Three Reasons Homeownership Can Hurt Building Wealth

For many of us, buying a house is the biggest financial decision we’ll ever make. There are plenty of reasons to do so: Feeling pride of ownership. Improving your own space. Wanting to put down roots.

But if you’re taking out a large mortgage and hoping for a lucrative investment? Proceed with caution.

Thinkstock/RomoloTavani

In a recent Housing Market Perspectives essay, William Emmons, lead economist for our Center for Household Financial Stability, asked whether owning a home could be bad for building wealth. He listed three pieces of evidence suggesting “caution in advocating homeownership as a primary means of wealth accumulation for many families.”

1. Homeowner Equity Lags Other Sources of Wealth

Emmons examined historical data for homeowners’ equity. Homeowners' equity is defined as the market value of U.S. households' residential real estate, minus the value of home-secured debt (basically, the value of real estate minus what's owed on that real estate).

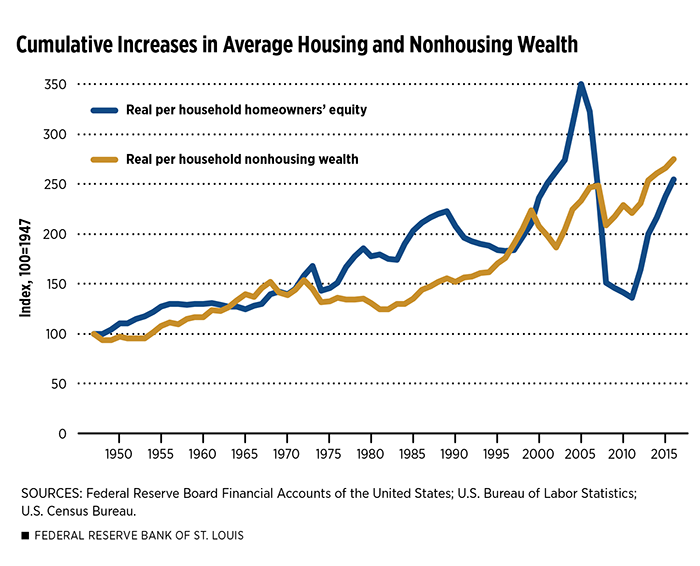

He found that from 1947 to 2016, homeowners’ equity grew at a smaller compound average annual rate (1.4 percent) than sources of nonhousing wealth such as stocks, bonds and savings accounts (1.5 percent).

Over the long run, he noted, nonhousing wealth outpaced homeowners’ equity. This is despite the latter seeing strong increases since 2011, post-recession.

2. Higher Volatility

Homeowners’ equity has experienced more dramatic ups and downs than nonhousing wealth over time.

In fact, Emmons said that the volatility of homeowners’ equity from 1947 to 2016 “far outstripped” the volatility of other sources of wealth, as seen by the peaks and troughs in the chart below.

If you think of your housing investment as you would, say, your retirement account, your house does not constitute a “diversified” portfolio. It can’t: It’s a single piece of property.

And that lack of diversification, Emmons said, can increase a family’s risk significantly when their home is financed by borrowing.

“Some research suggests that individual house prices may be twice as volatile as broad house price indexes,” he wrote.

3. Volatility and Race/Ethnicity

Housing wealth is especially volatile for black and Hispanic families, according to the Fed’s Survey of Consumer Finances. The survey collects information about family incomes, net worth, balance sheet components, credit use and more.

But that higher volatility hasn’t yielded a higher reward: The average increases in the value of black and Hispanic families’ homeowners’ equity are no higher than the gains experienced by other families, Emmons said.

Per the Survey of Consumer Finances, here are the 2016 average amounts of homeowners’ equity held by different racial/ethnic groups. These are listed along with the share of total wealth each amount represents:

- Black families: $57,694, 41.2 percent of total wealth

- Hispanic families: $69,055, 37.9 percent of total wealth

- Asian or other families: $218,937, 30.7 percent of total wealth

- White, non-Hispanic families: $205,145, 22.8 percent of total wealth

Emmons said the higher concentrations of housing in their portfolios can leave black and Hispanic families more susceptible to volatility.

To Own or No?

None of this is to say don’t buy a house. But it should caution against pouring a large percentage of your resources into homeownership solely for wealth-building purposes.A home may be great for nesting, but that doesn’t make it a nest egg.

Additional Resources:

- Housing Market Perspectives: Is Homeownership Bad for Wealth Accumulation?

- In the Balance: Household Wealth is at a Post-WWII High: Should We Celebrate or Worry?

- Housing Market Perspectives: Homeownership and the Racial Wealth Divide

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us