Quick Guide to Understanding the Federal Budget

You may use a budget to determine how much money you need to cover certain expenses such as rent, utilities and groceries, as well as planning for emergencies or investing for the future. Budgets provide a framework to promote your economic well-being.

The U.S. government budget serves the same purpose: the budgetary process of the United States determines how much money the government can spend and where to allocate resources. The federal budget drives fiscal policy and determines the size and scope of the federal government, which in turn helps shape the economy.

Due to its size and scope, the federal budgetary planning process is complex. It involves many people—from the White House, from Congress and from federal agencies, and ultimately taxpayers.

When the Federal Budgetary Process Starts

The federal government fiscal year begins Oct. 1. However, the process for finalizing the federal budget begins much earlier, typically a year prior.

The budgetary planning process begins in the fall when federal agencies submit their budget requests to the Office of Management and Budget. The OMB prepares and manages the budget on behalf of the president.The Budget and Accounting Act of 1921 gave the president overall responsibility for budget planning by requiring him to submit an annual, comprehensive budget proposal to Congress; that act also expanded the president’s control over budgetary information by establishing the Bureau of the Budget (renamed the Office of Management and Budget in 1971).

By convention, the president each year submits a proposed budget to Congress by the first Monday in February,The president submits a budget to Congress by the first Monday in February every year. The budget contains estimates of federal government income and spending for the upcoming fiscal year and also recommends funding levels for the federal government. though in some cases the timing differs based upon circumstances. The proposed budget, which is not the final budget, is prioritized by the president’s revenue and spending focus areas.

Government Spending: Focus Areas

As outlined in a previous blog post, federal government spending is divided into three categories:

- Mandatory spending: Funds that pay for Social Security, Medicare, veterans’ benefits, and other categories of mandated spending. In other words, spending that has been designated by law.

- Discretionary spending: Funds that support national defense, health and safety, transportation, education, housing, and other social and environmental programs. Discretionary spending is allocated by Congress through appropriations to federal agencies.

- Interest on the public debt: Funds the government allocates to pay toward outstanding debt.

Resolutions, Appropriations and Authorization

Each April, the U.S. Congress prepares a budget resolution, or a framework, for setting spending limits. The House and Senate each hold hearings of their respective budget committees to hear requests from federal agencies, which outline why their particular programs require the funding. Each committee then submits budgetary resolutions for a vote. Once the resolutions are voted on, Congress begins the appropriations process.

An appropriation is a law that provides budget authority or approval to receive funds. Each year, Congress passes appropriation bills that are generated by 12 financial subcommittees and grouped by the type of program and agency.

Congress can enact supplemental appropriations at any time when there is an urgent funding need.

Once Congress passes all appropriation bills, the completed budget goes back to the president for authorization (formal signature). If Congress, or Congress and the president, cannot agree on the budget, Congress can pass an omnibus bill. An omnibus bill packages together certain budgetary measures for a limited time to ensure funding.

The Deficit and National Debt

The national debt is the amount of money the federal government has borrowed to cover outstanding balances, like the balance you may have on your credit card. If spending exceeds revenue in a given fiscal year, there’s a budget deficit. To make up the deficit, the federal government has to borrow money, which it does by selling marketable securities like Treasury bonds, bills, and Treasury inflation-protected securities.

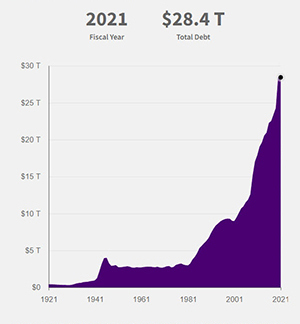

U.S. National Debt Has Grown over the Last 100 Years

SOURCE: Historical Debt Outstanding data set from Fiscal Data; Bureau of Labor Statistics.

NOTES: 2021 dollars. Updated Sept. 30, 2021.

The total national debt is an accumulation of this borrowing along with the interest owed to investors who have purchased the securities. If over time the federal government has deficits (spending greater than tax revenues), the national debt grows.

The national debt allows the government to continue to pay for critical programs and services, even if funds are not immediately available.

U.S. Debt Ceiling and Government Shutdowns

Debt Ceiling

The debt ceiling, or debt limit, is a restriction imposed by Congress on the amount of outstanding debt the federal government can hold. This is like the credit limit your bank can impose. The debt ceiling is the maximum amount that Treasury can borrow to pay “bills” that are due as well as pay for future investments and interest on previously borrowed money. Congress can raise the debt ceiling, but if it is reached without Congress taking action, the government must stop spending, thereby losing the ability to pay bills or fund government programs and services.

While the United States has reached the debt ceiling at times, it has never run out of resources or failed to meet its financial obligations.

Government Shutdowns

Unlike spending stopped by a debt ceiling, a government shutdown is caused by Congress, or Congress and the president, failing to reach an agreement on the budget. Until there is a compromise, federal agencies must discontinue all nonessential functions until funding legislation is passed. Essential services and mandatory spending initiatives are allowed to continue. The overall health of the economy can be a factor in the budgetary process. In economic downturns, a reduction of federal revenue leading to reduced federal spending is expected. This expectation leads to an increased likelihood of debt ceiling overages and government shutdowns in the future.

Notes:

- The Budget and Accounting Act of 1921 gave the president overall responsibility for budget planning by requiring him to submit an annual, comprehensive budget proposal to Congress; that act also expanded the president’s control over budgetary information by establishing the Bureau of the Budget (renamed the Office of Management and Budget in 1971).

- The president submits a budget to Congress by the first Monday in February every year. The budget contains estimates of federal government income and spending for the upcoming fiscal year and also recommends funding levels for the federal government.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us