Tracking Wage Inflation in Real Time

The recent evolution of inflation continues to be a main concern for policymakers and the public. From September 2021 to September 2022, the U.S. consumer price index grew 8.2%—a historically high number. For most industries and sectors, wages are a major component of production costs, and wage increases can result in price increases, thus policymakers and analysts are paying close attention to the evolution of wages.

Understanding the Sources of Wage Data

The major source of wage inflation data in the U.S. is the Current Employment Statistics (CES) survey from the Bureau of Labor Statistics (BLS). As reported last week, average hourly earnings for all private employees in October increased by 4.7% from a year earlier. However, the CES information is released at a lag of about three weeks, which is often not fast enough to be informative about the current state of the economy. To better understand current economic conditions, we turn to high-frequency data sets with information on wages and hours. In this blog post, we use private payroll data from Homebase to estimate overall wage inflation in real time.

The CES is a monthly survey of approximately 131,000 businesses that collects information on hours, wages and vacancies for the week including the 12th of the month. Homebase is a private company providing payroll, scheduling and time sheet tools to businesses across the country. Throughout the COVID-19 pandemic, Homebase has provided data on individuals’ hours, average wages, location, and industry at a high frequency. However, Homebase is not perfectly representative of the U.S. labor market. Most of the establishments in the data set are small relative to the average establishment size in the U. S., and retail firms and leisure and hospitality firms are also overrepresented. Finally, wages are not reported in Homebase for some workers, typically those paid a salary rather than by the hour, and there are several aspects of wage data that are not included in the Homebase data, including tips, benefits, and overtime payments. All these features contribute to a lower level of wages in the Homebase data set than in the CES data, yet the monthly wage changes by state are well correlated over time, as we show next.

Predicted Wage Inflation

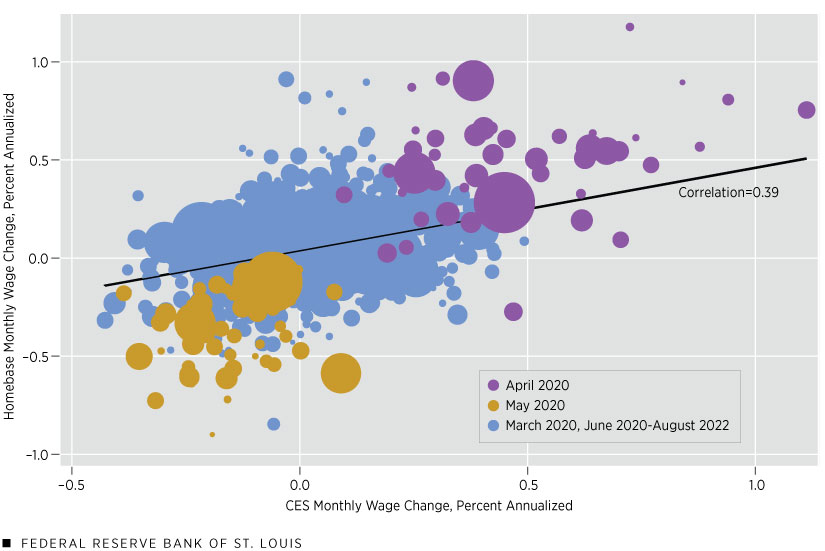

To predict national wage changes, we created a dataset of average state- and national-level wages using the CES and the Homebase data. The first figure below shows a scatter plot of monthly wage changes in the CES and the monthly state-level wage changes in Homebase, weighted by the population of each state. Each data point represents one state-month combination, with a line of best fit running through the points showing the relationship between the two changes.

State-Level Wage Changes: Homebase vs. Current Employment Statistics

SOURCES: Homebase, Current Employment Statistics and authors’ calculations.

NOTES: The black line is the line of best fit. Dot size reflects the relative size of a state’s population.

The correlation between the changes in the CES wages and the changes in the Homebase measure of wages is 0.39, which is high enough to make Homebase data useful for forecasting. As Homebase data are available at a higher frequency, we exploit this relationship to predict overall weekly wage inflation. Formally, we used the coefficients from a regression similar to the one shown in the figure and used weekly Homebase wage changes to forecast CES wage changes, and then used the weighted average across states to obtain predicted values of weekly national wage change.

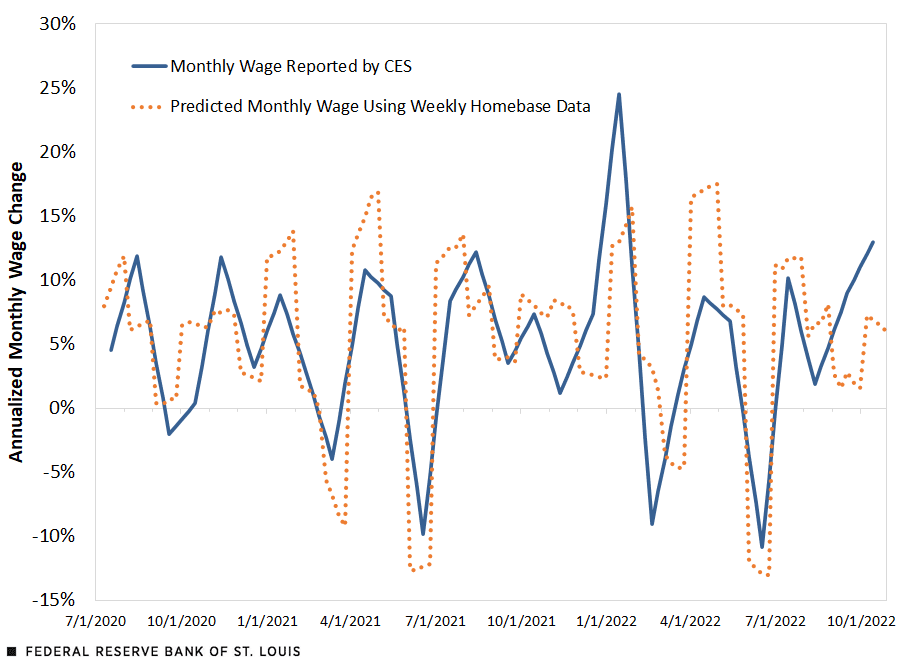

The next figure shows the time series of the predicted values in dotted orange and the time series of actual wage data in blue; in both cases, the data are not seasonally adjusted. As shown in the figure, the two time series are highly correlated. However, the advantage of the Homebase data is the availability for more recent weeks, which allows us to predict movements in wages before the monthly CES data are reported.

Monthly National Wage Changes: Predicted vs. Actual

SOURCES: Homebase, Current Employment Statistics and authors’ calculations.

NOTE: Data are not seasonally adjusted.

Private Sources Can Help Gauge Wage Inflation

New private sources of high-frequency wage data are helpful for examining current economic conditions. The Homebase data set is well suited to this, despite having smaller establishments and an uneven distribution of firms across industries. Using these new data, we can better understand the current state of wage inflation in the U.S.

Citation

Maximiliano A. Dvorkin and Maggie Isaacson, ldquoTracking Wage Inflation in Real Time,rdquo St. Louis Fed On the Economy, Nov. 8, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions