A Gift Horse for the States: Federal Mandates

At adjournment the 102nd Congress had passed or was debating 265 bills affecting state governments. More often than not, these bills contain mandates that require the states to either act or not act in particular ways. Unfortunately for states, such mandates are typically signed into law without the federal funds to support their execution. The most prominent examples of congressional mandates are environmental regulations, such as the Clean Air and Clean Water Acts, which require state governments to enforce certain prescribed standards.

Frequently, federal mandates accomplish goals of clear national importance. Occasionally, however, the legislation extends an idea that worked in one locale to the entire nation. Edward Koch, former U.S. Congressman and mayor of New York City, argued in a 1980 article that this occurs because members of Congress are often "taken in by the simpl[e]... and flimsy empirical support...offered to persuade [them] that the proposed solution could work throughout the country."1

At times, the projected costs of these mandates for state governments can be extremely high. For example, Tennessee, which regularly calculates the projected expense of all federally proposed mandates, reported that in fiscal year 1992 the cost to the state of all existing mandates enacted since 1987 was $126 million, or 1.3 percent of its annual budget.2 By fiscal year 2002, these same mandates are expected to cost Tennessee $241.8 million each year. In his article, Koch also attempted to assess the impact of 47 federal and state mandates on New York City. To meet the requirements of these mandates through 1984, he explained, would cost the city $711 million in capital expenditures and $6.25 billion in expense-budget dollars.3 These amounts, not counting an additional $1.66 billion in lost revenue, represent about 12 percent of New York City's annual expenditure over the four-year period.

The Influence of the Federal Government

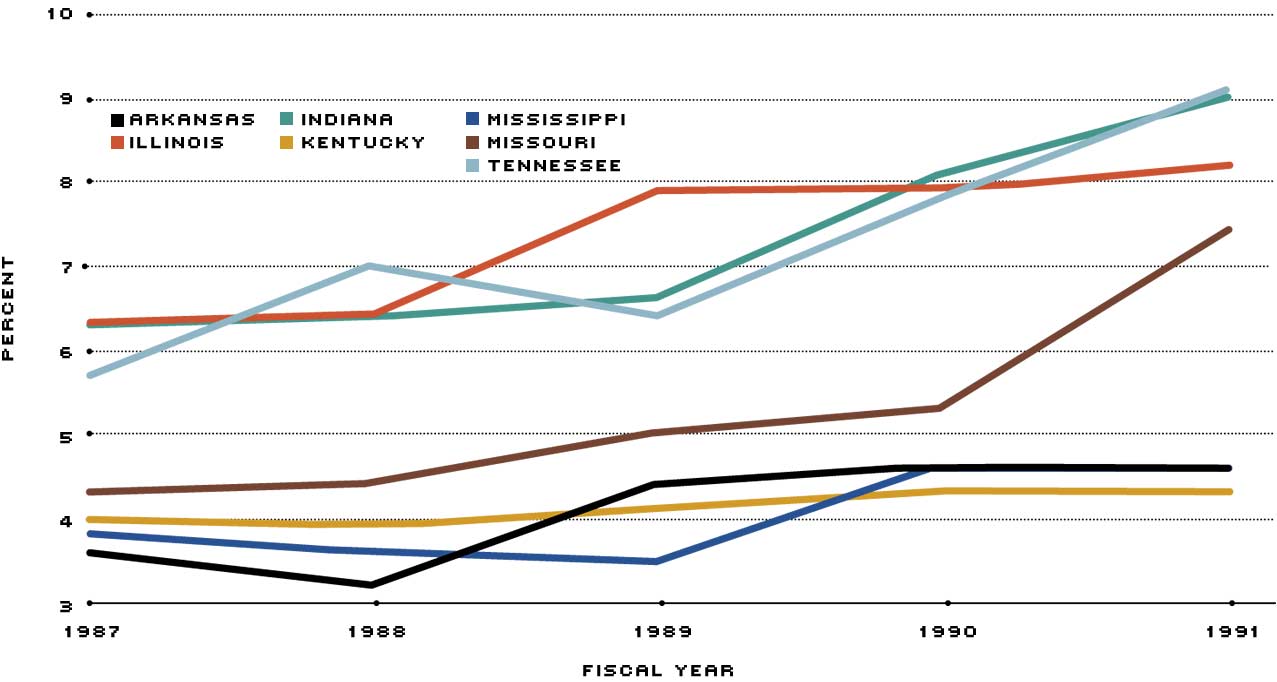

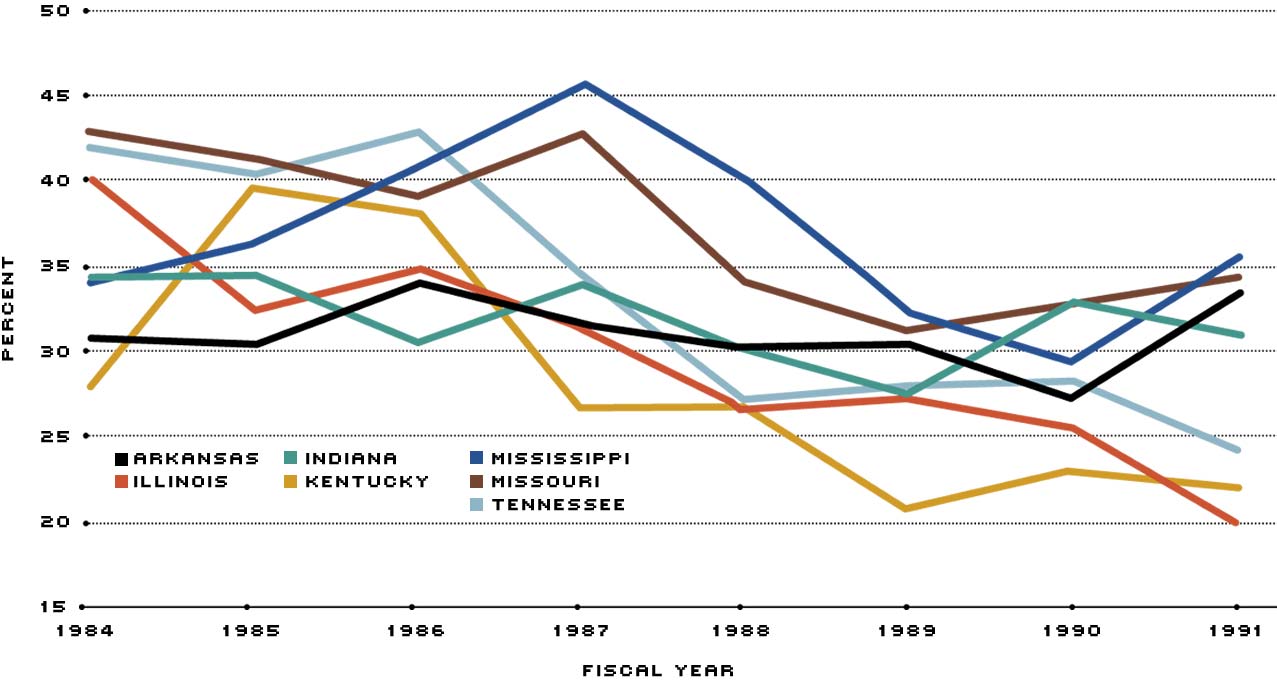

Estimates of mandated costs from states are generally not available. Federal grants-in-aid, however, can provide an indication of a state's dependence on the federal government for funding in a particular sector. Computing ratios of federal grants-in-aid to state expenditure is one way to assess the federal government's impact. Changes in this percentage over time can represent either a change in the amount of federal aid, a change in the level of state expenditure, or some combination of the two. Charts 1 and 2 illustrate the changes in two major areas of federal aid closely related to federally mandated programs—highways and public welfare—for Eighth Federal Reserve District states.

Federal Highway Grants Relative to State Highway Expenditures

Highway funding percentages exhibit the clearest downward trend, with all states declining fairly steadily since about 1987. Illinois, Kentucky and Tennessee actually received less federal aid money in 1991 (in 1987 dollars) than they did in 1984. All District states except Kentucky increased their real state expenditure on highways over the period.

Federal Welfare Grants Relative to State Welfare Expenditures

Welfare funding ratios appear relatively stable over time. Since 1984, however, Arkansas' welfare funding ratio has plummeted 16 percentage points, while Mississippi's ratio jumped 30 points. Arkansas' decline occurred because a 40 percent increase in real state expenditures was met with only a 6 percent increase in federal aid. Conversely, Mississippi's 42 percent increase in the amount of federal grants was met with only an additional 17 percent from the state. No state's real level of federal aid or expenditure declined over the period.

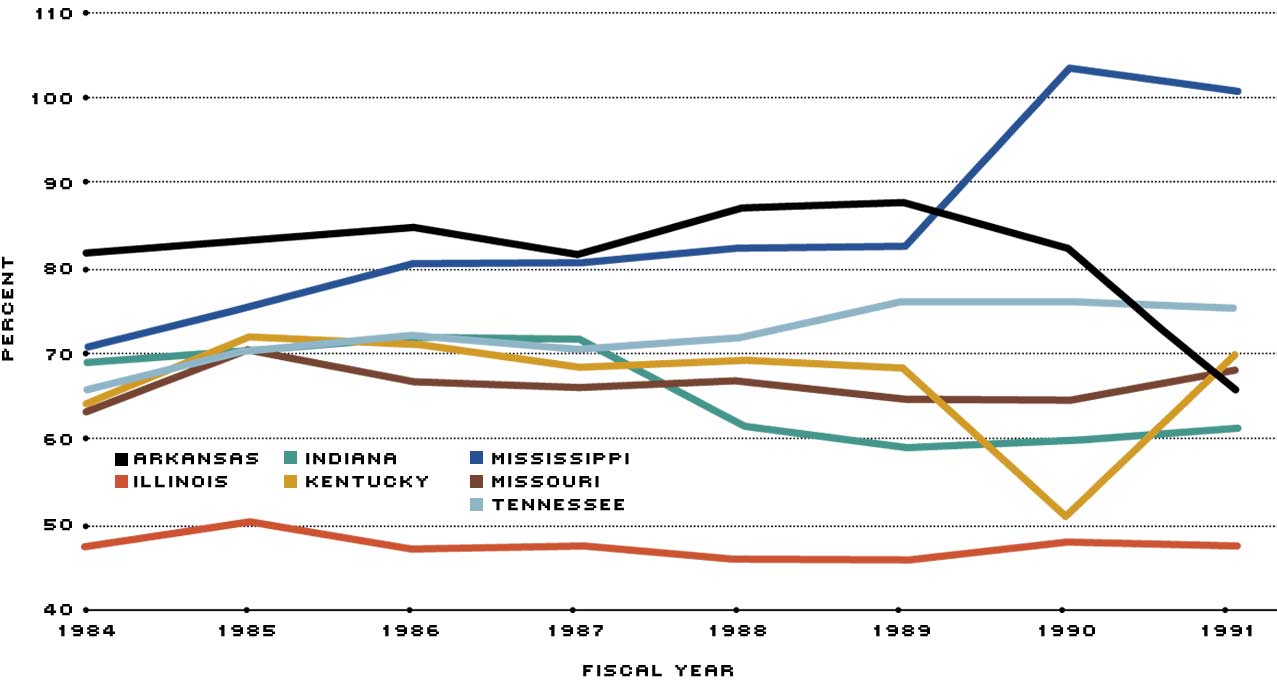

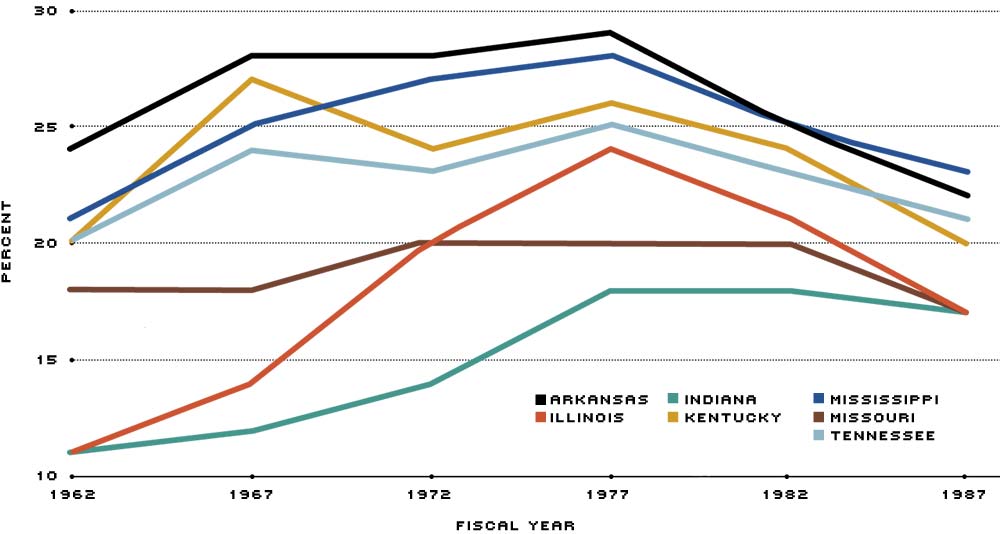

State and Local Government General Revenue from Federal Government

Federal grants to state and local governments peaked in the late 1970s and have declined ever since.

Recent legislation continues the federal government's influence over state affairs. For example, the Alcohol, Drug Abuse and Mental Health Administration Act of 1992 has a provision that requires states to prohibit the sale of tobacco products to minors under the age of 18 by fiscal year 1994. If they do not, the states risk losing some funding earmarked for substance abuse and mental health. Missouri and Kentucky are both affected by this law. More subtle coercion can be found in the Intermodal Surface Transportation Efficiency Act of 1991. This law offers grant money to states to establish motorcycle helmet and seat belt laws. States not participating in the program by fiscal year 1994 would be required to spend 1.5 percent of their highway money on highway safety programs. Thus, the federal government is not taking away any grant money already promised, but forcing states to participate in a new grant program.

Overall, the federal government has had to learn to maintain its relative power over states without the purse to support its actions. The declining funding ratios depicted in the charts, which result from real state expenditures growing faster than federal grants, support this statement. Most likely, this has occurred because of a tighter federal budget resulting from an increasing deficit. In the process, Congress has found that mandating is a useful tool to accomplish goals without increasing the federal budget. Influence through federal grants and mandates is not a new occurrence, however; the federal government has previously outstretched its (sometimes) empty hands.

The Evolution of Mandates

Historically, the relationship between the federal and state governments was a constitutional question about shared sovereignty. Not until the 1930s and the New Deal did the federal government begin to assume a similar role to the one it plays today. The Great Society programs of the 1960s greatly enhanced this role as the central government's clout over the state's grew. This shift in governmental balance still concerns many state legislators today. While they complain loudly about the costs of unfunded mandates, the issue they raise is not solely, and perhaps not even chiefly, fiscal. "There [are] coequal concerns about status—the pointed lack of respect for the position of states and localities as constitutional entities within the federal system."4

Of course, federal grants to states predate the New Deal. As early as 1917, the federal government began giving grants to the states for vocational education programs in high schools. Even earlier, a non-monetary federal grant-in-aid was authorized by the Morrill Act of 1862, which gave land to the states to endow colleges in the agricultural and mechanical arts. By the 1930s, in the midst of depression, Roosevelt's administration demonstrated that the federal government could move, alter and create institutions on a grand scale. A myriad of popular social programs introduced new national institutions. By the 1960s, increased perceptions, reinforced by the civil rights movement, that state governments were performing poorly, even in areas properly assigned to them, turned the populace to the federal government for aid. "Reformers urged the federal government to augment state spending and redirect state and local priorities. The result was a rapid proliferation of grants to states...designed to strengthen their capacities and influence their decisions."5

A change in federal-state relations occurred around 1978. Federal grants in-aid, which had increased steadily for 20 years, began to shrink. State and local governments, which had become accustomed to lobbying Congress for additional assistance, were thus introduced to fend-for yourself federalism.6 Any monies still being received from the federal government came with attached conditions. Complaints were lodged about these conditions, but the conditions gained legitimacy because acceptance of the grants was clearly voluntary. Basically, accepting federal funds was tantamount to agreeing to be bound by certain national standards and rules.

The imposition of certain nationalstandards and rules is but one of the numerous guises worn by mandates. Not all are related to funding, but all of the following coerce either subtly or openly:

- Direct orders mandate state or local action under the threat of criminal or civil penalty, but do not make compliance contingent upon the receipt of federal funds. An example is the application of federal minimum wage and overtime pay provisions to state and local government employees under the Fair Labor Standards Act Amendments of 1974.

- Crosscutting requirements are routinely attached to all relevant federally funded programs and address such issues as financial accounting practices, antidiscrimination and minimum wage levels. Examples are Title VI of the Civil Rights Act of 1964, which bars discrimination in federally assisted programs, and the Davis-Bacon Act, which sets minimum wage levels on federally assisted construction projects.

- Crossover sanctions compel compliance in one program area by threatening the imposition of penalties (such as grant reduction) in another. An example is the Highway Beautification Act of 1965, which threatened to withhold highway construction funds if states did not comply with billboard control laws.

- Partial preemptions establish basic federal standards for a program, but leave execution to the states if they meet these minimum standards or legislate stricter ones. Effectively, partial preemptions turn the states into regional offices of the federal government by requiring states to carry out the directives of the federal government. Examples are the Clean Air, Clean Water and Safer Drinking Water Acts, as well as other environmental programs and the Occupational Safety and Health Act (OSHA).

The courts have also been involved in forcing the hands of the states. Before the mid-1950s, federal courts, interpreting the Constitution, had habitually told states what they might not do. With Brown v. Board of Education II in 1955, the Supreme Court began telling states what they must do. Federal courts then began regulating the actions of states in such areas as education, prisons and the mentally ill. Of course, these edicts came without federal funds because courts do not have the power to raise money.

Over time, the Supreme Court has also allowed Congress the leeway it exercises today in legislating regulations to the states. For example, the Court ruled in 1871 (Collector v. Day) that a federal income tax could not be levied against a county judge in Massachusetts because he was an employee of a local government. This followed from a 19th-century conception of federalism, that Congress did not regulate state and local governments or tax their employees because it perceived of these governments as separate, sovereign and equal. A changing interpretation of federalism, however, was reflected in the Court's 1939 decision overturning Collector v. Day.

More recently, when Congress extended Fair Labor Standards Act protection to state and local employees in 1974, the Supreme Court, in 1976, forbade the action, citing Congress' lack of authority to regulate the conduct of state and local governments under the commerce clause of the Constitution (National League of Cities v. Usery). This too was overturned in 1985 (Garcia v. San Antonio Metropolitan Transit Authority) because of its impracticability. With this decision, the Court seemed to wash its hands of the subject, leaving the states to the mercy of what Justice O'Connor in dissent called Congress' "underdeveloped capacity for self-restraint."7

Tracking the Effects of Federal Mandates

"First they underestimate the costs and then they underfund the underestimate."8

One basic flaw in the process of legislating mandates, leading to their recent proliferation, is that unrealistic projections of the cost of realizing mandated goals are made. A law ordering coastal states to test beach water regularly illustrates this. Congress was willing to contribute some money and authorized $3 million in grants to cover the cost. A representative from Florida complained, however, that it would take more than $2 million a year to test the 8,500-mile Florida shoreline alone. That left less than $1 million for more than 20 other coastal states.9

To quantify the expected costs of prospective mandates, Congress enacted the State and Local Government Cost Estimate Act of 1981. It requires the Congressional Budget Office (CBO) to estimate the cost that state and local governments would have to incur for any bill reported from full committee in the House or Senate that is likely to require at least $200 million annually. In practice, CBO calculates estimates for all legislation to gauge if the $200 million threshold is surpassed. After the first six years (through 1988) and 3,500 estimates, the CBO found only 382 that involved any costs or savings for state and local governments, and only 89 that exceeded $200 million per year.10 This does not imply that most mandates are costless, however; many problems exist in the estimations.

One major problem is that the language of proposed legislation is often left purposely vague, allowing for broad interpretations of how states might implement such legislation. This practice undermines the validity of these estimates. Compounding this problem, the legislation's final draft often differs considerably from the draft that prompted the estimation.

A different problem arises in situations like the 1985 Supreme Court ruling in Garcia v. San Antonio Metropolitan Transit Authority, where the breadth of coverage is extensive. A quick and precise estimate of the impact of this ruling was impossible because it affected more than 7 million public employees in 50 states and approximately 3,000 counties, 19,000 municipalities, 17,000 townships, 15,000 school districts and 29,000 local special districts, all of whom became legally entitled to overtime pay.11

Supplementing the CBO's cost estimates, individual states track potential mandates themselves to determine the possible effects. A report by Martha Fabricius for the National Conference of State Legislatures cites examples of how states analyze and track the effects of proposed mandates. For example, Missouri's Legislature uses a special calendar to draw attention to federal mandates. Each time the state's House votes to act on a federal mandate, whether to allocate funds or alter state legislation to conform with federal standards, it is recorded on the calendar. This system helps put federal lawmakers on notice every time the state is forced to vote on something as a direct result of a federal requirement. In Oklahoma, the Senate publishes a weekly newsletter that keeps legislators up-to-date about federal activities. Most states also send members of their legislatures to Congress to meet regularly with and lobby their state's congressional delegations.

The Effects of Federal Mandates on State Budgets

Not all states will be affected by different provisions of different bills in the same manner. According to the Fabricius report, many provisions involved no additional state expenditure because, usually, the state had already included the proposed legislation in state law. For example, a law requiring handicapped accessibility at polling places led to CBO cost estimates ranging from $845 per county in Georgia to $10,000 in the city of Minneapolis. Georgia required only reregistering the handicapped into districts where accessibility was available, while Minneapolis required the construction of wheelchair ramps in all polling places. These alternative approaches to the same problem account for most of the cost differentials among states.

Several projections taken from the Fabricius report serve to demonstrate the varying cost effects further.12 The Child Welfare and Preventive Services Act of 1991, major provisions of which were included in a tax bill in October 1992, extends Medicaid benefits to a broader class of children. Forty-one states had estimated the total cost of complying with the bill as originally written at $997 million for fiscal year 1992. This figure represents 4.1 percent of the estimated total Medicaid expenditures by these states in fiscal year 1991. Arkansas reported no impact of this legislation reported costs of only $106,000. Missouri and Mississippi, on the other hand, each reported costs of at least $7 million. Larger states, such as New York and Pennsylvania, reported costs of more than $400 million each (see sidebar for more on Medicaid).

The National Voter Registration Act of 1991 (popularly known as the Motor Voter Bill) would have allowed for voter registration when applying for either a driver's license or unemployment insurance benefits. (The act was vetoed by President Bush, but has been reintroduced in Congress this session.) The total estimate for fiscal year 1992 for 41 states was $58 million. Kentucky projected minimal impact, while Indiana and Missouri projected increases of less than $1 million. Illinois, however, estimated its costs at slightly more than $40 million. These inordinately large costs occur because of Illinois' current lack of a statewide, computerized network for voter registration. When combined, the projected costs to the 41 reporting states in fiscal year 1992 for the seven proposed mandates reviewed by Fabricius were about $1.7 billion, with Eighth District states reporting costs ranging from $11 million for Arkansas to $54 million for Mississippi.

These estimates legitimize the concern that no regard is made for the cumulative effect of mandates over time. According to Tennessee's Department of Finance and Administration, cumulative new state funding for existing federal mandates since 1987 will amount to $495 million by the end of fiscal year 1993. The projected $242 million annual cost to Tennessee by fiscal year 2002 for all mandates enacted between 1987 and 1992 is approximately equivalent to the state levying either a one-half percent increase in its 6 percent sales tax or a 9-cent increase in its 20-cent per gallon gasoline tax.13

At first glance, larger states might appear better able to afford the additional expense imposed by mandates because of their larger tax base. This, however, is not necessarily true. If we compare the projected costs in the Fabricius report for fiscal year 1992 with actual fiscal year 1991 general expenditures, we find that the impact for most District states (which are relatively small), as well as some large states like New York, California or Texas, is similar. With few exceptions, states have impacts of significantly less than 1 percent of general expenditure on their budgets. While this may not seem extreme, it is in addition to the monies already being spent by the states on federal mandates. The more fundamental issue, however, is whether mandates should occur at all. Should the federal government force states to allocate their resources in a predetermined way, even if the eventual expense amounts to only pennies on the dollar?

Should There Be Federal Restraint?

It is certainly not true that all mandates are bad. Many do accomplish goals of national importance, and the federal government should be able to legislate without being "held hostage to the states."14 Besides, no one is against clean air or water, or better access to education for handicapped children. Better methods of tracking the plethora of existing mandates and their cumulative effects need to be devised, however. Toward this end, numerous bills, requiring that no mandate be passed unless it can be funded federally, have been introduced in both the House and Senate.15 Ultimately, though, pressure from the states and public debate will be required to make the federal government more sensitive to the burdens it imposes by a ruling, a vote or a signature.

Endnotes

- Koch, p. 44. [back to text]

- District state fiscal years begin on July 1 of the previous calendar year. For example, fiscal year 1985 began on July 1, 1984. [back to text]

- Koch, p. 42. [back to text]

- David R. Beam in Fix and Kenyon, p. 23. [back to text]

- Rivlin, p. 87. [back to text]

- Fix and Kenyon, p. 2. [back to text]

- Derthick, p. 51. [back to text]

- Koch, p. 47. [back to text]

- Rapp, p. 53. [back to text]

- Theresa A. Gullo in Fix and Kenyon, pp. 43. [back to text]

- Gullo in Fix and Kenyon, pp. 46-7. [back to text]

- Only 43 states had responded to the report when written, some with incomplete answers. [back to text]

- Tennessee, 1992, pp. 3-4. [back to text]

- Michael Fix in Fix and Kenyon, p. 35. [back to text]

- Current issues of the Hall of the States Mandate Monitor list the most recent legislation. [back to text]

References

Derthick, Martha. "Federal Government Mandates: Why the States Are Complaining," The Brookings Review (Fall 1992).

Fabricius, Martha A. Fiscal Impact of Proposed Mandates from the 102nd Congress, State-Federal Issue Brief, vol. 4, Washington, D.C.: National Conference of State Legislatures (November 1991).

Fix, Michael, and Daphne A. Kenyon, eds. Coping with Mandates: What Are the Alternatives? Washington, D.C.: The Urban Institute Press (1990).

Koch, Edward I. "The Mandate Millstone," The Public Interest (Fall 1980).

National Conference of State Legislatures. Hall of the States Mandate Monitor (1992, various issues).

Rapp, David. "Just What Your State Wanted: Great New Gifts From Congress," Governing (January 1991).

Rivlin, Alice M. Reviving the American Dream. Washington, D.C.: The Brookings Institute (1992).

Tennessee Department of Finance and Administration. "Federal Mandate Costs and Federal Aid Trends" (February 1993).

______. "The Impact of Federal Mandates" (April 1992).

U.S. Bureau of the Census. State Government Finances, Series GF-(1984-91)-3. Washington, D.C.: U.S. Government Printing Office.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us