Lower Inflation, GDP Growth Positive Signs for U.S. Economy

KEY TAKEAWAYS

- Headline and core inflation have declined sharply since their peak rates in 2022, but both measures remain well above the Fed’s 2% target.

- Consistent with the FOMC’s strategy, inflation has trended lower, and the U.S. economy has continued to grow at a healthy pace.

- Expansionary fiscal policy over the past year or more has boosted real GDP, but it has also contributed to the rise in interest rates and increased inflationary pressures.

Recent Inflation Developments

The strategy that the Federal Open Market Committee (FOMC) has pursued to return inflation to its 2% target rate without triggering a recession and widespread layoffs appears to be paying dividends. In June, the personal consumption expenditures price index (PCEPI) was up 3% from a year earlier, while in July the consumer price index (CPI) was up 3.3% from a year earlier. These levels are far below the peak rates of 7% and 8.9%, respectively, that occurred in June 2022. The marked deceleration in headline inflation has occurred against the backdrop of continued strength in labor markets, above-trend growth in real gross domestic product (GDP) over the first half of 2023, and below-average levels of financial market stress for most of 2023.

Lower food and energy prices have been a key factor in reducing headline inflation. Over the 12 months ending in June 2023, refiners’ acquisition cost of crude oil has declined from $114 per barrel to about $71 per barrel. Recently, though, crude oil prices and the prices of refined products (gasoline and diesel) have rebounded. The pace of food price increases in the CPI has also slowed, but in July food prices remained about 5% above year-earlier levels, a little less than half the peak year-over-year increase registered in August 2022.

Price indexes that strip out food and energy are commonly known as core indexes. Over the 12 months ending in July, the core CPI increased by 4.7%, while the core PCEPI increased by 4.1% over the 12 months ending in June. These core CPI and core PCEPI readings are below recent peaks of 6.6% and 5.2%, respectively, that occurred in September 2022.

The FOMC’s 2% inflation target is based on the headline inflation rate. However, many FOMC participants, including Fed Chair Jerome Powell (PDF), tend to pay closer attention to the core inflation rate because they believe it is a better predictor of future headline inflation. The reason is that food and energy price increases tend to be temporary. In other words, what goes up (down) also comes down (up). But recent research by St. Louis Fed economist Michael McCracken and another colleague found that food price increases have become a significant predictor of headline CPI inflation. This suggests the core CPI or core PCEPI that removes food prices might not be as valuable a predictor of future headline inflation as economists and Fed officials believe.

So, what’s the outlook for food prices? Each month, economists at the U.S. Department of Agriculture publish a near-term outlook for food prices. In its August 2023 outlook, the USDA expects food prices to increase by 5.9% in 2023, but then slow to a 2.8% increase in 2024 (these are midpoints of the forecast range). Over the 12 months ending in July 2023, the CPI’s food category has increased by 4.9%, well below the 10.5% increase registered over the 12 months ending in December 2022. Thus, the sharp slowing in food prices so far in 2023, and into 2024 if the forecasts are accurate, may bode well for the future direction of headline inflation.

The Near-Term Outlook Improves—Sort Of

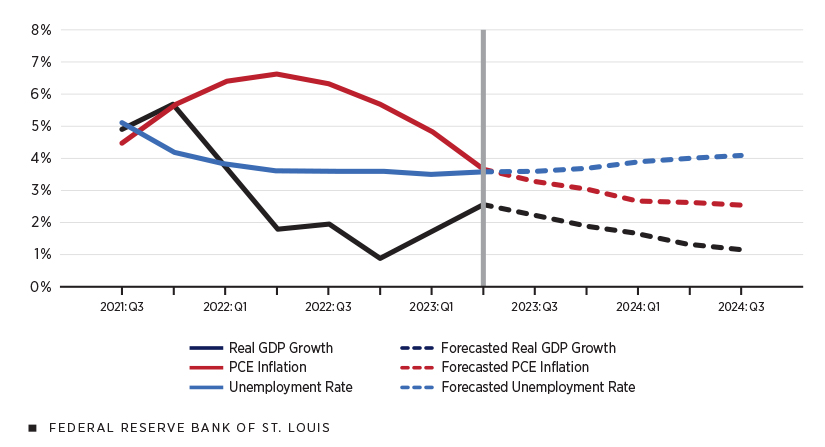

The third quarter 2023 Survey of Professional Forecasters, published by the Federal Reserve Bank of Philadelphia, indicates that private-sector professional forecasters expect slowing growth of real GDP, headline inflation and core inflation over the next four quarters, as well as a modest rise in the unemployment rate. These forecasts, less the one for core inflation, are plotted in the figure below. Pointedly, though, forecasts for real GDP growth over the following four quarters remain positive.

What Forecasters Predict for Economic Growth, Inflation and Unemployment

SOURCES: Survey of Professional Forecasters, August 2023.

NOTES: The figure shows quarterly percent changes at annual rates except for the unemployment rate, which is the average for the months of the quarter indicated. Data for the third quarter of 2023 to the third quarter of 2024 are forecasted.

Earlier this year, a short, mild recession was the baseline forecast for many economists, including staff at the Federal Reserve Board of Governors. However, with July unemployment still under 3.5%, job growth averaging more than 217,000 over the three months ending in July, and real GDP growth exceeding its estimated potential rate for four consecutive quarters (through the second quarter of 2023), many forecasters no longer expect a recession this year.According to the median FOMC participant, the longer-run estimate of real GDP growth is 1.8%. Indeed, a recent survey (PDF) of business economists conducted by the National Association for Business Economics found that nearly half of respondents expect the next recession will not occur until the second half of 2024 or later.

Some key data at the beginning of the third quarter have bolstered expectations of an improving economy over the second half of 2023. In particular, retail sales, automotive sales and industrial production all posted healthy rates of increase in July. Accordingly, some forecasters have ramped up their estimates for third quarter real GDP growth. In this vein, the Federal Reserve Bank of Atlanta’s GDPNow forecasting model has pegged third quarter growth at an annualized rate of 5.9%. However, few other forecasts are that optimistic. For example, the consensus in the August Survey of Professional Forecasters was for third quarter real GDP growth of 1.9%.

Healthy demand from consumers, businesses and the government for final goods and services has been an elixir for labor demand. Although private sector job openings in June (at 9.6 million) were about 20% below their March 2022 peak, they were still 33% higher than their level in January 2020, before the COVID-19 pandemic. The inability of many firms to fill job openings also has kept nominal wage gains above their pre-pandemic rates. In July, the median wage measured by the Atlanta Fed’s wage tracker was up by 6% from a year earlier. Headline CPI inflation was up by 3.3%, resulting in a real wage gain of about 2.75% since July 2022.

In addition to the increase in real wages, consumers have benefited from rising levels of real wealth. First, above-trend real GDP growth has boosted corporate earnings and, thus, equity prices; stock prices (as represented by the S&P 500) are up by a little more than 17% year to date. Second, house prices have continued to increase—they are up 7.3% in 2023 through July—despite a 32% decline in total (new and existing) home sales since January 2022. However, with mortgage rates rising to near 7.5%, the risk to home sales and further house price gains seems skewed to the downside.

Fiscal Policy Actions Are a Two-Edged Sword

Nonresidential construction activity—both public and private—has been another key driver of the economy’s forward momentum this year. Three new laws—the 2021 Infrastructure Investment and Jobs Act, the Inflation Reduction Act of 2022 and the 2022 CHIPS and Science Act—have boosted nonresidential construction activity directly, through increased budgeted outlays, and indirectly, through government subsidies to private companies. For example, from November 2021 through June 2023, public highway and street construction has increased by nearly 25%, while construction on private manufacturing facilities has increased by 109%. According to an October 2022 report by McKinsey & Co., these three pieces of legislation will boost federal discretionary expenditures by $2 trillion over the next decade, so further impetus is likely.

Expansionary fiscal policy produces both benefits and costs. The direct benefits of increased discretionary outlays are increases in final goods and services, and thus increases in real GDP. Moreover, if the new capital spending raises productivity, then real per capita incomes, and thus living standards, will also increase. However, increasingly large federal budget deficits and a rising debt-to-GDP ratio, which are the Congressional Budget Office’s baseline projections, also tend to raise interest rates and inflation. For example, large, pandemic-related fiscal actions appear to be an important factor in the scale and persistence of inflation since early 2021.

Stronger economic growth and the prospect of persistently large budget deficits also appear to be spurring higher interest rates. Currently, the yields on 10-year nominal and real government bonds have increased to their highest levels in more than a dozen years. This development presents yet another risk to the U.S. economic outlook, since higher interest rates tend to reduce expenditures on interest-sensitive goods and services (e.g., autos and housing) and the prices of financial assets, like stocks.

Key Themes in the U.S. Economic Outlook

Above-trend real GDP growth, healthy labor market conditions and declining—but still above target—inflation remain key themes in the U.S. economic outlook. If inflation remains stubbornly high in the face of continued resilience from the economy, then further actions by monetary and fiscal policymakers could be required to bring inflation back to the Fed’s 2% target.

Note

- According to the median FOMC participant, the longer-run estimate of real GDP growth is 1.8%.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us