Are Minimum Wages Intrusive?

If there were but one issue economists could agree about overwhelmingly, it would have to be the minimum wage. Most economists agree not only that it is probably the most intrusive form of labor legislation, but also that its effects on employment can be accurately predicted. Testing these predictions with actual data, however, has proven more difficult than it first appeared, and lately, some evidence calls the established theory into question.

Why Have Minimum Wages?

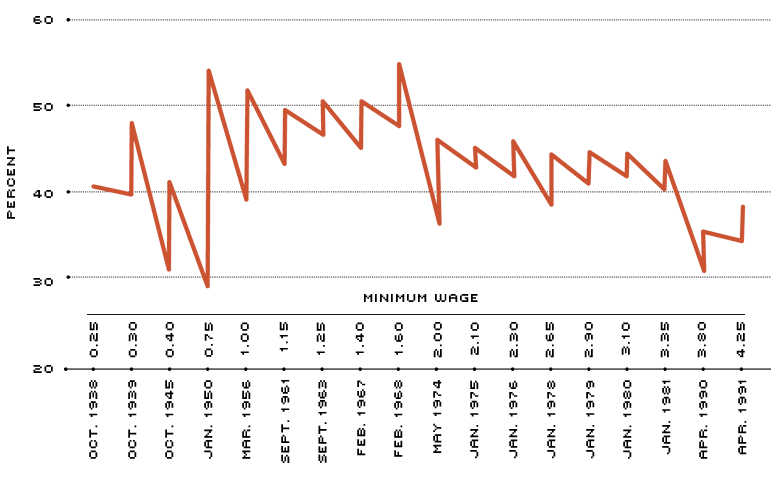

The Fair Labor Standards Act of 1938 established the first federal minimum wage at $0.25 per hour. Having recently suffered through the Great Depression, Congress worried that current labor conditions, which they found "detrimental to the maintenance of the minimum standard of living necessary for health, efficiency, and the general well-being of workers [would] spread and perpetuate, burden commerce, lead to labor disputes and interfere with the marketing of goods." Thus, the minimum wage was primarily intended to increase worker welfare. The accompanying chart illustrates subsequent increases in the minimum wage and its relation to the average hourly manufacturing wage of the time.1 Interestingly, for most of the 1950s and '60s, the minimum wage averaged about 50 percent of the prevailing manufacturing wage; in the 1970s, the average ratio was about 45 percent; in the 1980s and '90s, this ratio has been about 37 percent.

The Minimum Wage as a Percent of the Average Hourly Manufacturing Wage

Vertical spikes represent the change in the minimum wage/manufacturing wage ratio after an increase in the minimum wage.

How a Change in the Minimum Wage Affects Employment: The Theory

Suppose a firm employs unskilled workers who receive the minimum wage and skilled workers who receive a higher wage because they are more experienced or more productive. Also suppose the firm is able to substitute skilled and unskilled labor, which are used in conjunction with capital to produce output. What outcomes should occur if the minimum wage is increased while all else remains the same?2

When the minimum wage is increased, the firm reacts to two events simultaneously. One is that the price of unskilled labor increases while other wages stay the same. This makes unskilled labor relatively more expensive than skilled labor, causing the firm to hire more skilled labor and less unskilled labor. In other words, the firm substitutes skilled for unskilled labor. The other event is that the total cost of production rises, inducing a profit-maximizing firm to produce a lower level of output, which requires less of all inputs. This causes the firm to employ less of both skilled and unskilled labor.

Combining the outcomes of these two events, we see that a minimum wage increase causes the demand for unskilled labor to decline. Its effect on skilled labor, however, is ambiguous: The demand for skilled labor could decline if the employment losses associated with reduced output outweigh the employment gains associated with substitution; the demand could increase if the substitution effect dominates the output effect.

In an inflationary environment, the opposite outcomes can occur even if the dollar amount of the minimum wage stays the same because the purchasing power of these dollars declines. In other words, the purchasing power of the minimum wage declines if no action is taken to keep the dollar amount of the minimum wage in step with inflation.

How a Change in the Minimum Wage Affects Employment: The Findings

Because the majority of workers earning the minimum wage are teenagers, most minimum wage studies have focused on this age category. Essentially, there are two major sets of findings: those from the 1970s and early 1980s, and those from the early 1990s. This gap in the literature occurs primarily because there was no change in the federal minimum wage between 1981 and 1990, although several states during this period raised their minimum wages above the federal floor for the first time.

Brown, Gilroy and Kohen (1982) present a fairly comprehensive survey of the early literature. In a nutshell, they show that most of these studies draw a similar conclusion: A 10 percent increase in the minimum wage reduces teenage employment between 1 percent and 3 percent. Similarly, Brown, Gilroy and Kohen (1983) find that employment drops between 0.5 percent and 1.5 percent for each 10 percent increase in the minimum wage. These findings were quite appealing to economists because they substantiated theoretical predictions and demonstrated how government intervention in the market can be intrusive.

More recent studies, however, find that employment was not adversely affected by minimum wage increases and that, in some cases, it actually increased. In a study of California, for example, where the minimum wage was raised to $4.25 per hour in 1988, Card (1992a) predicted an employment decline of between 3 percent and 8 percent. He found instead a 4 percent employment increase. Katz and Krueger (1992) and Card and Krueger (1993) performed similar studies of Texas and New Jersey using survey data from fast-food restaurants. These studies also found increases in employment after a minimum wage increase—in one case almost 13 percent. Moreover, both studies found that those firms most affected by the increase had the greatest employment gains.

Other recent studies by Taylor and Kim (1993) and Neumark and Wascher (1992) find more conventional outcomes: between 1 percent and 9 percent declines in teenage employment for each 10 percent increase in the minimum wage. A subsequent investigation into Neumark and Wascher by Card, Katz and Krueger (1993), though, led to conflicting conclusions, leaving the results open to debate. Further inquiries will no doubt be made before the matter is settled.

What Does This Mean for Minimum Wages?

The last round of studies suggests that (1) perhaps general labor market models do not apply to low-wage workers as readily as once thought, or (2) the minimum wage increases between 1990 and 1992 represent episodes that lie outside the general framework—that there were special circumstances driving these recent results. In either case, the argument against minimum wages because of their employment effects seems to be temporarily moot. On the other hand, there is little evidence to support the claim that minimum wages increase worker welfare either. Thus, it is hard to argue that the benefits of minimum wages outweigh an economist's aversion to interfering in reasonably competitive markets. Ultimately, as University of Michigan professor Charles Brown puts it, "the case against the minimum wage seems to...rest more upon that aversion than on the demonstrated severity of any harm done to those directly affected."3

Endnotes

- The coverage of minimum wage legislation has grown dramatically. At its inception in 1938, about 43 percent of the work force was subject to the minimum wage. Today, that figure is about 87 percent. The main exceptions are agricultural workers, some domestic and retail employees, executive, administrative and professional personnel. [back to text]

- The following analysis can be quickly complicated to better reflect actual market conditions. For example, the fact that not all employees are covered by minimum wage laws can be included in the analysis. The main thrust of the outcome, however, would not change. A different story emerges, though, if the firm is not in a competitive labor market. [back to text]

- Brown (1988), p. 144. [back to text]

References

Brown, Charles. "Minimum Wage Laws: Are They Overrated?" Journal of Economic Perspectives (Summer 1988), pp. 133-45.

Brown, Charles, Curtis Gilroy and Andrew Kohen. "The Effect of the Minimum Wage on Employment and Unemployment." Journal of Economic Literature (June 1982), pp. 487-528.

_________. "Time-Series Evidence of the Effect of the Minimum Wage on Youth Employment and Unemployment." Journal of Human Resources (Winter 1983), pp. 3-31

Card, David. "Do Minimum Wages Reduce Employment? A Case Study of California, 1987-1989." Industrial and Labor Relations Review (October 1992a), pp. 38-54.

_______ and Alan B. Krueger. "Minimum Wages and Employment: A Case Study of the Fast Food Industry in New Jersey and Pennsylvania." Princeton Univ., Industrial Relations Section, Working Paper 315, (August 1993).

________, Lawrence F. Katz and Alan B. Krueger. "An Evaluation of Recent Evidence on the Employment Effects of Minimum and Subminimum Wages." NBER Working Paper No. 4528, (November 1993).

Katz, Lawrence F., and Alan B. Krueger. "The Effect of the Minimum Wage on the Fast-Food Industry." Industrial and Labor Relations Review (October 1992), pp. 6-21.

Neumark, David, and William Wascher. "Employment Effects of Minimum and Subminimum Wages: Panel Data on State Minimum Wage Laws." Industrial and Labor Relations Review (October 1992), pp. 55-81.

_________. "Employment Effects of Minimum and Subminimum Wages: Reply to Card, Katz and Krueger." NBER Working Paper No. 4570 (December 1993).

Taylor, Lowell J., and Taeil Kim. "The Employment Effect in Retail Trade of California's 1988 Minimum Wage Increase." Heinz School of Public Policy and Management Working Paper No. 93-16, Carnegie Mellon Univ., (February 22, 1993).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us