Has the Growth in the Price of Education Outpaced Overall Inflation?

The prices of goods and services are typically captured by price indexes such as the consumer price index (CPI), which measures the cost of a typical basket of goods and services purchased by American consumers. When this same goods-and-services basket becomes more expensive, the CPI increases: That is inflation.

But a price index does not need to be only about “typical” goods and services. It can be specialized too. The U.S. Bureau of Labor Statistics, which compiles CPI data, also releases price indexes for recreation-related expenditures, medical care-related expenditures, etc.

This blog post considers education-related expenditures. The BLS produces a price index for “educational books and supplies” and one for “tuition, other school fees and child care.” The first index summarizes the cost of buying a typical educational books-and-supplies basket; the second index summarizes the costs of tuition at all levels of schooling, other education-related fees and child care.

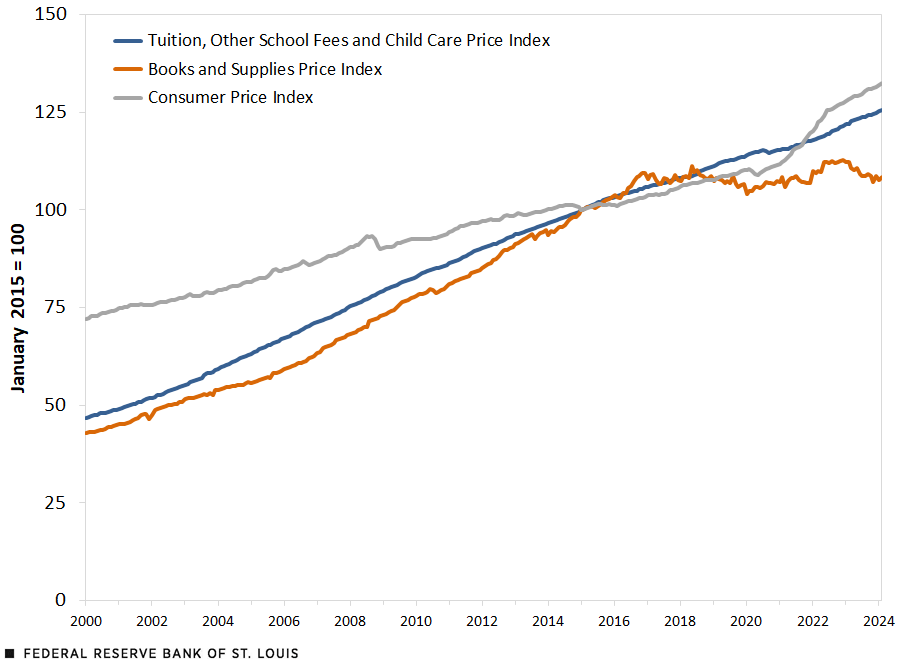

The figure below plots these two indexes, together with the CPI, from January 2000 to February 2024. By design, the indexes are normalized to 100 in January 2015. From the figure, it is clear that the cost of education-related expenditures grew faster than the CPI for most of this period. Over the years, when one allocated $1 of spending toward education, one had to give up more and more of the typical goods and services represented in the CPI. That is the sense in which education has become more expensive.

The Indexed Price of Education-Related Expenditures vs. CPI

SOURCES: Bureau of Labor Statistics and author’s calculations.

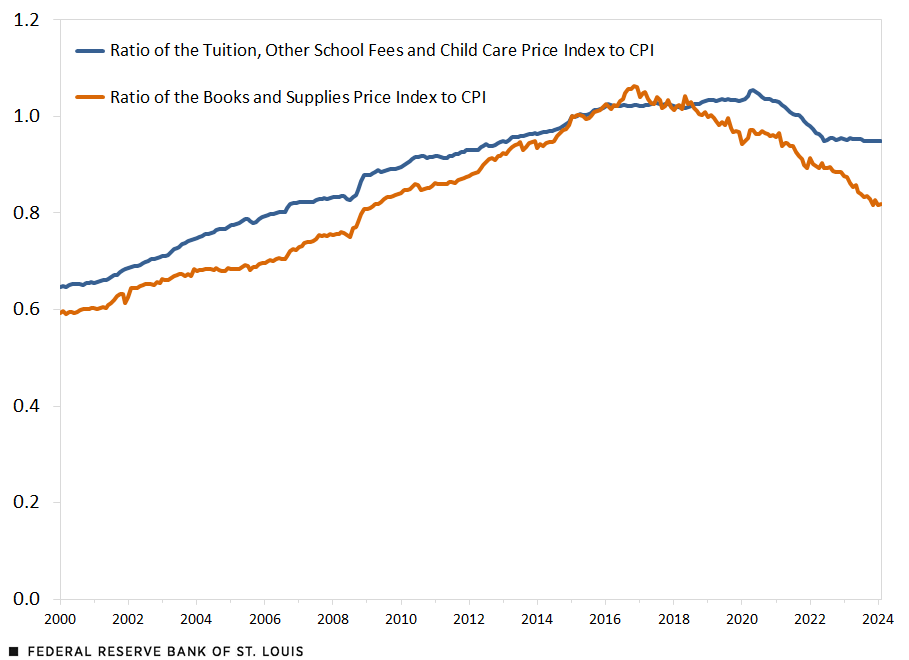

To better see the difference between the price of education and the general price level, the next figure plots the ratios of the two education-related price indexes to the CPI. Consider the ratio of the books and supplies price index to the CPI. An increase means that the cost of purchasing the typical educational books-and-supplies basket is increasing faster than the cost of purchasing the typical goods-and-services basket. When it decreases, the cost of the typical goods-and-services basket is increasing faster than the cost of books and supplies. A similar interpretation applies to the tuition, other school fees and child care price index.

The Ratios of Education-Related Price Indexes to CPI

SOURCES: Bureau of Labor Statistics and author’s calculations.

The second figure shows that the books and supplies price index grew faster than the CPI until around the start of 2017, while the tuition, other school fees and child care price index grew faster than the CPI until around the end of 2015, after which the ratio looks more level. This was already transparent in the first figure: Education was becoming more expensive relative to other consumer purchases. This trend stopped in the second half of the 2010s, however.

The price of education-related books and supplies stagnated after 2017, as can be seen in first figure. Since the CPI continued to rise after 2017, the second figure shows a sharp decline in the price of education-related books and supplies relative to other consumer purchases. The price of tuition, other school fees and child care rose steadily after 2015, as can be seen in the first figure. But because increases in the price of other consumer purchases were increasing at roughly the same pace over the next few years, the second figure shows the price of tuition, schooling fees and child care relative to the CPI becoming noticeably flatter. Then, it dips strongly during 2021-22 as overall inflation in the U.S. peaks.

The lesson from these two figures is twofold. First, the price of education, which has for decades risen faster than the price of typical consumer expenditures, is no longer doing so. It still rises but not as fast as it used to. Second, this slowdown in the price of education relative to other consumer purchases started before the COVID-19 pandemic began in 2020.

Citation

Guillaume Vandenbroucke, ldquoHas the Growth in the Price of Education Outpaced Overall Inflation?,rdquo St. Louis Fed On the Economy, April 15, 2024.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions