A Look at the Affordable Banking Movement

Thinkstock/wutwhanfoto

Thinkstock/wutwhanfoto

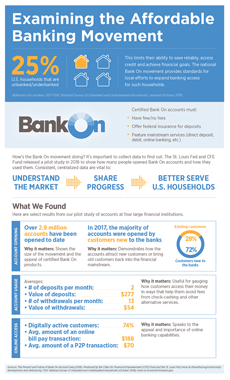

About 25 percent of U.S. households had difficulty getting full bank services in 2017, according to a survey of unbanked and underbanked households released by the Federal Deposit Insurance Corp. (FDIC) in October 2018.

Unbanked people, who have no bank account at all, and underbanked consumers, who have a bank account but still must rely in part on alternative financial services like payday lenders, face a number of difficulties and expenses that those with full banking access don’t. The unbanked and underbanked tend to spend more on financial services and struggle to build a credit history and save reliably. They also lose out on the convenience of services such as automatic paycheck deposits.

Meet the Bank On Movement

All in all, having a bank account means having more financial stability. For that reason, community and other organizations involved in a national initiative called Bank On have worked for more than a decade to connect unbanked and underbanked people to accounts that are certified safe and affordable.

But are customers taking full advantage of Bank On accounts? And do the banks get anything out of offering them?

Because no consistent data was collected nationally on these accounts or their use, those questions have been difficult to answer.

The movement had been going on for more than 10 years, but there was insufficient data on what the accounts were, said Meredith Covington, manager of community development policy and analysis for the Federal Reserve Bank of St. Louis.

So the Cities for Financial Empowerment Fund (CFE Fund) and the St. Louis Fed started a pilot study of, and gathered 2017 data on, the accounts from four banks: Bank of America, JPMorgan Chase, U.S. Bank and Wells Fargo. The results were released in October 2018 in a report titled The Present and Future of Bank On Account Data (PDF).

Key Takeaways

- Having a bank account means having more financial stability, so advocates in the Bank On movement have worked to link people who don’t have access to full banking services to safe, affordable accounts.

- While the movement is more than a decade old, no national data had been collected on the Bank On accounts to show if consumers were using them and if banks got any benefit from offering them.

- The St. Louis Fed and CFE Fund conducted a pilot study of four banks’ national Bank On account data for 2017 that showed most account holders were new customers for the banks and regularly used the accounts.

By the Numbers

-

Nearly 3 million

Bank On certified accounts have opened across the country.

-

Almost 1.4 million

of the accounts were open in 2017.

-

16 million+ debit transactions

processed, on average, by pilot banks each month.

What they don’t yet have data to show is whether the presence of Bank On coalitions has helped to reduce the number of people who are unbanked. It may be a few years before there is enough data to make that kind of connection, Covington said.

Bank On Accounts Have No or Few Fees

About three years ago, the CFE Fund consulted the FDIC to develop standards for Bank On accounts. To be certified as Bank On, the accounts must:

- Have no overdraft fees.

- Charge nothing or only a few dollars a month in other account fees, such as those for having a balance below a certain amount.

- Have deposits federally insured.

- Offer mainstream services including direct deposit, debit or prepaid cards, and online banking.

Banks don’t expect Bank On accounts to be highly profitable, Covington said, but they do hope offering the accounts can help with meeting Community Reinvestment Act requirements. The 1977 act is intended to encourage banks to meet the credit needs of their communities, particularly those of low- and moderate-income neighborhoods.

Banks also might be able to win new customers for other more profitable products and services.

People often learn about the accounts from word of mouth, including through working with community agencies, Covington said. For example, a person who worked with Habitat for Humanity to become a homeowner might hear about the Bank On program through that nonprofit.

How the St. Louis Fed Is Involved

Seventy-five coalitions promote Bank On accounts around the country, and a variety of different local groups had been asking banks for data about the accounts, but the metrics they asked for were different. It also was only after the standards for Bank On accounts were developed that it was possible to compare “consistent” data because the accounts had similar features, Covington said.

The banks also wanted the collection and analysis of their data to be in the hands of an organization they trusted to handle it carefully and keep individual banks’ data private. The CFE Fund asked if the Federal Reserve System wanted to be involved, Covington said. The St. Louis Fed took on the role, with its Community Development department as the lead for the project and the Bank’s statistics department gathering the data.

Bank On Customers Use a Variety of Services

The data show that large majorities of Bank On customers at pilot study banks used the free deposit and withdrawal services.

Having the ability to access those services saves an account holder about $200 each year—which is about the average annual cost of check-cashing and money order services for someone who doesn’t have a bank account, according to a NerdWallet study. If all the 2017 account holders in the Bank On study used those services, collectively they would have saved $277 million, according to the St. Louis Fed’s and CFE Fund report.

About a third of Bank On account holders used direct deposit, such as having a tax refund or paycheck deposited directly into their accounts. A smaller percentage—18 percent—used “peer-to-peer” services, which allow customers to transfer and receive money and pay or be paid by someone through their accounts.

Overall, the report shows that “supply was meeting demand,” Covington said. “That these accounts are being offered and people are using them.”

Additional Resources

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us