Tracking Families That Cross the Income Threshold for Food Stamps

Many social programs, such as Temporary Assistance for Needy Families (TANF) or the Supplemental Nutrition Assistance Program (SNAP), are designed to help families stabilize their income or food consumption in times of crisis. However, many families who are eligible for these programs do not utilize those resources because of administrative burden or lack of information about their eligibility.

©whyframestudio/iStock via Getty Images

When families switch in and out of eligibility for these programs, the costs in terms of time and resources may outweigh the temporary benefits they provide, and families may choose not to enroll. But for households with volatile income, maintaining consistent access to food can be difficult, and food stamps could help smooth out food consumption over time. This blog post examines the likelihood that families with a young child cross the income threshold for food stamps and how likely that family is to receive them.

Switching across the Eligibility Threshold

In this post, we document that a significant number of families switch across the eligibility threshold for food stamps; that is, they were initially eligible to apply for SNAP benefits but later became ineligible because of higher income. Many families switched multiple times: 22.9% of families experienced two or three switches across the eligibility threshold. We show that families who had frequent switches across the income threshold were less likely to receive food stamps even in the years they were eligible.

The data come from the Panel Study of Income Dynamics (PSID)—a survey from the University of Michigan that follows families over time and collects information on income, wealth, demographics and other household characteristics. We use biennial information from the PSID between 1994 and 2019, as 1994 is the year when the PSID began regularly reporting a family’s food stamp usage.

For each family, we calculate how often they switched across 130% of the federal poverty line, the gross income threshold for food stamp recipiency.In this post, we examine only the gross income threshold; however, SNAP also has a net income threshold that is 100% of the poverty line for after-tax income. There are other requirements, such as resource limits and work requirements. The gross income threshold and the net income threshold are adjusted for the number of children and the number of adults in a household, while the resource limits and work requirements do not rely on the presence of children. There are also asset limits, which are set by the states. Because we do not use information on wealth, we could be overcounting or undercounting the number of times families switched across the income threshold. The Pew Research Center found that the liquid asset limits do not appear to impact program participation (PDF) while vehicle asset limits can have an impact. The Urban Institute also found that 17.9% of people with income below the threshold had asset levels that disqualified them (PDF) from SNAP recipiency—these below-threshold, high-asset people were more likely to be older and to be well-educated and, most importantly for our sample, less likely to have children. However, we examined only the gross income threshold here.

We constructed two samples. The first sample comprises families who had at least one child under the age of 2 in the first year they were observed while the second sample is made up of families who had no children during the entire period in which we observed them. These are our young-children and no-children samples, respectively.

For the young-children sample, we found the first period a family was observed with a child under 2 in the household and a total household income level below 130% of the poverty line. Then, we observed income levels and food stamp status every other year until the child was 7. For example, a family was observed with a 1-year-old child and income below 130% of the poverty line in 1999. Then we matched them to their real household income in 2001, 2003 and 2005, when their child was 7 years old. The no-children sample was constructed similarly.

We then calculated how often that family switches across the total household income threshold of 130% of the poverty line, given their family size.Although families may have had several children over the course of the sample, we kept only each family’s first observation in which they were observed in years 0, 2, 4 and 6. For the no-children sample, we kept the first set of observations in which a family had no children. Because we follow families for six years, the number of switches has a maximum value of three if the family switches every period.

Most Families Switch across the Income Threshold

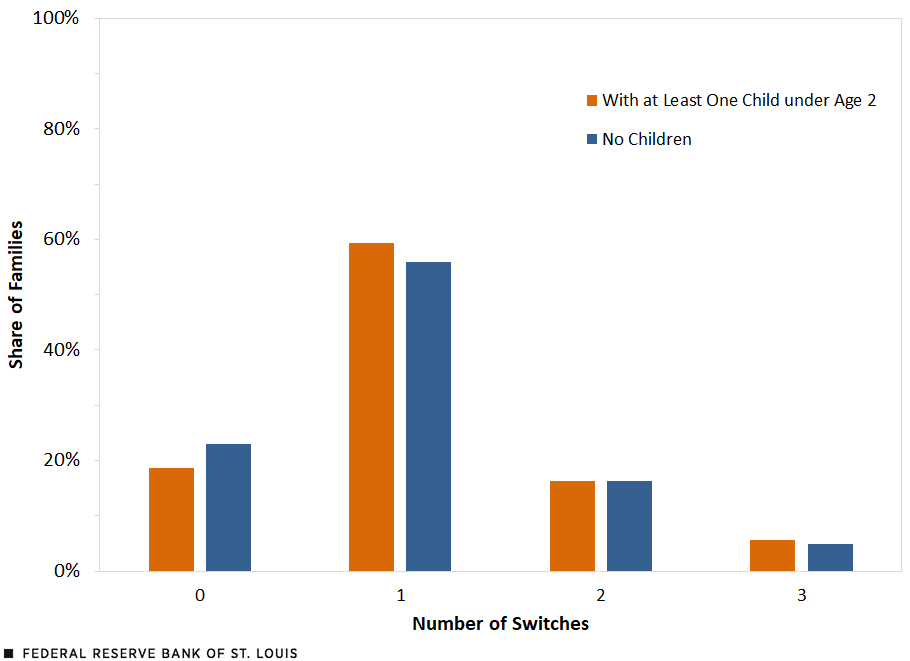

The figure below shows the share of PSID families with each possible number of switches across 130% of the poverty line. Only 18.7% of families with young children remained under the threshold for the entire six-year period we followed them, while 59.4% switched once. Another 21.9% of those families experienced more than one switch across the eligibility threshold.

The Number of Times a Family Crossed 130% of the Poverty Line

SOURCES: Panel Study of Income Dynamics and authors’ calculations.

Originally, we expected families with young children to be more likely to have zero switches or two switches (meaning that they were below the eligibility threshold and later fell below it again), remaining below the threshold longer. When a new child enters the family, the mothers often experience more instability in employment and thus family income suffers, i.e., the motherhood penalty. However, there were few differences between families with young children and families with no children when it came to switching across the food stamp threshold. The families with young children had slightly larger probabilities of one or three switches, meaning they were slightly more likely to end up above the threshold.

The Likelihood That a Family Received Food Stamps

Still, being eligible for food stamps doesn’t mean a family will enroll to receive that benefit. The table below shows the relationship between the number of switches and the likelihood that a family received food stamps in the initial period. All families in both samples meet the income requirements for food stamps in the initial period,In this post, we only looked at the income requirements, but some of the families were likely ineligible based on resource limits or on work requirements. yet only 20% of all families actually received food stamp benefits. Families with children were far more likely to receive food stamps in the first period they were observed across all numbers of switches. Families with no children had lower levels of food stamp recipiency.

| Number of Switches across 130% of the Poverty Line | Families with at Least One Child under Age 2 | Families with No Children |

|---|---|---|

| 0 | 53% | 29% |

| 1 | 22% | 6% |

| 2 | 41% | 11% |

| 3 | 31% | 12% |

| SOURCES: Panel Study of Income Dynamics and authors’ calculations. | ||

Families with and without children who are experiencing multiple switches across the income threshold were less likely to receive food stamps in the initial period than families whose incomes remained below the threshold for all six years. Because there is an administrative and informational cost to apply for the program, it is unsurprising that families were not getting the benefits when their incomes frequently varied even though they may have been eligible for benefits in some years.

Conclusion

The total household income is only one qualification for receiving food stamps, but many families who meet that qualification do not enroll in the program. Many have suggested that the lack of enrollment may be due to the administrative burden or a lack of knowledge about the program. In this post, we showed that these issues may be more relevant when families incomes frequently cross the income eligibility threshold.

Notes

- In this post, we examine only the gross income threshold; however, SNAP also has a net income threshold that is 100% of the poverty line for after-tax income. There are other requirements, such as resource limits and work requirements. The gross income threshold and the net income threshold are adjusted for the number of children and the number of adults in a household, while the resource limits and work requirements do not rely on the presence of children.

- Although families may have had several children over the course of the sample, we kept only each family’s first observation in which they were observed in years 0, 2, 4 and 6. For the no-children sample, we kept the first set of observations in which a family had no children.

- In this post, we only looked at the income requirements, but some of the families were likely ineligible based on resource limits or on work requirements.

Citation

Hannah Rubinton and Maggie Isaacson, ldquoTracking Families That Cross the Income Threshold for Food Stamps,rdquo St. Louis Fed On the Economy, Sept. 20, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions