The Fed’s Emergency Lending Powers Explained

As the COVID-19 crisis unfolded in 2020, the Fed took emergency steps, rummaging deep in its toolbox for emergency lending tools to ensure that credit would keep moving through the economy.

For only the third time in its history, the central bank pulled out a set of direct lending tools that go beyond its usual lending to banks and other depository institutions.

With approval and backstop funding from the U.S. Treasury, the Federal Reserve Board of Governors set up several lending and funding facilities in 2020.

The Fed introduced the temporary facilities “to support the flow of credit to businesses, households and communities where it was not otherwise available,” according to an August 2020 Open Vault blog post.

The facilities were aimed at supporting various types of funding and credit markets and businesses of all sizes, authors Jane Ihrig, Gretchen Weinbach and Scott Wolla wrote. That included the “commonly discussed” facility that supports business loans under the Paycheck Protection Program (PPP).

And as Christopher Neely wrote in a December 2020 On the Economy blog post, “These facilities were intended to provide credit to a variety of sectors—including small- and medium-sized businesses, money market mutual funds, consumer lending, and corporate and municipal borrowing.”

But how does the Fed have the authority to extend that kind of credit?

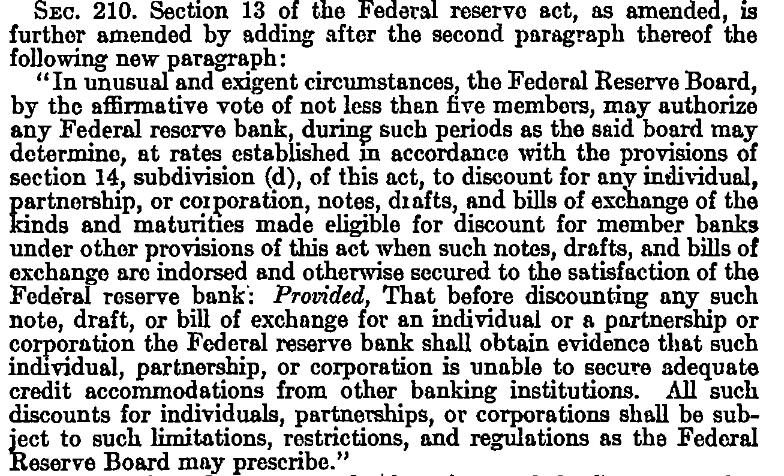

Section 13(3) of the Federal Reserve Act

The Fed’s emergency lending programs—like those used during the pandemic—are authorized under Section 13(3) of the Federal Reserve Act. That authority is rarely used, said David Wheelock, a senior vice president and special policy advisor to the St. Louis Fed president. Wheelock answered questions about the 13(3) authority, and when and how the Fed wields it.

Q. What is the 13(3) authority?

A: Section 13(3) of the Federal Reserve Act was inserted during the Great Depression to allow the Fed to make loans directly to private concerns that are unable to obtain loans from banks and other lenders in “unusual and exigent”—that is, unusual and urgent—circumstances.

Q. What is the Treasury’s role?

A: The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 requires the Fed to seek approval from the Treasury Secretary to lend under Section 13(3). It also requires that any such loans be made available to a broad class of borrowers, rather than to just a single borrower. This change came after the Fed, using Section 13(3) powers, extended credit in 2008 to individual firms (e.g., American International Group Inc., or AIG, the world’s largest insurer).

Q. Why does the Federal Reserve Board have these powers instead of the Federal Open Market Committee (FOMC)?

A: Under the Federal Reserve Act, the Board has the authority to set the rules by which the Fed makes loans under Section 13(3) and all other lending programs. The regional Reserve banks carry out the function under the regulations set by the Board. Fed lending programs are distinct from monetary policy and, thus, are not under the purview of the FOMC, whose role is solely to determine monetary policy.

Q. What has been the goal of the 13(3) programs used during the COVID-19 crisis?

A: The goal has been to ensure ample supply of credit to markets, firms and municipalities. When the pandemic hit in March 2020, credit markets were disrupted, and funding became unavailable on reasonable terms in some cases. Congress supported the Fed’s 13(3) lending programs by appropriating some $454 billion for the Treasury to use to backstop them—that is, to cover potential losses from these emergency loans.

Q. How do these 13(3) programs compare with those used during the 2007-09 financial crisis?

A: The programs were similar to (and in a few cases, the same as) those used in the financial crisis. However, unlike that time, none of the programs were established to lend to a single firm this time. As noted above, the Dodd-Frank Act of 2010 prohibited 13(3) loan programs for individual firms.

Q. Has the Fed used its emergency lending authority any other time?

A: The Fed’s Section 13(3) authority was also used in the 1930s, but the loans were all small loans to individual firms, mostly small businesses, in locations where bank loans were not available.

Emergency Lending Programs Are Winding Down

Most of the lending facilities set up under Section 13(3) during the pandemic have ended or are set to expire on March 31.

Community development finance institutions and other nonbank lenders have asked the Fed to continue operating the facility that provides low-interest loans to financial institutions that in turn make PPP loans to small businesses. With approval from the U.S. Treasury Secretary, the Fed extended that lending facility until June 30.

After that, Section 13(3) emergency lending will rest again in the toolbox.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us