Who Pays Income Taxes, and How Much?

This is the second of a two-part series. Part I covered the origins and purpose of federal income taxes.

Albert Einstein is credited with saying, “The hardest thing in the world to understand is the income tax.” Indeed, for many taxpayers, figuring something like AGI may as well be E=MC2.

In this post, we’re not advising you how to file your taxes or maximize your refund. But the St. Louis Fed is committed to helping people of all ages better understand personal finance. So, let’s demystify some income tax basics.

Understanding Taxable Income

Federal individual income tax must be paid to the U.S. government on all forms of annual earnings that make up someone’s taxable income.

It begins with gross income, which is everything you earn for the tax year. Broadly, this includes wages, bonuses, interest income, rental income, capital gains and more. And there are Internal Revenue Service guidelines for who must file. For example, a single person who was under 65 when 2017 ended would typically file a return for tax year 2017 if his or her gross income was at least $10,400.

Then you figure adjusted gross income (AGI) by making certain adjustments, or deductions. These include health care savings account deductions, student loan interest, contributions to certain retirement accounts, and other qualifying deductions.

Additional exemptions, deductions and credits can come into play to further reduce tax liability:

- The personal exemption for tax year 2017 is $4,050, as is the exemption for a qualifying dependent.

- The standard deduction for tax year 2017 is $6,350 for a taxpayer filing single and $12,700 for married taxpayers filing jointly.

- Popular tax credits include the earned income tax credit, the child tax credit and the lifetime learning credit.

The Federal Income Tax Is Progressive

According to the Office of Management and Budget, the federal government estimates it will collect nearly $1.7 trillion in individual income taxes for fiscal year 2018. Meanwhile, the IRS expects that about 155 million individual tax returns will be filed during the 2018 tax season.

Who’s paying, and roughly how much? It’s important to understand that federal individual income tax is a progressive tax based on the ability-to-pay principle: A progressive tax is a tax in which higher-income earners pay a larger percentage of their income in tax than do lower-income earners.

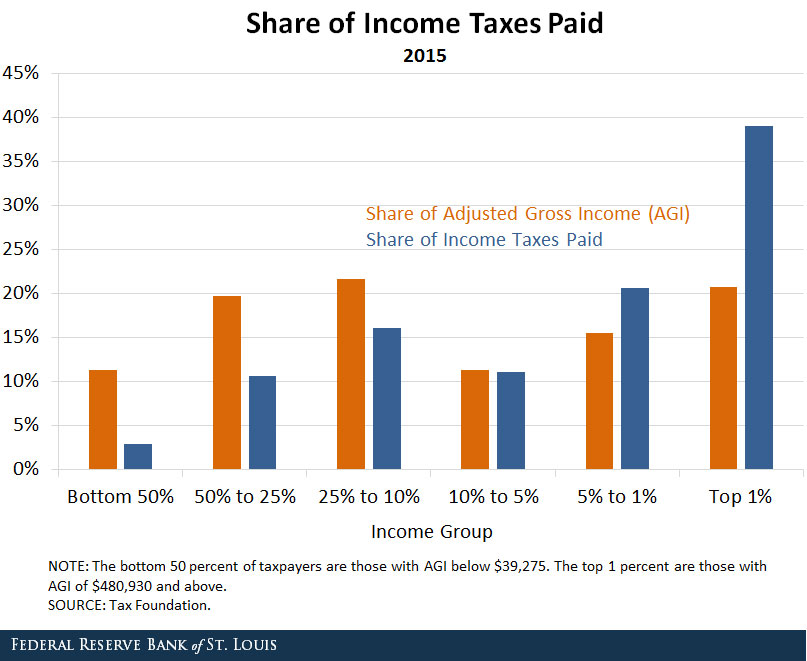

The Tax Foundation reports that the top 50 percent of income earners paid about 97 percent of all federal income taxes in 2015. The figure above shows a more detailed distribution of tax paid by income group.

Tax Rates Are Based on Tax Brackets

The IRS categorizes taxable income into tax brackets with progressively higher rates. For tax year 2017 (with a filing deadline of April 17, 2018), the seven tax brackets range from 10 percent to 39.6 percent.

Taxable income that falls within a particular bracket is taxed according to the rate for that bracket. Additional income is taxed according to the rate in the next tax bracket. So, say you’re a single person who had $10,000 worth of taxable income in 2017. You’d pay a tax rate of 10 percent on the first $9,325, and then a tax rate of 15 percent on the remaining amount.

| Rate | Single | Married Filing Separately | Married Filing Jointly | Head of Household |

|---|---|---|---|---|

| 10% | $0-$9,325 | $0-$9,325 | $0-$18,650 | $0-$13,350 |

| 15% | $9,326-$37,950 | $9,326-$37,950 | $18,651-$75,900 | $13,351-$50,800 |

| 25% | $37,951-$91,900 | $37,951-$76,550 | $75,901-$153,100 | $50,801-$131,200 |

| 28% | $91,901-$191,650 | $76,551-$116,675 | $153,101-$233,350 | $131,201-$212,500 |

| 33% | $191,651-$416,700 | $116,676-$208,350 | $233,351-$416,700 | $212,501-$416,700 |

| 35% | $416,701-$418,400 | $208,351-$235,350 | $416,701-$470,700 | $416,701-$444,550 |

| 39.6% | $418,401 or more | $235,351 or more | $470,701 or more | $444,551 or more |

| NOTES: This table shows brackets for those returns due April 17, 2018. Last December, President Donald Trump signed the Tax Cuts and Jobs Act, which makes many changes for tax year 2018 (due in 2019). The seven income tax brackets are retained, but tax rates are lowered and income tiers are adjusted. | ||||

| SOURCE: Internal Revenue Bulletin: 2016-45. | ||||

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us