could invest the funds collected for stored-value cards in risky assets to increase their earnings. This could impair their ability to redeem stored-value balances at par (face value). Also, what happens if the firm issuing the stored-value balances becomes illiquid or insolvent or declares bankruptcy? Who, if anyone, would be liable for these funds, and what claim could holders of the card balances have on the assets of the issuer?

Some might believe that deposit insurance could solve these potential problems. The Federal Deposit Insurance Corporation (FDIC), however, has not yet determined whether stored-value card balances held through banks would be insured, not to mention those held through nonbanks. Besides, the FDIC and other bank regulators, like the Federal Reserve, do not have the authority to permit or require insurance on balances at nondepository institutions or even at all depository institutions.7 If it is determined that stored-value card balances will not be insured, issuing institutions could disclose this information up-front, along with the customer's rights and responsibilities, as banks are now required to do for other nondeposit products like mutual funds.

To handle these potential disparities, some analysts have recommended that depository institutions alone be allowed to issue stored-value balances. This action would ensure uniformity of regulation and responsibility. Others agree. In a May 1994 report to the Council of the European Monetary Institute, the Working Group on European Union Payment Systems recommended that only depository institutions be allowed to issue stored-value cards. A regulatory environment that creates confidence in the product or the firm issuing the product might also allay the public's concern, as the example in the "A Lesson From the Free Banking Era" section demonstrates. Even with the recommendation, however, recent stored-value card pilot programs overseas have generally not met early expectations because usage is below anticipated levels and enrolling merchants has been difficult.8

The Effect on Monetary Policy

In all likelihood, it would not be too difficult to take stored-value card balances to the next step: person-to-person exchange of balances without first returning them to the issuer for credit. This action would make the balances function much more like currency, although at some point final settlement would be required through the banking system. However, once it reaches a point at which these balances do trade among consumers and firms without immediately passing through banks, a system of private currency that could potentially compete with cash will have been established.

This emergence of private currency in the United States would not be new, however; traveler's checks are a form of private currency that is familiar to everyone. Historically, private currency has existed in the economy at various times, which begs the question, how might it affect monetary policy?

Blinder, in his testimony before Congress, stated that it is most unlikely that, "What amounts to a form of private currency might damage the Federal Reserve's control of the money supply and lead to inflationary pressures." Assuming the emergence of stored-value cards does not create money but only substitutes for current forms of money, the biggest change would be in the measurement of money. Electronic currency may, however, change the details of how monetary policy is implemented, as previous financial innovations, like money market mutual funds, have.

Is There a Future for These Cards?

Whether stored-value cards take off depends on their acceptability. Merchants must be willing to accept them as a form of payment, and consumers must have the assurances they now have with other types of payment instruments. Clearly, there is some regulatory role for the government, but what that role is has not yet been determined. Most regulators and industry proponents agree, though, that Congress should wait and allow the market to develop before attempting to regulate it.

At recent hearings on the matter, members of Congress have acknowledged that payment instruments must be widely accepted, convenient, cost effective, safe and confidential to ensure wide usage. Any regulation should strive to attain these goals. Industry recognizes this too, as made clear by one of MasterCard International's senior vice presidents, Heidi Goff: "The bottom line is, consumer trust is key to our continued success."9

Stored-value card balances will also not likely replace cash as a means of payment. Although there may be some who see cash becoming a useless relic, others understand that it will continue to serve an important role. Electronic mail is a good analogy. Although e-mail has become a popular communications tool, the U.S. Postal Service is still operating and widely used.

Finally, it behooves potential purveyors of electronic currency to lay out all the issues regarding its usage up-front because only informed consumers and merchants will venture into this territory. The early international evidence shows that the stored-value card pilots have not been as successful as anticipated. This suggests there is a slow learning curve that all involved must go through for the cards to be successful. It also says, perhaps, that people aren't ready to part with their hard currency just yet.

Endnotes

- The term "smart card" refers to a card with a microchip on it. It need not have "money" stored on it, though; personal identification or medical information, for example, can also be stored on the card. However, this article will focus on the stored "money" capability of the card. [back to text]

- See U.S. Congress, p. 23. [back to text]

- See U.S. Congress, p. 30. [back to text]

- While, theoretically, it might be possible to pay interest on stored-value card balances, it is unlikely to happen because of the cost involved in determining the balance on a stored-value card at any given time. [back to text]

- See Blinder (1995). [back to text]

- The Securities and Exchange Commission (SEC), however, imposes certain portfolio restrictions on some nonbanking institutions with transaction-like accounts—money-market mutual funds, for example. [back to text]

- Federal Reserve member banks are required to have deposit insurance; nonmember banks usually petition the FDIC for it. [back to text]

- See Block (1996). [back to text]

- See U.S. Congress, p. 18. [back to text]

- The discussion of U.S. dollars or other foreign legal tender "backing" stored-value card balances is symbolic because the funds are not actually deposited with any state or federal authority like bonds were during the Free Banking Era. The analogy is made, however, to help the reader understand that, like checks, funds are being held at the bank as collateral for the liability it is issuing in the form of stored-value balances. [back to text]

References

Blinder, Alan S. Statement before the Subcommittee on Domestic and International Monetary Policy of the Committee on Banking and Financial Services, U.S. House of Representatives (October 11, 1995).

Block, Valerie. "Smart Cards Off to a Bumpy Start, Critics Say," American Banker (January 17, 1996).

Gorton, Gary. The Enforceability of Private Money Contracts, Market Efficiency, and Technological Change, National Bureau of Economic Research, Working Paper No. 3645 (March 1991).

Rockoff, Hugh. "The Free Banking Era: A Reexamination," Journal of Money, Credit, and Banking (May 1974), pp. 141-67.

Rolnick, Arthur J. and Warren E. Weber. "Explaining the Demand for Free Bank Notes," Journal of Monetary Economics (January 1988), pp. 47-71.

U.S. Congress, House of Representatives, Committee on Banking and Financial Services, Subcommittee on Domestic and International Monetary Policy. The Future of Money—Part I, Serial No. 104-27, 104 Cong. 1 Sess., (July 25, 1995).

Wenninger, John and David Laster. "The Electronic Purse," Current Issues in Economics and Finance, Federal Reserve Bank of New York (April 1995).

Working Group on EU Payment Systems. Report to the Council of the European Monetary Institute on Prepaid Cards (May 1994).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us