Which Households Prefer ARMs vs. Fixed-Rate Mortgages?

In this blog post, we look at the different characteristics of households holding adjustable-rate mortgages (ARMs) and fixed-rate mortgages in the 2019 Survey of Consumer Finances (SCF).Despite the recent release of the 2022 SCF, we have chosen to use the 2019 SCF because it does not include any of the changes and dynamics associated with the COVID-19 pandemic, which are beyond the scope of this blog post. Motivated by the current high mortgage rates, which can make outstanding ARMs more expensive when their rates reset, we are interested in finding out which borrowers are exposed to these higher rates. We found that households holding ARMs were younger and earned higher incomes and that their initial mortgage sizes were bigger and had larger outstanding balances compared with those holding fixed-rate mortgages.

Characteristics of ARMs

About 40% of U.S. households have mortgages, of which 92% have fixed rates and the remaining 8% have adjustable rates. Fixed-rate mortgages have a set interest rate for the life of the loan, which must be paid on top of the principal loan amount. Adjustable-rate mortgages have rates that generally track a benchmark rate that reflects current economic conditions and is more closely affected by the interest rate set by the Federal Reserve.Although rates for ARMs are designed to be adjustable, rates on ARMs are often fixed for an introductory period, usually five or seven years, after which the rate is typically reset annually or twice a year. Additionally, ARMs may have restrictions on how much the rates can change and an overall cap on the rate.

For example, during the Fed’s current tightening period, the 30-year mortgage rate increased from 4.8% in October 2018 to 7.6% in October 2023, while the rate on the 5/1 ARMThis means the rate is free to adjust annually after being fixed for the first five years. rose from 4.1% to 7.6% during the same period. To put this in perspective, consider a household that borrowed $200,000 using a 5/1 ARM in October 2018. This household made monthly payments of $964 during the first five years of the mortgage. The monthly payments then increased to $1,412 in October 2023, when the rate adjusted.

By contrast, a fixed-rate mortgage would not experience an increase in payments in 2023, having locked in the lower rate for the life of the loan. Given this risk, fixed-rate mortgages generally have higher introductory rates. Had the household taken out the same $200,000 in a fixed-rate mortgage at 4.8%, the payment would have been $1,053 in October 2018, but then it would have remained constant in 2023.

Mortgage payments account for about 30% of household income, and as we showed in an earlier Economic Synopses essay, outstanding mortgages represent about 70% of household liabilities, so this increase in monthly payments represents a considerable additional burden on households.

Identifying Households with ARMs

To understand which households are most affected by changes in interest rates through ARMs, we calculated the share of households with mortgages that hold either ARMs or fixed-rate mortgages across the income distribution and compared some general characteristics of these households and their mortgages, including the rates, the initial size of the mortgages, and the remaining balance.

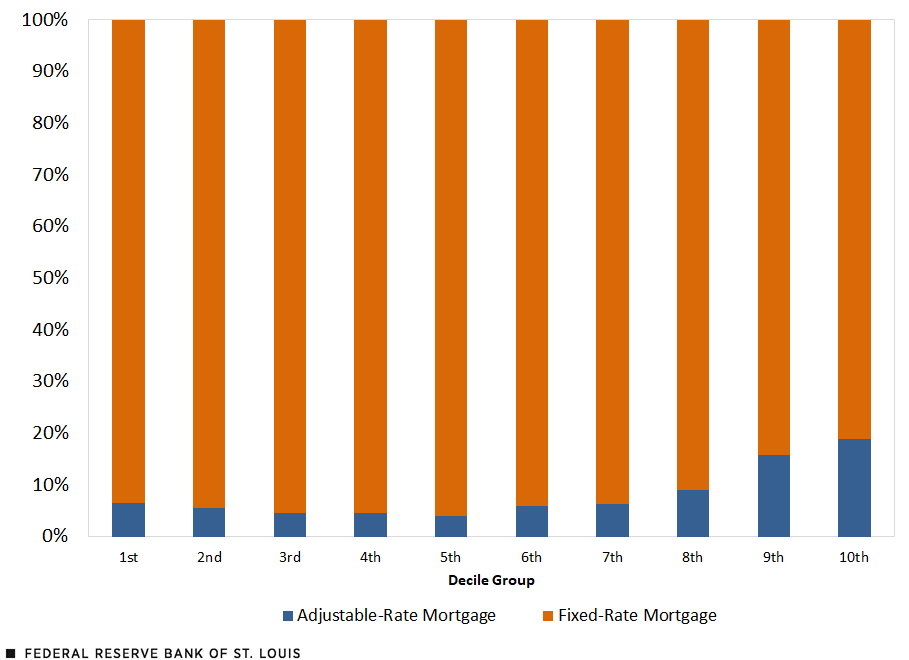

The figure below shows the share of mortgages by income decile. Overall, ARMs represent a minority of total mortgages.

Distribution of Types of Mortgages by Income Decile

SOURCES: 2019 Survey of Consumer Finance and authors’ calculations.

NOTE: Households are divided into income deciles, in which the first decile represents those with the lowest income and the 10th represents those with the highest income.

As shown in the figure, the share of mortgages that have adjustable rates is generally higher among households in the higher-income deciles: 18.8% in the top decile (the 10th) compared with 6.5% in the bottom decile (the first).While our numbers are based on the 2019 SCF, this Wall Street Journal article reported that ARM applications were just over 7% of all mortgage applications in 2023

One possible explanation for why holding ARMs is more concentrated in higher-income deciles is that households with higher income are more able to absorb the risk of higher payments when interest rates increase. In exchange, these households can benefit immediately from the lower introductory rates that ARMs tend to have. On the other hand, households with lower income may not be able to afford their mortgage if rates adjust to a substantially higher level and thus prefer the predictability of fixed-rate mortgages, especially since they have the option to refinance at a lower rate if rates drop.

The table below shows some other general characteristics of ARMs and their borrowers versus those of fixed-rate mortgages and their borrowers.

| Adjustable-Rate Mortgage | Fixed-Rate Mortgage | |

|---|---|---|

| Average Interest Rate | 2.25% | 4.02% |

| Median Size of Initial Amount | $207,913 | $167,323 |

| Median Size of Remaining Balance | $150,613 | $129,643 |

| Median Household Income of Mortgage Holder | $158,122 | $105,624 |

| Median Household Age of Mortgage Holder | 32.1 | 50.3 |

| SOURCES: 2019 Survey of Consumer Finance and authors’ calculations. | ||

| NOTE: Household age is the median age of the household reference person. | ||

ARMs tend to have lower interest rates. However, the median initial borrowing amount is over $40,000 larger for ARMs, and the median remaining balance that households still need to pay is also larger. The median household income among ARM holders is also 50% more than the median income of those holding fixed-rate mortgages. This is consistent with the figure above, in which the share of ARMs increases among higher-income households. The median age of ARM holders is also 18 years lower.

ARMs Appear to Skew toward Younger, Higher-Income Households

In sum, ARMs seem to be more popular with younger, higher income households with bigger mortgages, and ARM ownership relative to fixed-rate ownership nearly tripled from the bottom to top income decile. Given their age and income, these types of households may be better equipped to weather the risk of fluctuating rates while their proportionally larger mortgages benefit from the lower introductory rates.

Notes

- Despite the recent release of the 2022 SCF, we have chosen to use the 2019 SCF because it does not include any of the changes and dynamics associated with the COVID-19 pandemic, which are beyond the scope of this blog post.

- Although rates for ARMs are designed to be adjustable, rates on ARMs are often fixed for an introductory period, usually five or seven years, after which the rate is typically reset annually or twice a year. Additionally, ARMs may have restrictions on how much the rates can change and an overall cap on the rate.

- This means the rate is free to adjust annually after being fixed for the first five years.

- While our numbers are based on the 2019 SCF, this Wall Street Journal article reported that ARM applications were just over 7% of all mortgage applications in 2023.

Citation

Yu-Ting Chiang and Mick Dueholm, ldquoWhich Households Prefer ARMs vs. Fixed-Rate Mortgages?,rdquo St. Louis Fed On the Economy, Feb. 6, 2024.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions