How Are Financial Conditions Tracked?

How are financial conditions tracked? And are they tighter today than they were in early 2022 when the Federal Reserve began raising the federal funds rate? How about compared with the average over the past 10 years—and the past 20 years?

Juan M. Sánchez, a St. Louis Fed vice president and economist, recently examined these questions when explaining why the Fed tracks financial conditions and how such conditions affect households’ and firms’ access to credit.

Watch the video:

You can find this and other videos featuring our Research economists on the St. Louis Fed’s YouTube channel.

Why Does the Fed Track Financial Conditions?

One of the ways monetary policy affects the economy and inflation is through financial conditions. This is one reason why the Federal Reserve tracks financial conditions, Sánchez explained.

For example, he said that as the Fed increases interest rates, financial conditions are expected to tighten, meaning that it becomes more difficult or expensive for households and firms to access credit. The tightening of financial conditions leads to a slowdown in the economy, which firms take into account when they set their prices. “And as a consequence, the increase in the interest rate should help bring down inflation to our target of 2%,” he said.

How Are Financial Conditions Tracked?

Sánchez noted that standard financial conditions indexes—such as those from Bloomberg, the St. Louis Fed, the Chicago Fed and the Kansas City Fed—use statistical methods to summarize financial variables. These variables might include the S&P 500 or indexes of volatility, such as the VIX Index, he said.

Since standard financial conditions indexes are based on financial variables, they can sometimes move in response to news that isn’t necessarily related to changes in access to credit, he explained.

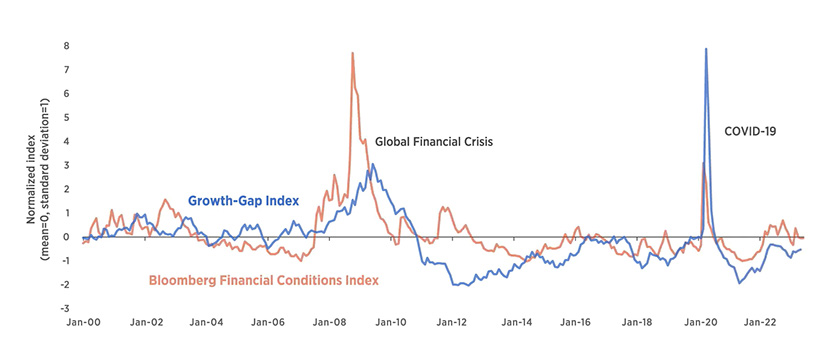

To solve for this, Sánchez and a co-author created a new index of financial conditions—one that doesn’t use financial variables—in an effort to capture how easy or hard it is for firms to access credit. This growth-gap index tracks the difference in employment growth between sectors that depend less on access to credit from the financial system and those that depend more on access to credit.The idea of classifying sectors by financial dependence is from literature. For example, see the June 1998 article “Financial Dependence and Growth” by Raghuram G. Rajan and Luigi Zingales in the American Economic Review; and the April 2014 article “Financial Development and Innovation: Cross-country Evidence” by Po-Hsuan Hsu, Xuan Tian and Yan Xu in the Journal of Financial Economics.

He explained how to interpret the growth-gap index:

- When financial conditions are “loose” (when there’s easy access to credit), the change in the index should be negative as sectors with low external financing dependence grow relatively slower than those with more external financing dependence.

- In contrast, the change in the index should be positive when financial conditions are tight, such as in 2008 during the financial crisis and in the early months of the COVID-19 pandemic.

How the New Index Compares with Standard Financial Conditions Indexes

Sánchez noted that the new index moves closely with standard financial conditions indexes, such as the one from Bloomberg, which suggests that standard indexes are capturing firms’ access to credit to some extent.

The Growth-Gap Index vs. a Standard Financial Conditions Index

SOURCES: Bureau of Labor Statistics, Bloomberg, Hsu et al. (2014) and author’s calculations.

And how are financial conditions today? As of Sánchez’s analysis, the last observation for the Bloomberg Financial Conditions Index was June 2023; for the growth-gap index, it was May 2023. He looked at the indexes relative to the first quarter of 2022 when the Fed started to raise the policy rate and to the averages over the past 10 years and 20 years.

“We would expect households and firms to feel today that financial conditions are tighter because they have tightened during the last two years, they are tighter than the average of the last 10 years, but financial conditions are close to a longer-horizon [20-year] average,” Sánchez said.

Note

- The idea of classifying sectors by financial dependence is from literature. For example, see the June 1998 article “Financial Dependence and Growth” by Raghuram G. Rajan and Luigi Zingales in the American Economic Review; and the April 2014 article “Financial Development and Innovation: Cross-country Evidence” by Po-Hsuan Hsu, Xuan Tian and Yan Xu in the Journal of Financial Economics.

Citation

ldquoHow Are Financial Conditions Tracked?,rdquo St. Louis Fed On the Economy, July 31, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions