How the Great Recession Hit Millennials Born in the 1980s

Thinkstock/LemonTreeImages

Laura Banks reached the milestone of her first home purchase later in life than she expected.

In June 2017, eight years after she had graduated college toward the end of the Great Recession, Banks closed on a St. Louis-area house with her new husband.

“We’re 30 and we’re adults now, finally,” Banks said in a July 5 interview. “That’s how we felt.”

By the time of the home purchase, Banks had managed to land her first permanent post-graduation job in a difficult market and earned a master’s degree while working at her next job. But Banks felt underemployed and found it difficult to save on the salaries she earned in those jobs.

The advanced degree had made it possible to land her next position, in corporate health care, which paid enough to allow her to save and to invest in the house.

Now Banks feels like she’s where she should be financially. “But I feel like I’m five years behind,” she said.

Children of the ’80s Were Hit Hardest by the Recession

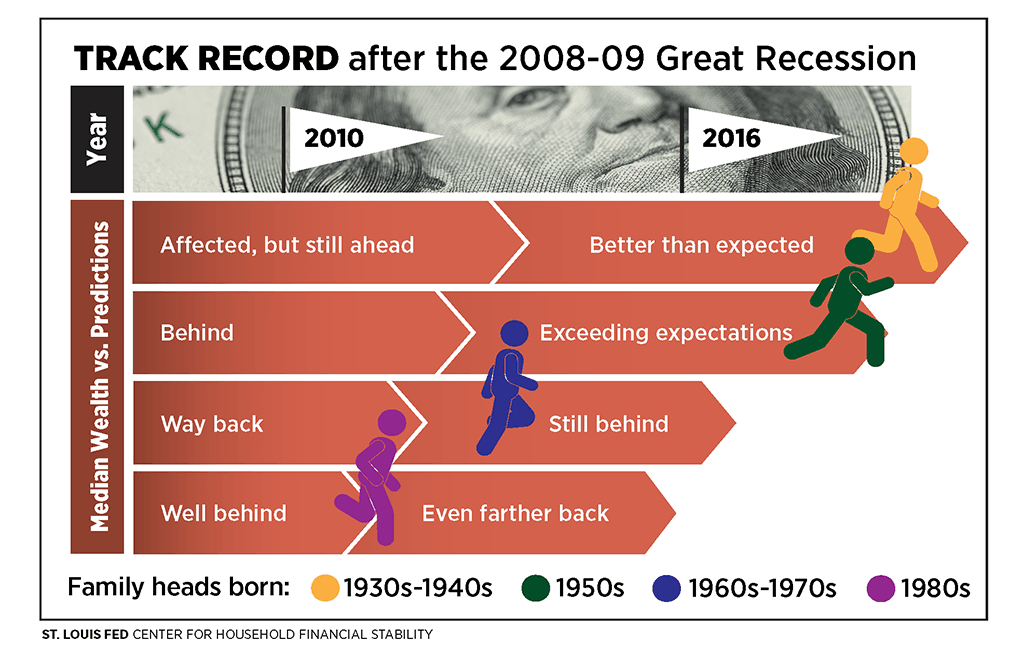

Banks’ sense that she’s hitting financial targets later than she should reflects the reality for her generation, according to findings from St. Louis Fed researchers. Millennials have less wealth than earlier generations did at the same age.

Lowell Ricketts, William R. Emmons and Ana Hernández Kent, all with the St. Louis Fed’s Center for Household Financial Stability, examined the impacts of the Great Recession on Americans born in different decades from 1930 to 1980. In their recent Demographics of Wealth essay—titled “A Lost Generation?”—they said the recession inflicted deep and widespread losses on the wealth of American families of all ages.

But, they noted, the damage has been unequal, with younger families suffering the most.

Deeper declines

The Demographics of Wealth researchers said “wealth” is a family’s net worth, the excess of its assets over its debts.

- Total assets include financial assets (such as bank accounts, mutual funds and securities) and tangible assets (including real estate, vehicles and durable goods).

- Total debt includes mortgages, other secured borrowing (such as vehicle loans) and unsecured debts (such as that from credit cards and student loans).

The wealth of the median family whose household head was born in the 1980s was nearly 25 percent behind where it should have been in 2010, the year after the recession ended, the researchers found. They based their benchmarks on the experiences of thousands of household heads surveyed about their finances by the Federal Reserve.

Slower rebounds

Not only have younger families experienced deeper declines in wealth, but they also have “rebounded much more slowly” from the recession than other generations, Ricketts told an audience at a 2018 Dialogue with the Fed event discussing the Demographics of Wealth research.

Instead of making up ground, the 1980s group was even farther behind in 2016, with wealth 34 percent below the predicted amount.

Other analysis showed similar trends. On average, millennials had a net worth of $90,000 in 2016, compared with the average $130,000 that Generation X households had when they were about the same age in 2001. That’s according to a recent Regional Economist article by YiLi Chien, an economist and research officer at the St. Louis Fed, and Paul Morris, a senior research associate.

Millennials Are Not Like Their Elders—in Many Ways

The Demographics of Wealth essay said households headed by someone born in the 1980s are “different.” For one, the predominant type of debt they owe is nonmortgage debt, including student and car loans and credit card debt.

“Because none of these types of debt finance assets that have appreciated rapidly during the last few years—such as stocks and real estate—they have received no leveraged wealth boost like that enjoyed by older cohorts,” the essay noted.

More Time, More Education

But something else sets the younger generation apart: “Two very powerful forces, time and education, are on their side,” Ricketts said in his talk. A child of the 1980s himself, he offered advice to others born in that decade:

- Start saving early and diversify assets and risks.

- Keep debts low and tied to appreciating or income-generating assets.

- Avoid over-investing in housing; a home purchase shouldn’t deplete your liquid savings buffer.

Ricketts also said that 1980s heads of households are the most highly educated, so it’s possible they could build up more money more quickly. He encouraged them to continue building education and skills.

A Different Approach

For their part, Chien and Morris wrote that millennials tend to be better about saving for retirement and avoiding credit card debt. They’ve delayed major life events, such as moving out on their own. Instead they opted for more school.

Those trends jibe with what Banks has heard from some friends. Her generation is doing one of two things, she said during the question and answer session at the Dialogue with the Fed event.

They’re taking a seize-the-day approach and traveling abroad with the idea that it doesn’t matter if they drain their bank account because the economy could fall apart again, she said.

Or, they’re living with their parents until the age of 29, marrying at 32, and not “even thinking about” having kids for five years until they’ve built up a nest egg and paid off student loans.

“I think that’s really an important factor to consider,” Banks said. “Just how much the recession really affected our idea of wealth, or our idea of what’s important in life.”

Additional Resources

- Demographics of Wealth: A Lost Generation? Long-Lasting Wealth Impacts of the Great Recession on Young Families

- Dialogue with the Fed: A Lost Generation? Young Families after the Great Recession

- Regional Economist: Accounting for Age: The Financial Health of Millennials

- Open Vault: Meet the “Dream Aspirers”: College-Grad Homeowners under Financial Stress

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us