Fast Cash and Payday Loans

—Benjamin Franklin

Introduction

Well over 400 years ago, Shakespeare wrote Hamlet. From this play, a famous line emerged: "Neither a borrower nor a lender be." But moving into today's world, it's common practice for consumers to borrow and for lenders to lend. Estimates show as many as 80 percent of American consumers owe an outstanding balance on some type of debt.1 This may be for conventional long-term loans, such as home mortgages, vehicle loans, or student loans, or for revolving credit, such as credit cards. It could even be for payday loans.

Payday loans are marketed as a convenient, short-term solution when a borrower needs cash in a hurry. Storefront payday loan businesses began to spring up across the country in the 1980s and quickly became commonplace.2 In 2017, there were 14,348 payday loan storefronts3 in the United States. By comparison, this was about the same number of Starbucks locations4 and slightly more than the 14,027 McDonald's locations in that same year.5 The 1990s brought expansion to the industry when the internet added the convenience of online payday lending.

What Are Payday Loans?

Payday loans are a type of alternative financial service that provide fast cash to cover emergency situations or help pay a borrower's expenses from one paycheck to the next. These unsecured loans have a short repayment period and are appropriately called "payday loans" because the duration of a loan usually matches the borrower's payday schedule. A balloon payment—full amount of the loan plus fees—is generally due on the borrower's next payday after the loan is made.

The loans are generally for $500 or less and come due within two to four weeks after receiving the loan.6 Loan lengths vary based on the borrower's pay schedule or how often income is received—so the length could be for one week, two weeks, or one month. Consumers paid more frequently within a month could potentially take out many more loans over a given time period than those paid monthly.

Online payday loans have the same basic structure as storefront loans, with the exception that all communication is conducted online. This includes the loan application, the authorization for a lender to electronically make a withdrawal from the borrower's checking account, and the direct deposit of the money borrowed into a borrower's checking account.7

Securing Payday Loans

Unlike traditional loans, borrowers do not need collateral or a particular credit score to get a payday loan. Generally, credit reports and credit scores are not part of the loan process.8 To obtain a payday loan, borrowers must meet certain requirements.9 The borrower must have

- a bank (or credit union) account or a prepaid card account;

- proof or verification of income from a job or some source;

- valid identification; and

- proof of age—must be at least 18 years old.

Payment Plan Options

Generally, there are options for re-payment of payday loans. One option requires borrowers to provide a postdated check. In this case, a check is written for the full amount borrowed plus fees and interest for the loan. The payday lender agrees to hold the check until the loan is due—the borrower's next payday. If the borrower does not return to the storefront to make other arrangements to pay or renew the loan, the lender can cash the check. If the borrower's checking account does not have enough funds to cover the check, the bounced check can trigger a fee as a result of the overdraft to the borrower's account and the loan will remain unpaid. The default can lead to the lender placing the debt in collection and suing the borrower.

Another payment option requires the borrower to authorize the lender to access his or her bank or credit union account electronically. The amount of the loan is deposited directly into the account, and the borrower gives the lender the right to electronically deduct the full amount from the account on the due date.10 If the borrower makes arrangements to renew the loan, only the additional fees are withdrawn. This option allows the lender to be paid ahead of the borrower's other bills and expenses. In some instances, payday lenders can offer longer-term payday installment loans and request authorization to electronically withdraw multiple payments from a borrower's bank account, typically due on each pay date.11

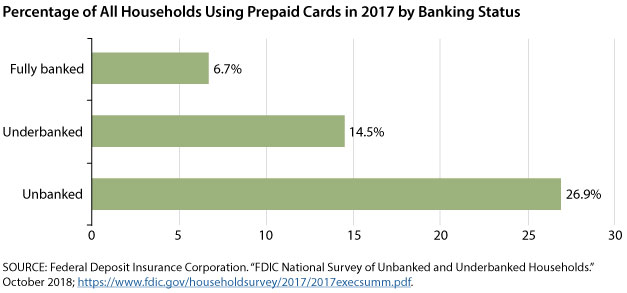

Percentage of All Households Using Prepaid Cards in 2017 by Banking Status

SOURCE: Federal Deposit Insurance Corporation. “FDIC National Survey of Unbanked and Underbanked Households” (PDF). October 2018.

Using a prepaid debit card can also be an option for securing a payday loan. Reloadable prepaid cards address the financial needs of some consumers, and usage is more common among unbanked households, especially in lower-income households, less-educated households, younger households, and some minority households (Figure).12 Unbanked borrowers, as the word implies, do not have a traditional bank or credit union account at all. Underbanked consumers have a bank account but also use alternative financial services, such as payday loans. When using a prepaid debit card, the amount of the loan is deposited directly on the card and the borrower gives the lender the right to electronically deduct the full amount from their prepaid card when the payment is due.

Calculating the Cost

The cost of a payday loan is problematic. Collectively, borrowers spend as much as $9 billion each year on payday loan fees. On average, the fee for a payday loan is $55 for a two-week loan, and the typical $375 loan will incur $520 in fees because of repeat borrowing.13 But the federal Truth in Lending Act arms borrowers with valuable knowledge and facts about the cost of borrowing. The law requires the lender to disclose the cost of a payday loan before a borrower enters into a loan agreement. The fee-based structure of payday lending is quite different from a traditional loan, and, comparatively, payday loans cost far more than traditional loans. Lenders must disclose the cost both in terms of the finance charge (fee) and also as an annual percentage rate (APR).14 From this information, consumers can compare the cost of a payday loan with other types of borrowing. To calculate the APR, the interest and fees for the amount borrowed are compared with what the amount would be for a one-year period (see "Calculating the APR of a Payday Loan").

Who Uses Payday Loans

As many as 12 million Americans use payday loans each year.15 Payday loans are marketed as helpful for unexpected or emergency expenses. However, 7 of 10 borrowers use the loans for basic expenses such as rent and utilities. This comes as no surprise since as many as 58 percent of borrowers have difficulty meeting basic monthly expenses.16

Payday lenders choose to locate their storefronts in areas where they market to specific segments of the population. For example, payday storefronts are more likely to be concentrated in locations with higher-than-average poverty rates, lower income levels, more single parents, and with some minority groups. Also, on average, payday loan borrowers have low education levels.17

Payday loans fulfill a need for many people, especially consumers who don't have access to traditional loans or who have no or low credit scores.18 In 2017, estimates show that among U.S. households, 6.5 percent (8.4 million) were unbanked; and 18.7 percent (24.2 million) were underbanked—that is, they had a bank account but used alternative financial services, such as payday loans.19 With bad credit (no or low credit scores), these consumers are often unable to get traditional loans, so they turn to alternative lenders.

State Regulation

Historically, payday lending has been regulated by individual state law; each state has its own specific regulations. It gets complicated trying to understand payday lending with so many differences. Seventeen states and the District of Columbia either prohibit payday lending entirely or have set interest rate caps that force lenders out of business because of unprofitability.20 The remaining 33 states permit payday lending. These states have either exempted payday loans from usury laws or chosen to not regulate the interest rates on the loans.21

Practices within states are determined by regulations that address concerns such as repeat borrowing, cooling-off (waiting) periods between loans, loan limits, loan lengths, renewal restrictions, and effective APR caps.22 To add to the complexity, some states require payday loans to have installment payments rather than the traditional single balloon payment.23 The many combinations of regulations within individual states mean payday loans are structured and priced very differently. Among states that permit payday lending, there is a wide variation in the cost of borrowing. Within a given state, lenders charge similar fees that are set at or near the maximum allowed by law (see "Sample of U.S. Payday Loan Interest Rates Calculated for a Typical Payday Loan").

| State | APR |

|---|---|

| California | 460% |

| Florida | 304% |

| Kansas | 391% |

| Kentucky | 469% |

| Mississippi | 521% |

| Missouri | 462% |

| Nevada | 652% |

| New Mexico | 175% |

| Tennessee | 460% |

| Texas | 661% |

| SOURCE: Center for Responsible Lending. “Map of U.S. Payday Interest Rates.” February 14, 2019. | |

Federal Regulation

Payday loans are commonly used by consumers in the military. For example, in 2017, about 44 percent of service members received a payday loan. This compares with only 7 percent of all consumers using these loans. To protect active duty service members from high interest rates and fees, the Military Lending Act was enacted in 2006 and expanded in 2015. This federal law prohibits payday lenders from charging active duty military members more than 36 percent interest on many loan products, including payday loans.24

In 2011, the Consumer Financial Protection Bureau (CFPB) was established under the Wall Street Reform Act (also called the Dodd-Frank Act).25 The CFPB was established to improve the enforcement of federal consumer financial laws while expanding consumer protective regulation, including those for payday loans.26 The CFPB is charged with developing and recommending new federal regulations. It continues to examine evidence and evaluate payday lending practices. This includes actively seeking public comments as concerns come into focus. Considerations include consumer access to credit and consumer protections from harm associated with lenders' payment practices. In February 2019, Kathy Kraninger, Director of the CFPB stated, "…I look forward to working with fellow state and federal regulators to enforce the law against bad actors and encourage robust market competition to improve access, quality, and cost of credit for consumers."27

Conclusion

Payday loans provide fast cash—immediately or at least within 24 hours from requesting the loan. They are convenient, and for some consumers they're the only available loan source. Their widespread use indicates that many consumers rely heavily on payday loans. Looking into payday lending—the structure, the high fees, the high rates of renewal and loan sequences, the cycle of debt—provides reason for concern. Consequently, many states prohibit payday loans, while others heavily regulate them. As with all forms of credit, borrowers need to be aware of what they are getting into when they take out a payday loan and avoid taking on debt they cannot afford. Borrowing is costly without the power of knowledge.

Alternative financial services: Financial services offered by providers that are not banks.

Annual percentage rate (APR): The percentage cost of credit on an annual basis and the total cost of credit to the consumer.

Bounced check: A check that is written from a checking account, submitted for payment, and returned because the account does not have enough funds to cover the amount of the check.

Collateral: Property required by a lender and offered by a borrower as a guarantee of payment on a loan.

Cooling-off period: An interval of time during which no action of a specific type can be taken.

Credit score: A number based on information in a credit report, which indicates a person's credit risk.

Interest: The price of using someone else's money.

Interest rate: The percentage of the amount of a loan that is charged for a loan. Also, the percentage paid on a savings account.

Overdraft: The result of an account holder authorizing a withdrawal through a check, ATM withdrawal, debit card purchase, or electronic payment when the account does not have enough money to cover the transaction.

Revolving credit: A line of available credit that is usually designed to be used repeatedly, with a preapproved credit limit. The amount of available credit decreases and increases as funds are borrowed and then repaid with interest.

Unsecured loan: A loan not backed with collateral.

Usury law: Consumer protection law that regulates the amount of interest charged on a loan by setting caps on the maximum amount of interest that can be charged.

- Horton, Melissa. "Payday Loan Statistics." LendEDU. September 28, 2018; https://lendedu.com/blog/payday-loan-statistics/.

- Lulic, Miron. "History of Payday Loans." October 13, 2014; https://www.loannow.com/history-payday-loans/.

- Consumer Financial Protection Bureau. "Consumer Financial Protection Bureau Releases Notices of Proposed Rulemaking on Payday Lending; Payday, Vehicle Title, and Certain High-Cost Installment Loans." February 2019; https://files.consumerfinance.gov/f/documents/cfpb_payday_nprm-2019-reconsideration.pdf.

- Cowley, Stacy. "Consumer Protection Bureau Cripples New Rules for Payday Loans." New York Times. February 6, 2019; https://www.nytimes.com/2019/02/06/business/payday-loans-rules-cfpb.html.

- Statista. "Number of McDonald's Restaurants in North America from 2012 to 2017, by Country"; https://www.statista.com/statistics/256040/mcdonalds-restaurants-in-north-america/.

- Consumer Financial Protection Bureau. "Payday Loans." 2017; https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/.

- Consumer Financial Protection Bureau. "Payday Loans and Deposit Advance Products: A White Paper of Initial Data Findings." April 24, 2013b; http://files.consumerfinance.gov/f/201304_cfpb_payday-dap-whitepaper.pdf.

- Consumer Federation of America, "Payday Loan Consumer Information." 2015; https://paydayloaninfo.org/.

- Consumer Financial Protection Bureau. "Payday Loans." 2017; https://www.consumerfinance.gov/ask-cfpb/what-do-i-need-to-qualify-for-a-payday-loan-en-1593/.

- Consumer Financial Protection Bureau. "Payday Loans." 2017; https://www.consumerfinance.gov/ask-cfpb/how-do-i-repay-a-payday-loan-en-1599/.

- Consumer Federation of America, 2015.

- Federal Deposit Insurance Corporation. "FDIC National Survey of Unbanked and Underbanked Households." October 2018; https://www.fdic.gov/householdsurvey/2017/2017execsumm.pdf.

- Pew Charitable Trusts. "Payday Loan Facts and the CFPB's Impact: FACT SHEET." January 14, 2016; https://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2016/01/payday-loan-facts-and-the-cfpbs-impact.

- Fox, Jean Ann. "The Growth of Legal Loan Sharking: A Report on the Payday Loan Industry." Consumer Federation of America, 1998; https://consumerfed.org/pdfs/The_Growth_of_Legal_Loan_Sharking_1998.pdf.

- Pew Charitable Trusts, 2016.

- Pew Charitable Trusts, 2016.

- Mahon, Joe. "Tracking Fringe Banking." Federal Reserve Bank of Minneapolis Fedgazette, September 2008.

- Bonsai Finance. "Payday Loan with a Prepaid Debit Card: How to Get a Loan When You Only Have a Debit Card." June 2018.

- Federal Deposit Insurance Corporation. "2017 FDIC National Survey of Unbanked and Underbanked Households." October 2018; https://www.fdic.gov/householdsurvey/.

- Consumer Financial Protection Bureau, 2019.

- Consumer Financial Protection Bureau, 2019.

- Burke, Kathleen; Lanning, Jonathan; Leary, Jesse and Wang, Jialan. "CFPB Data Point: Payday Lending." CFPB Office of Research, March 2014; http://files.consumerfinance.gov/f/201403_cfpb_report_payday-lending.pdf.

- Montezemolo, Susanna. "Payday Lending Abuses and Predatory Practices: The State of Lending in America & Its Impact on U.S. Households." Center for Responsible Learning, September 2013; http://www.responsiblelending.org/state-of-lending/reports/10-Payday-Loans.pdf.

- Sandbert, Erica. "Everything You Need to Know About Payday Loans." U.S. News & World Report, October 2018; https://loans.usnews.com/everything-you-need-to-know-about-payday-loans.

- Simon, Helen. "The Motley Fool; What Is the Consumer Financial Protection Bureau, and How Can It Help You?" December 12, 2015; https://www.fool.com/investing/general/2015/12/12/what-is-the-consumer-financial-protection-bureau-a.aspx.

- Pew Charitable Trusts. "Payday Lending in America: Who Borrows, Where They Borrow, and Why." July 2012; http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/PewPaydayLendingReportpdf.pdf.

- Consumer Financial Protection Bureau. "Consumer Financial Protection Bureau Releases Notices of Proposed Rulemaking on Payday Lending" February 06, 2019; https://www.consumerfinance.gov/about-us/newsroom/consumer-financial-protection-bureau-releases-notices-proposed-rulemaking-payday-lending/.

Citation

Jeannette Bennett, ldquoFast Cash and Payday Loans,rdquo Federal Reserve Bank of St. Louis Page One Economics, April 10, 2019.

These essays from our education specialists cover economic and personal finance basics. Special versions are available for classroom use. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us