See a Real, 28-Pound Gold Bar at the Economy Museum

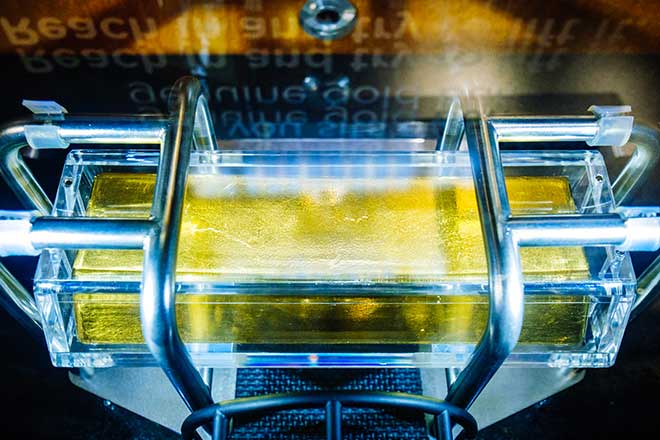

Visitors to the Federal Reserve Bank of St. Louis’ Economy Museum can experience our latest exhibit, which is 9.75 inches long and 1.5 inches tall, weighs nearly 28 pounds and is made of .9999 fine gold.

That’s right: The St. Louis Fed museum has a real gold bar on loan from the U.S. Mint.

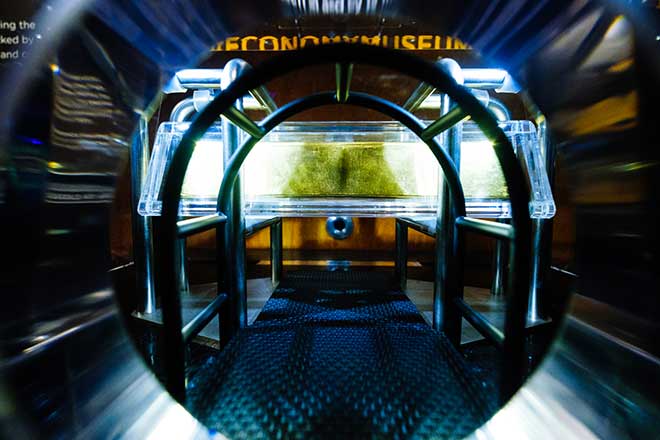

The gold bar is housed in a specially designed case that gives visitors like you the opportunity to see and even try to lift real gold, worth about $670,000 (as of this writing).

The Economy Museum’s gold bar exhibit will teach visitors where gold is stored in the United States and about the history of the gold standard in the U.S.

I asked Economy Museum Director Tom Shepherd to share some cool facts about the gold bar, also sometimes called gold bullion or gold ingot. We also talked about how the St. Louis Fed collaborated with the Mint to make this exhibit happen.

How much does a gold bar weigh?

Tom Shepherd: It weighs just under 28 pounds, 27.435 pounds to be exact. It came from the U.S. Mint’s West Point facility. It looks like a brick but it’s slightly sloped on its four vertical sides, making the bottom wider than the top.

Measurements for precious metals like gold, silver and platinum are often expressed in troy ounces. This gold bar weighs about 400 troy ounces. A troy ounce of gold is equivalent to 31.1034768 grams of gold.

How much is a gold bar worth?

Shepherd: Well, the market value of gold changes daily. You can check out the St. Louis Fed’s data aggregation service, FRED, to see the morning and afternoon prices of gold in U.S. dollars per troy ounce from the London Bullion Market Association. As of early March 2020, we’re looking at about $1,680 per troy ounce. So, about $670,000 in market value.

Meanwhile, the U.S. Treasury Department records government-owned gold reserves at a statutory rate of $42.2222 per fine troy ounce of gold. That’s gold held as an asset of the U.S., the book value. Most U.S. gold is held at the Mint including at Fort Knox. A small percentage is in the New York Fed’s vault, deep underground.

Why is gold an important part of U.S. history?

Shepherd: Gold is important for a variety of reasons. The California gold rush of 1849 brought about 300,000 new residents to California, which was sparsely populated at the time. Gold was also the basis of the gold standard that many countries used to back their currency.

What is a gold standard, and why isn’t the U.S. on the gold standard?

Shepherd: A gold standard sets the value of money equal to a specified amount of gold. To maintain a gold standard, governments must be ready and willing to buy and sell gold at a set price.

Economy Museum Director Tom Shepherd enjoyed working with experts to create an interactive gold bar exhibit for visitors to the St. Louis Fed.

Before World War I, almost all developed countries followed some version of the gold standard. After the Federal Reserve was created in 1913, part of its job was to maintain the value of U.S. currency in terms of gold. To accomplish this, the Fed had to have 40 cents worth of gold in its vault for every dollar it issued.

During the Great Depression, demand for goods and services fell and dragged down the U.S. price level. Requiring the Fed to hold gold to create money restricted its ability to stimulate the economy and maintain stable prices. To permit a more active response, the U.S. left the gold standard for domestic transactions in the 1930s.

The 1934 Gold Reserve Act signed by President Franklin D. Roosevelt transferred ownership of the Fed’s monetary gold to the U.S. Treasury. Later, in 1971, President Richard Nixon ended convertibility of dollars to gold for international transactions.

Since then, then U.S. has had a fiat currency system. In a fiat system, money is not backed by a commodity like gold, but rather by the full faith and credit of the government.

How rare is it to have the U.S. Mint lend you a gold bar?

Shepherd: Pretty rare. The Atlanta and Kansas City Feds both have one, but they all operate differently. It is quite the involved process to get a bar from the Mint. Throughout this process, I learned about the U.S. Mint’s structure, locations and operations. They were great to work with.

We had to meet both the St. Louis Fed’s and the Mint’s security requirements for the case. And then we had to get the bar here from New York. From start to finish the project has taken almost two years, so we had to stay dedicated to completing the exhibit. To that end, the bar will be under constant surveillance.

The gold bar exhibit—called “Raise the Bar”—is currently located toward the end of the Economy Museum experience, in Zone 5.

Later, it will be transferred into the museum’s expansion space that is coming soon—focusing on ancient coin and currency. We have some of these artifacts out now for people to see, like Aztec axe money and Egyptian glass money.

How long will you have the gold bar at the St. Louis Fed Economy Museum?

Shepherd: We have an ongoing agreement to display the bar; the agreement will be reviewed every five years. So, the gold bar should be here for quite a while.

I would like to thank everyone who was involved in this process. Nearly 60 people at the Federal Reserve Bank of St. Louis played some role in making this exhibit come to life.

More to explore

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us