Employers in Fed’s Eighth District Eye Softer Hiring Plans for 2024

A recent survey found that the share of employers in the Eighth Federal Reserve DistrictHeadquartered in St. Louis, the Eighth District includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, eastern Missouri and western Tennessee. planning to increase their workforce in 2024 has fallen below those in previous years, including the 2015-20 average. The share of District firms indicating plans to hike starting wages for new hires also fell, suggesting continued easing in the regional labor market.

Each December, the St. Louis Fed surveys regional contacts on their hiring plans for the upcoming year. These surveys have attracted particular scrutiny in the wake of the COVID-19 pandemic and the labor market upheaval that resulted from the pandemic’s economic shock. Because the St. Louis Fed has been asking employers about their hiring plans since 2014, these questions help provide a sense of how conditions have changed over a broader time frame.

Wage Growth Falls, Remains Above 2015-20 Average

Sharp increases in wages have been one of the most significant economic stories of the last few years. In the month of December from 2015 to 2020 on average 29% of firms that were hiring reported raising starting wages for most jobs to attract new hires. In December 2021, this practice soared to 76%, reflecting widespread worker shortages and intense wage pressures as firms competed for workers. In 2022, this figure fell slightly to 70%, and in the 2023 survey, it fell further to 45%.

This is in line with a broad array of data—both quantitative and qualitative—showing continued easing in the labor market. Along the same lines, the share of firms reporting that they are not raising starting wages for new hires (leaving wages unchanged) has grown from 6% in 2021 to 16% in 2022 and then to 28% in the current survey. While these numbers reflect a labor market that is still tighter than the pre-pandemic norm, it shows significant movement toward normalization.

Other survey information supports this interpretation. The share of employers who said that job candidates have not been willing to accept the compensation levels offered fell from 29% in 2021 to 12% in the most recent survey, while the share of employers reporting a lack of qualified applicants fell from 55% in 2021 to 47% in 2022 and then to 42% in 2023.

Job Growth Slows, Share of Firms Planning to Decrease Headcount at Highest Level on Record

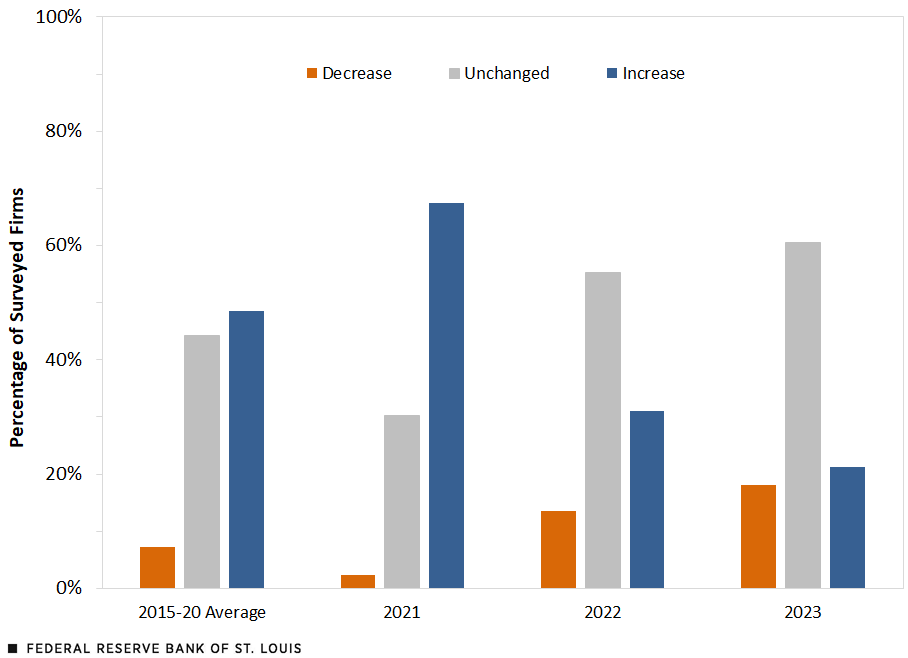

When asked about their plans for employment levels over the next year, 61% of firms said they planned to keep employment levels unchanged, 21% said they planned to increase employment, and 18% said they planned to decrease employment. As shown in the figure below, this represents a significant shift from the previous few years.

Survey Question: Do You Expect Your Firm to Increase Employment, Leave Employment Unchanged or Decrease Employment over the Next 12 months?

SOURCE: Federal Reserve Bank of St. Louis.

NOTE: Responses are from December in the year indicated.

The share of firms that reported reducing headcount over the last three months rose from 20% in 2022 to 46% in 2023, additional evidence of a continuing slowdown in hiring. While some saw lower headcounts due to struggles in replacing departing workers, most of these firms said that they were purposefully reducing headcount, either by not backfilling positions, reducing the number of open positions or laying off workers.

Note

- Headquartered in St. Louis, the Eighth District includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, eastern Missouri and western Tennessee.

Citation

Nathan Jefferson, ldquoEmployers in Fed’s Eighth District Eye Softer Hiring Plans for 2024,rdquo St. Louis Fed On the Economy, Jan. 2, 2024.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions