What Does the Fed Look at to Predict Recessions?

Accurately predicting recessions, like accurately predicting anything, is hard to do. But the Fed has to try in order to reach its goals of stable prices and maximum employment.

Signs before Previous Recessions

In hindsight, it’s easy to spot some patterns around recessions. For example:

- A big increase in oil prices has preceded nearly every U.S. recession since World War II.

- Asset bubbles swelled before the two most recent recessions: stock prices before the dot-com bust in 2000 and housing prices before the financial crisis.

- An unusual relationship involving interest rates on debt—called an inverted yield curve, or inversion—has come before all recessions since 1960. This occurs when the interest on a short-term debt (say, three-month Treasuries) is higher than the interest on a long-term debt (say, 10-year Treasuries).

No Single Variable

Still, figuring out in “real time” when we are in a bubble is difficult, said David Wheelock, vice president and deputy director of research at the St. Louis Fed. And in any case, not every boom-bust cycle has been followed by a recession.

The same is also true of the other patterns: Not all inversions or oil price increases led to recessions.

“Unfortunately, there’s no single variable that always tells us we’re on the verge of a recession or not,” Wheelock said.

What Does the Fed Watch?

Wheelock said the Fed keeps an eye on a variety of signs. These include:

- Commodity prices.

- Consumer spending on everything from cars and houses to food and clothing.

- The health of the labor market, by looking at indicators such as the unemployment rate and whether employment is continuing to grow.

Rapidly rising asset prices may signal a bubble and an overheating economy—the boom before a bust. The Fed can combat the cycle by raising interest rates, or “tightening” monetary policy, to slow the growth of spending.

A former Fed chairman, William McChesney Martin Jr., compared that part of the Fed’s job to ordering the punch bowl removed “just when the party was really warming up.”

In the case of an overheating economy, it may be appropriate in some circumstances to tighten monetary policy, Wheelock said.

“And take away the punch bowl.”

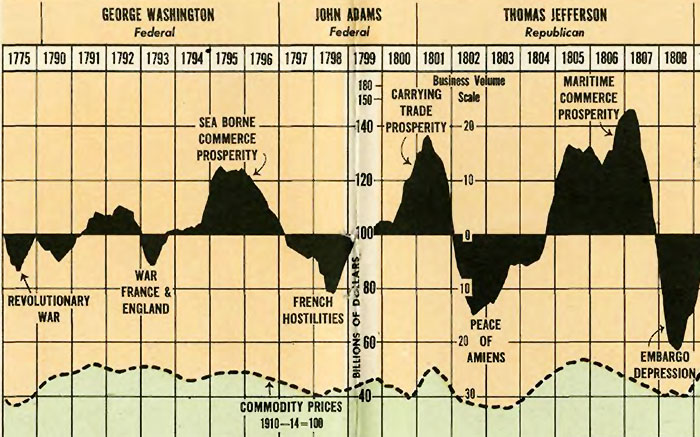

Did you know? The St. Louis Fed keeps a digital library of economic history. It's called the Federal Reserve Archival System, or FRASER for short. This decades-old chart shows business booms and depressions going back to the Revolutionary War. See the full timeline.

Additional Resources

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us