How Do Coins Get to Where They’re Needed?

Most people probably don’t think a lot about how coins get to banks, retailers and wallets.

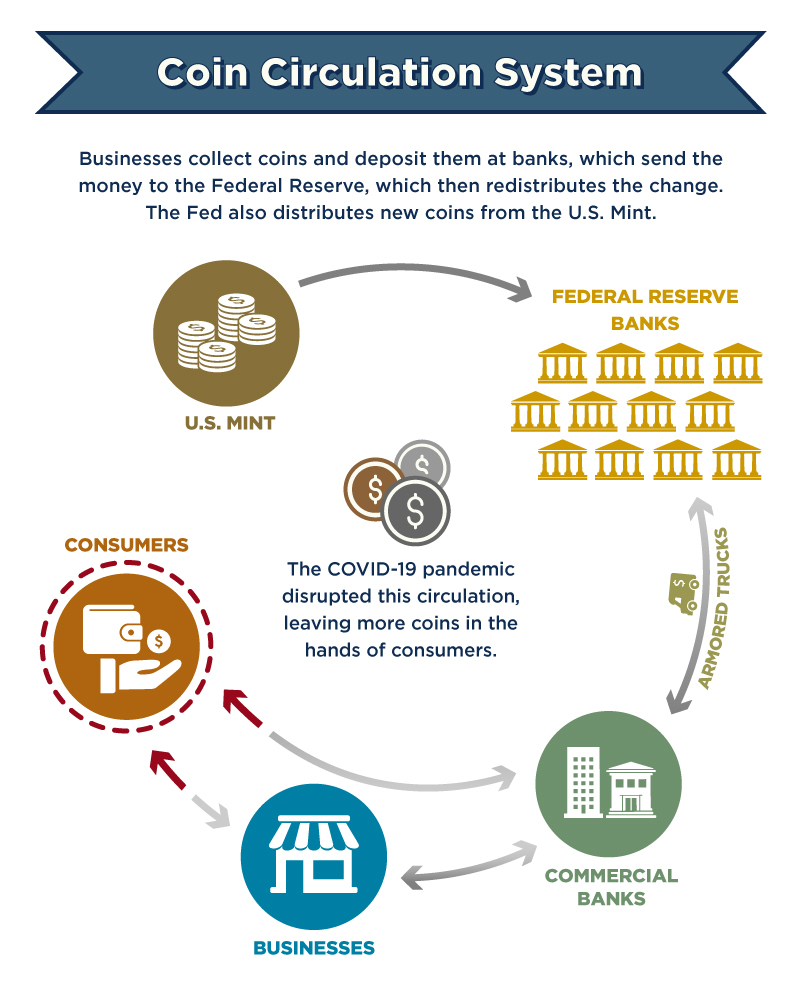

But Federal Reserve banks and commercial banks think about the flow of coins through the economy all the time, Federal Reserve Chair Jerome Powell told the U.S. House Committee on Financial Services in June. That’s because it’s those institutions’ job to get coins to where they need to be: in the hands of businesses and consumers.

The COVID-19 pandemic disrupted how coins make their way through the economy. Dimes gathered dust on dressers and quarters languished in drawers rather than dropping into change sorters in bank lobbies or washing machine coin slides in laundromats.

Now more people are thinking about how coins get to where they’re needed.

So what does the Fed have to do with getting coins to stores? What can banks do with the coins their customers bring them? Here are the answers to those and other questions you might have about coin circulation.

The sources for most of the answers are the Currency and Coin Frequently Asked Questions page on the FRB Services (Federal Reserve Bank Services) site and Currency and Coin Services on the Federal Reserve Board’s site. For more on coin circulation issues during the pandemic, see the box in this blog post.

Where do coins go after I use them to buy something?

Businesses collect and deposit coins in depository institutions such as commercial banks. The banks send coins they don’t need for their customers through “correspondent” banks or directly to the 28 cash offices of the 12 regional Federal Reserve banks. The St. Louis Fed is one of the Reserve banks.

What do the Federal Reserve banks do with the coins?

The Reserve banks take orders for coins and distribute them—both those already in circulation and new ones—to approximately 8,400 banks, savings and loans, and credit unions. The Reserve banks store some coin in their vaults, but also contract with coin terminals operated by armored carriers to store, receive and distribute coins.

Do the Federal Reserve banks accept all coins?

The Reserve banks accept coins that can be legally used as money in the U.S., but not seriously damaged, foreign or counterfeit coins.

Should I bring my coin stash to a Federal Reserve bank or to one of its branches?

No. Reserve banks take deposits only from commercial banks and other depository institutions. Check with your bank or other local institutions to see if they accept coins. You also could use a coin-counting kiosk, found at some grocery and big box stores.

Who makes coins?

The United States Mint, a federal agency, is the only manufacturer of coins that can legally be used as money in the U.S.

How do new coins get to the people and businesses who need them?

The Reserve banks buy coins at face value from the Mint. They store the coins and use them to fill orders from depository institutions, which supply coins to their customers.

How does the Mint know how many coins to make to supplement the ones in circulation?

The Federal Reserve banks give coin order information and forecasts to the Mint. The Federal Reserve System’s Cash Product Office, headquartered in the San Francisco Fed, oversees Reserve banks’ cash departments.

I want to use shiny new coins. Where can I get them?

Contact commercial banks about getting new coins or replacing worn ones. Neither the Fed nor the Mint sells new coins directly to the public for circulation, though the Mint does sell coins for commemorative purposes.

How the Fed Is Helping to Get Coin Moving

Before the COVID-19 pandemic, there were enough coins moving around the economy. The U.S. Treasury estimates that as of April the total value of coin in circulation was $47.8 billion, up from $47.4 billion a year earlier.

All those coins are still there, so enough coins remain in the economy. But when businesses and banks closed because of the pandemic, coins didn’t make their way around as quickly.

“The slowed pace of circulation has reduced available inventories in some areas of the country,” the Federal Reserve Board noted in a Frequently Asked Questions webpage on the issue.

So what’s being done?

- The Federal Reserve announced a “strategic allocation of coin inventories” June 11, capping coin orders and encouraging banks and other depository institutions to order only the coins customers need for the near future.

- The central bank also convened a U.S. Coin Task Force made up of representatives of the industries and institutions in the coin supply chain, including the U.S. Mint, armored carriers, bankers associations and retailers. The task force issued initial recommendations Aug. 3.

- The U.S. Mint asked consumers to help by using exact change for purchases, depositing coins at banks or turning them in at coin kiosks.

- Some banks and businesses have offered incentives for consumers to bring in their coins.

The Mint also is making coins as fast as it can, but—like other manufacturers—has to be on the lookout for COVID-19, Fed Chair Jerome Powell said during the press conference following the July Federal Open Market Committee meeting.

“It’s a significant issue,” Powell said of coin circulation. “We’ve got a lot of resources on it, and we do feel like we’re making progress.”

More to Explore

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us