Will High Inflation Persist?

Monetary policy efforts to curb inflation have been a major component of economic news this past year. And for good reason: At its peak in June 2022, the headline consumer price index (CPI) was almost 9% higher than it was a year before. The consumer price index excluding food and energy—often known as core CPI—peaked in September, at about 6.7%. By either measure, we reached levels of inflation unseen since the early 1980s.

CPI and Core CPI Inflation Reached 40-Year Peaks in 2022

Even though inflation started to cool toward the end of 2022, it is still unclear how long it will take to return to its long-run average—that is, if currently high inflation will persist. In this post, we explore this question by examining the persistence profiles of four measures of inflation—headline and core CPI, as well as headline and core PCE (personal consumption expenditures price index). We do so for two time periods.

As the figure above suggests, inflation has been less volatile since roughly 1983, a period of relative macroeconomic stability often referred to in the economic literature as the “Great Moderation.” We provide measures of persistence during and prior to this period. Whether inflation persists may depend on which of the two regimesIn the economic literature, a regime switch occurs when there are significant breaks in the patterns of key macroeconomic variables from one period to the next. we are in—that is, whether we have switched back to the regime from before the Great Moderation or are still in the less volatile period.

Inflation Persistence before vs. during the Great Moderation

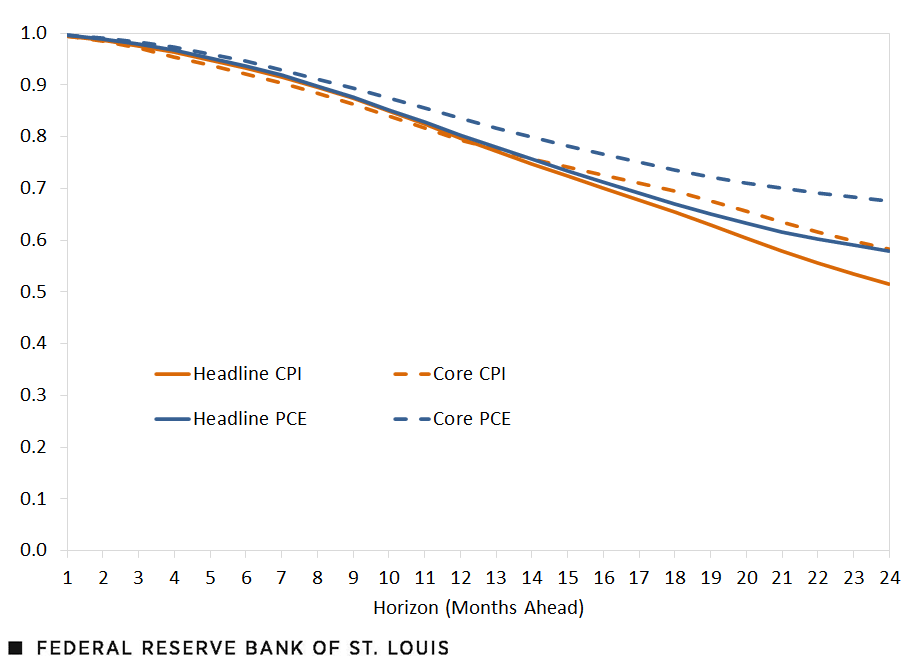

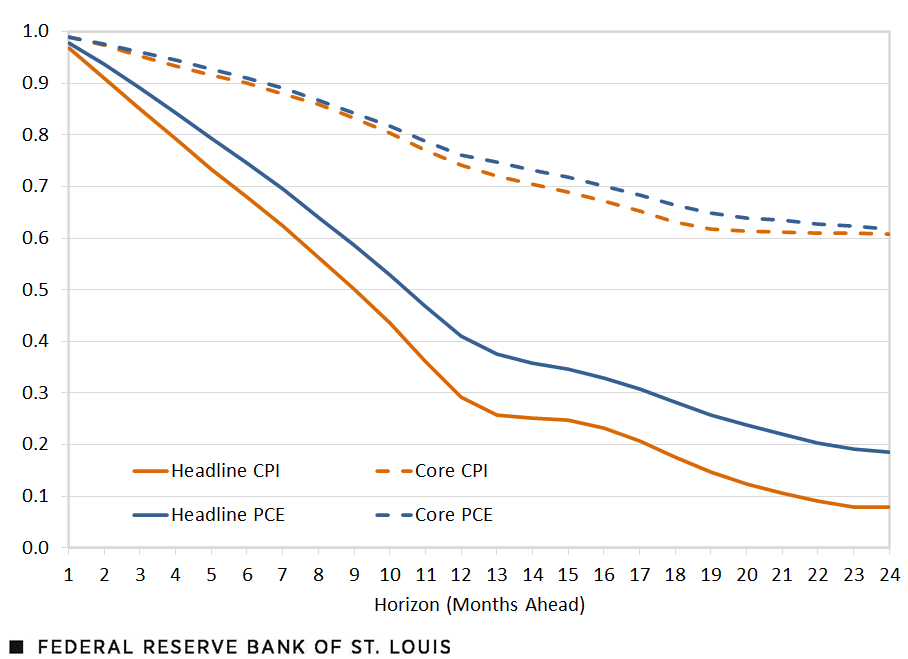

Data for our analysis come from the Bureau of Labor Statistics and the Bureau of Economic Analysis and are retrievable from online database FRED. For consistency, we limit the start date of all series to January 1960. Each of the two figures below plots the autocorrelation coefficients between year-over-year inflation (measured as the percent change from a year ago of a given index) and inflation at horizons of one month up to 24 months (two years) ahead. The first figure below plots autocorrelations before the Great Moderation, which we define as before 1983, while the second figure plots Great Moderation autocorrelations (1983 to present).

For both samples, inflation in the immediate future (one to three months ahead) is highly correlated with current inflation and suggests a return to normalcy is not imminent. Even so, the autocorrelations decline the further we go into the future.

Pre-Great Moderation, there are some modest differences in the persistence profiles of the headline and core measures of inflation, but overall, inflation is quite persistent even at longer horizons like one and two years into the future. In fact, autocorrelation for each lies above 0.5 two years out, suggesting it could take quite some time before these measures of inflation revert to the mean prior to the Great Moderation.

Autocorrelation of Current Inflation with Future Inflation: Pre-Great Moderation Sample

SOURCES: Bureau of Labor Statistics, Bureau of Economic Analysis and authors’ calculations.

NOTES: Inflation is measured as the percent change from a year ago of a given index. We define the pre-Great Moderation period as before 1983.

Although all four measures of inflation persistence move closely with one another pre-Great Moderation, there is a clear delineation between the persistence profiles of core versus headline measures during the Great Moderation. As the next figure illustrates, the correlation between future and current inflation in this period declines at a much faster pace for headline CPI and PCE than for core CPI and PCE.

Starting at nearly 1 at the one-month-ahead horizon, correlation coefficients remain above 0.7 at the one-year-ahead horizon for both core measures, while they had already dropped well below 0.5 for both headline measures.

Autocorrelation of Current Inflation with Future Inflation: Great Moderation Sample

SOURCES: Bureau of Labor Statistics, Bureau of Economic Analysis and authors’ calculations.

NOTES: Inflation is measured as the percent change from a year ago of a given index. We define the Great Moderation period as 1983 to the present.

It is clear from headline measures that inflation was more persistent before the Great Moderation. Though less obvious, this is also true for core measures: At the same horizon, autocorrelation coefficients for core CPI and PCE generally are a bit higher for the pre-Great Moderation period than they are during the Great Moderation.

Inflation Persistence Will Depend on Our Current Regime

Uncertainty around high inflation has come to characterize 2022 for the U.S. economy, and the question of when inflation will revert to its long-run mean is top of mind for policymakers and consumers alike. The answer likely depends on whether we are still in the Great Moderation or have switched to the previous regime, as inflation persistence profiles differ between the two.

If the former is the case, then we can expect stronger mean reversion, as the autocorrelations show weaker inflation persistence over the Great Moderation sample. On the other hand, if a switch has indeed occurred, current inflation may persist, and prices may take longer to come down.

Note

- In the economic literature, a regime switch occurs when there are significant breaks in the patterns of key macroeconomic variables from one period to the next.

Citation

Michael W. McCracken and Trần Khánh Ngân , ldquoWill High Inflation Persist?,rdquo St. Louis Fed On the Economy, Jan. 10, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions