Central Bank Balance Sheets and Policy Rate Decisions

KEY TAKEAWAYS

- Many central banks are raising interest rates to fight inflation. But the higher interest rates will affect the revenue that their balance sheets produce.

- A comparison of four major central banks shows that those with larger balance sheet-to-GDP ratios in 2021 appeared less aggressive in raising rates by early 2023.

- Economic conditions vary across the world, and so many factors could cause central banks to pursue different monetary policy responses to rising inflation.

The major challenge facing monetary policymakers is the sudden and rapid rise of inflation. Beginning in 2021, inflation increased substantially among many advanced economies. For example, in the U.S., consumer price index inflation jumped from 1.4% in January 2021 from a year earlier to a peak of 9.1% in June 2022. The 12-month inflation rates in the U.K. and euro areaThe euro area, or eurozone, consists of the 20 European Union member states whose currency is the euro. rose similarly, from 0.9% in early 2021 to 9.6% and 10.6%, respectively, by October 2022. Even Japan, which has for decades experienced near-zero or even negative inflation, saw rates rise as high as 4.3% as of January 2023.

Policy Rate Hikes: The Expected Response to Inflation

Given that central banks are tasked with maintaining price stability, we would expect to see policy rate increases in response to surging inflation, and in some cases, we have. However, the implementation of quantitative easing (QE) policy since the 2007-09 Great Recession may have complicated the decision to raise the policy rate in certain economies. Looking at the relative sizes of the balance sheets maintained by these economies’ central banks may help us understand why.

QE and Its Impact on Central Bank Balance Sheets

QE policy typically involves the purchase of long-term government bonds to reduce long-term interest rates and thereby stimulate the economy. The impact of QE on central bank balance sheets can be demonstrated through a simple example. Let the first table below be the central bank’s balance sheet before QE. It consists of short-term government bonds and long-term government bonds on its asset side and reserves and cash on its liability side.

| Assets | Liabilities | ||

|---|---|---|---|

| Short-term government bonds | $20 | Reserves | $25 |

| Long-term government bonds | $10 | Cash | $5 |

Now suppose that the central bank executes QE policy that involves purchasing another $50 in long-term government bonds; when paying for these bonds, it increases the reserves held by commercial banks at the central bank. The balance sheet after QE is shown in the next table.

| Assets | Liabilities | ||

|---|---|---|---|

| Short-term government bonds | $20 | Reserves | $75 |

| Long-term government bonds | $60 | Cash | $5 |

As we can see, the central bank’s balance sheet expands due to QE. More specifically, QE purchases have two effects:

- They increase the bonds that the central bank holds as assets.

- They increase by an equal amount the central bank’s liability, a narrow measure of the money supply called the monetary base, which consists of currency held by the public and bank reserves.

If the long-term interest rates earned on government bonds on the asset side of the balance sheet are higher than the short-term interest rates paid by reserves on the liability side, then the central bank could generate a profit. In many countries, profits generated by the central bank are transferred to the national government. This generally has been the case since the Great Recession.

Central Bank Bond Portfolios and Interest Rate Risk

However, such a portfolio leaves the central bank exposed to interest rate risks. A rise in interest rates means that the central bank begins paying more on its liabilities while the amount it earns on coupons from its long-term bond portfolio remains unchanged. Therefore, if interest rates start to rise, the central bank faces reduced revenue or even losses. Because central banks typically return their profits to the government, lower revenue or losses can increase a fiscal deficit.

This incurred loss could be substantial if the central bank holds a lot of long-term bonds. For instance, suppose the interest rate rises enough such that the average interest rate paid on central bank liabilities is 1 percentage point higher than that paid on central bank assets. In this case, the annual loss would be roughly equal to 1% of the size of the central bank’s balance sheet. Thus, the larger the balance sheet, the greater the potential loss.

Four Central Banks’ Balance Sheets Grew

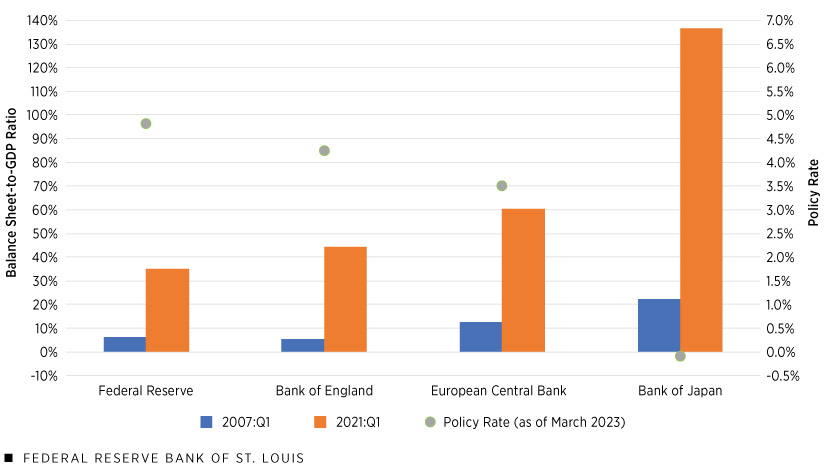

The following figure compares the balance sheet size of four major central banks—the Federal Reserve in the U.S., the Bank of England in the U.K., the European Central Bank in the euro area and the Bank of Japan in Japan—relative to gross domestic product (GDP) between the first quarter of 2007 (the blue bar), right before the Great Recession and prior to QE, and the first quarter of 2021 (the orange bar), when inflation first began to rapidly rise.

Balance Sheet Size and Policy Rates at Four Central Banks

SOURCES: Board of Governors of the Federal Reserve System, Bank of England, European Central Bank and Bank of Japan.

The balance sheets of all four central banks show sizeable growth relative to the GDP of their associated economies because of the QE policies conducted after the Great Recession. In the U.S., the Federal Reserve’s balance sheet (relative to GDP) increased from 6.4% to 34.8% between the first quarter of 2007 and the first quarter of 2021. Meanwhile, the Bank of England’s and the European Central Bank’s balance sheets rose from 5.3% to 44.3% and from 12.6% to 60.3%, respectively, during this same period. The Bank of Japan’s balance sheet jumped from 22.2% at the beginning of 2007 to 136.7% at the beginning of 2021. With such large balance sheets, raising the policy rate could impose a high cost on the central banks themselves; in turn, this could impact the revenue of their countries’ respective governments.

To illustrate just how high this cost could be, let’s look at the euro area: For every 1 percentage point increase in the average interest rate difference between its liabilities and assets, the European Central Bank’s revenue falls by approximately 80 billion euros.

The Pace of Policy Rate Responses across Central Banks

Monetary policy responses to increasing inflation have differed in magnitude across the central banks in our analysis. In the first half of 2022, the Federal Reserve started a rate hike cycle, and within one year it raised the policy rate target range from 0%-0.25% to 4.75%-5% in March 2023. Similarly, the Bank of England lifted its policy rate from 0.1% to 4.25% in 14 months.

On the other hand, the European Central Bank’s response has been slower and a bit smaller in magnitude, even though its inflation rate has exceeded that of the U.S. The policy rate for the euro area had only increased to 3.5% in March 2023. Lastly, the Bank of Japan has continued to maintain its loose monetary policy stance, keeping its policy rate unchanged at -0.1% despite the country’s inflation rate being well above that central bank’s 2% target. The green dots in the figure above represent each central bank’s policy rate as of March 2023.

Looking at the figure, we can observe that the central banks with larger balance sheet-to-GDP ratios in early 2021 had policy rates in March 2023 that were lower than the policy rates of central banks with smaller balance sheet-to-GDP ratios; in other words, the central banks with larger balance sheets appear to have had more passive policy responses. This could be a coincidence, or it could reflect central bank concerns regarding recession or bond portfolio losses.

It is important to keep in mind that economic conditions vary across the world, and therefore many factors might cause central banks to choose different monetary policy responses. For example, the European Central Bank’s slower pace of rate hikes may be due to concerns over economic risks and the shock caused by Russia’s invasion of Ukraine in 2022. Policymakers may also evaluate a rising inflation rate differently. The incoming governor of the Bank of Japan, for instance, has said that “it will take some time for inflation to sustainably and stably achieve the [Bank of Japan’s] 2% target,” and as such, the central bank’s loose monetary policy stance remains an appropriate approach.See the Feb. 23, 2023, article “Incoming BOJ Chief Says Low Rates Remain Appropriate—for Now” in U.S. News & World Report.

Many Factors Shape Monetary Policy Decisions

Is the negative relationship between policy responses and the size of central bank balance sheets that we observed in our analysis simply a coincidence? We certainly hope so. The primary role of central banks is to maintain price stability within an economy, not generate revenue for the government. Therefore, revenue should not be a determining factor in decisions regarding monetary policy.

However, the reality is that central banks do face political pressure or public criticism when it comes to making and losing money.This concern is not idle. Agustín Carstens, director of the Bank for International Settlements (often called the central banks’ bank), warned against the risk of allowing growing losses to deter central banks from fighting inflation. A reduction in revenue or a loss will be felt by the government and is thus one way or another eventually borne by the public, the consequences of which may be difficult for the political authorities to absorb.

Notes

- The euro area, or eurozone, consists of the 20 European Union member states whose currency is the euro.

- See the Feb. 23, 2023, article “Incoming BOJ Chief Says Low Rates Remain Appropriate—for Now” in U.S. News & World Report.

- This concern is not idle. Agustín Carstens, director of the Bank for International Settlements (often called the central banks’ bank), warned against the risk of allowing growing losses to deter central banks from fighting inflation.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us