Four Snapshots of U.S. Inflation and Price Levels

The U.S. economy and inflation looked a lot different in the 2010s than they did 40 years before.

Changes in supply and demand were reflected in prices much more quickly in the 1970s, St. Louis Fed economist Fernando Martin said at a May 21 event.

“The economy was very different, much less resilient, less flexible,” he told an audience at a virtual Breakfast with the Fed event sponsored by the Little Rock, Ark., Branch of the St. Louis Fed.

As the COVID-19 pandemic has shown, though, economic shocks—unpredictable or unexpected events that affect the broader economy—can have a big effect.

What has inflation in the U.S. looked like over the past five decades? In his presentation (titled “Is Inflation Making a Comeback?”), Martin, a Research officer, offered some snapshots and charts of U.S. inflation and price level history, from high inflation in the 1970s and early 1980s to the reversal of a price level trend for durable goods during the pandemic.

One note: At the time of Martin’s presentation, the latest available data extended through March. Charts presented in the blog post are shown through the end of May, the latest available at the time of publication.

Inflation Spikes in the 1970s and Early 1980s

NOTES: The shaded areas indicate recessions, as determined by the National Bureau of Economic Research’s Business Cycle Dating Committee. The most recent end date is undecided.

To illustrate inflation trends going back to 1960, Martin turned to percentage changes in the price index for personal consumption expenditures, or PCE. The Federal Open Market Committee (FOMC), the main monetary policymaking body of the Federal Reserve, has an inflation target that is based on the annual change in this index, which Martin called “the Fed’s personal favorite.”

As a January 2019 Open Vault post explained, the index is prepared by the Bureau of Economic Analysis and accounts for prices that U.S. consumers pay for a wide range of goods and services. “It also accounts for changes in consumer behavior,” according to the post. “For example, if the price of a certain good increases, consumers may switch to a similar good that costs less. That kind of substitution is captured in the calculation of the index.”

Martin plotted the annual growth rate of the index on a monthly basis, showing the percentage change for a particular month from the same month a year earlier. For example, the inflation rate for January 2020 is calculated as the percentage change between January 2020 and January 2019. The above PCE inflation chart from FRED, the St. Louis Fed’s economic database, is a recreation, with data through May 2021, the latest available as of the blog post publishing date. It shows large spikes in inflation in the 1970s and early 1980s.

These days, supply is much more flexible than it was back then, and consumers have many more options for certain goods, Martin said. That means they can more easily find an alternative if a particular product becomes scarce or expensive. “So prices don’t react as much to temporary shocks,” he said.

When Paul A. Volcker became Fed chairman in August 1979, he led a shift in monetary policy in efforts to control inflation. Inflation then fell from its high rates during the 1980s.

Since then, inflation has moved around 2%, Martin said. “But it fluctuates. Sometimes it can be higher; sometimes it can be lower.”

Inflation Mostly Stays below 2% since 2012

In the 2010s, the Fed navigated a very different inflation issue. After the FOMC in January 2012 set an explicit inflation target of 2%, inflation was mostly below that target, as shown in the above FRED chart. Martin pointed out that PCE inflation averaged 1.4% from 2012 to 2019.

Martin also looked at a measure of inflation that removes some of the short-term volatility—the trimmed mean PCE inflation rate from the Federal Reserve Bank of Dallas, which is plotted in the chart below. (Both the charts have data that start at January 2012 and continue through the end of May 2021, the latest available as of the blog post publishing date.)

This measure trims “extreme observations”; that is, individual items with price changes that are outliers in a particular month, on the high side or the low side, are taken out before calculating the inflation rate. “If you do that, you get this measure, which is much less volatile,” Martin said.

But the result is the same—since 2012, inflation has mostly been below 2%.

In August 2020, the FOMC announced a new framework for monetary policy, including a new approach to inflation targeting. The inflation target is still 2%, but now the Fed seeks to hit the target on average over the long run, Martin said. That means, for inflation to ultimately average out to 2%, it’s expected that the Fed is going to let inflation “ride” moderately above 2% for a while after periods of low inflation.

“The open question, of course, is for how long and by how much,” Martin said. “This year and next are going to be good tests on what this new framework involves.”

Pandemic Reverses Trend in Prices for Durable Goods

Martin moved to showing changes in price level components to illustrate some trends before and during the pandemic. He looked at the three main groups for classifying what consumers purchase: nondurable goods, durable goods and services. The chart above shows the price levels for those components. The chart has data that start at January 2012 and continue through the end of May 2021, the latest available as of the blog post publishing date.

Nondurable goods are those that are either immediately consumed or consumed after a short while, such as food and oil. Durable goods are long-lasting products like cars and computers. Services are activities or actions offered as products. Martin described the three categories as “sandwiches, iPads and haircuts.”

The trend for nondurable goods had been relatively constant, while that for durable goods had been trending down before 2020, when the main economic effects of the pandemic took hold.

In 2020, the price level for nondurable goods initially went down “quite substantially” as people stayed home and consumption dropped, but there has been a recent increase in those prices, Martin said. The price level for durable goods went down at first, too, but has since gone up—a trend most likely related to a sharp increase in demand, he said.

“So as we stopped going to restaurants and cinemas, we started buying bigger TVs and more computers, etc.,” Martin said. But the reversal of the downward trend in the price level for durable goods is likely transitory as supply catches up with demand, which can take a while with these goods because more time is needed to make them.

“There is a big spike in demand,” Martin said. “But at some point, there are only so many cars and so many computers you can buy.”

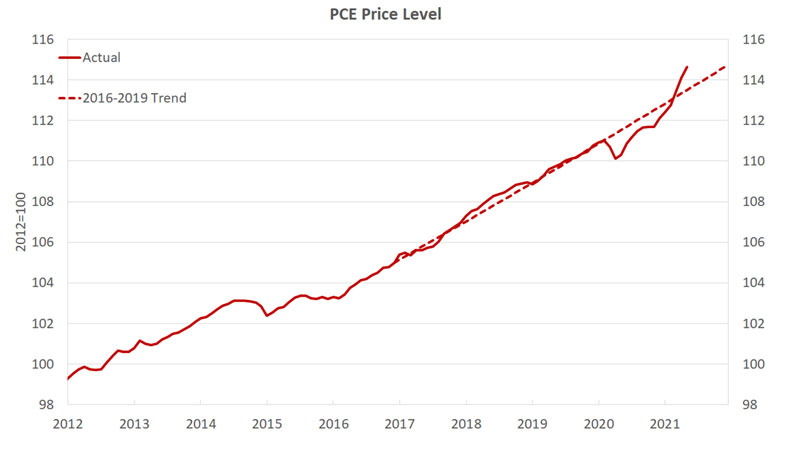

Overall Price Level Goes Above Trend after Pandemic Drop

Martin projected the overall price level (the PCE price index) assuming that the trend from 2016 to 2019 had continued, as can be seen in the chart below. As the pandemic hit, the price level dipped well below the trend line. But it has been catching up since then and is now above the trend, he said.

SOURCE: “Is Inflation Making a Comeback?” Presentation by Fernando Martin on May 21, 2021, at a Breakfast with the Fed virtual event sponsored by the Little Rock Branch of the St. Louis Fed.

DESCRIPTION: A chart shows the PCE price index from 2012 to 2021, with the y-axis showing the base is 2012=100 and index levels from 98 to 116. A dotted line shows a trend line from 2016 to 2019 extended into 2021. A solid red line shows the actual trend with seasonally adjusted data through the end of May 2021, the latest available as of the blog post publishing date.

This year, the “base effect” is helping drive up inflation measured in year-over-year changes, Martin said. That is, when a month in 2020 shows depressed prices, the percentage change compared with the same month this year, as prices come back to normal, will be larger than it would have been if compared with a more usual price level. “So, it’s really that inflation today is going to be higher because the price level was very low in the past,” he said.

The nature of the higher inflation due to the base effect is “purely temporary,” Martin said. But there can be other inflationary pressures, he said.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us