How Supply Chain Disruptions Contributed to Inflation in 2021

Producer price index (PPI) inflation increased rapidly during the COVID-19 pandemic, with an uneven impact across industries. PPI inflation is the change in input costs to producers. How much did disruptions to supply chains contribute to this increase in inflation?

Research Officer Ana Maria Santacreu and Research Associate Jesse LaBelle examined this question in a May 2022 Economic Synopses essay. Their analysis drew on their article published in the St. Louis Fed’s Review in the second quarter of 2022.

Industries’ Bottleneck Exposure and PPI Inflation

To analyze the impact of supply chain disruptions on PPI inflation, the authors created a measure of domestic and foreign exposure to such disruptions for 26 U.S. industries that was based on:

- A measure of bottlenecks using Purchasing Managers’ Index data from S&P Global—in particular, data on the number of unfulfilled new orders and suppliers’ delivery times

- The share of inputs that these industries source from each country

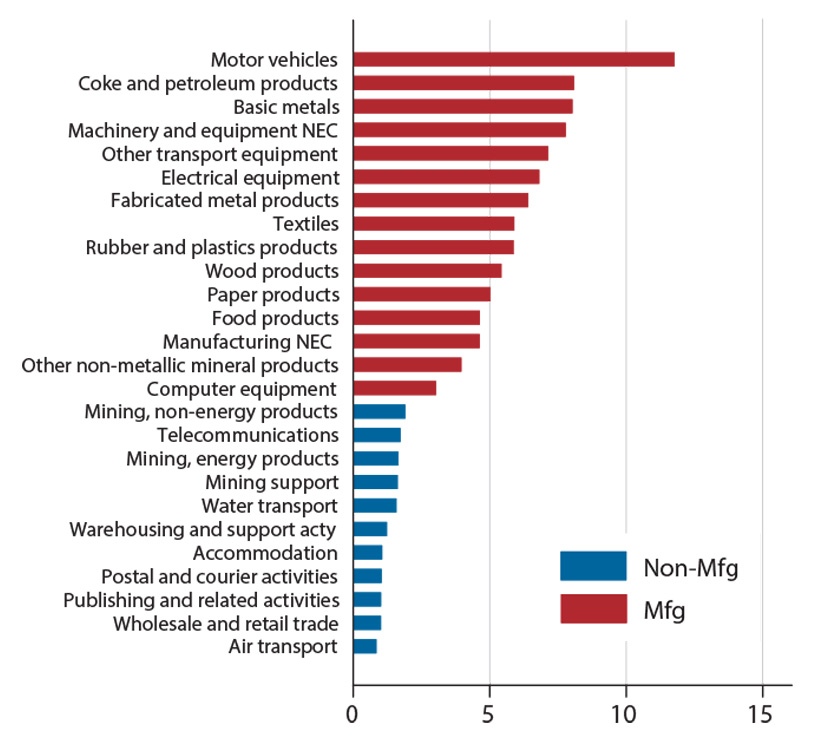

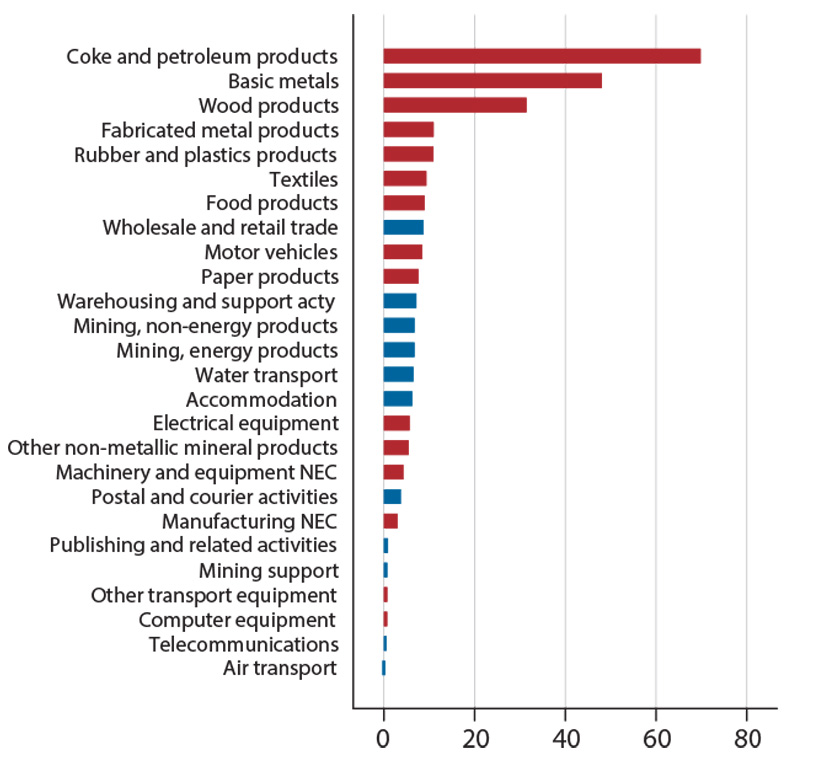

The figures below, which are from the Economic Synopses essay, show their measure of foreign bottleneck exposure across the U.S. industries as well as PPI inflation for these industries, averaged for January to November 2021.

The authors noted that the manufacturing sector had higher foreign bottleneck exposure than the services sector did, and that industries with the highest exposure also tended to experience higher PPI inflation over the period they examined.

Average Foreign Bottleneck Exposure and PPI Inflation

January-November 2021

A. Foreign bottleneck exposure

B. PPI inflation, percent

NOTES: The first chart shows 26 U.S. industry averages for exposure to foreign backlogs; the second chart shows year-over-year PPI inflation. “NEC” means “not elsewhere classified” and “acty” is “activity.”

SOURCES: Organization for Economic Cooperation and Development’s Trade in Value Added database; IHS Markit; the U.S. Bureau of Labor Statistics; and authors’ calculations.

The authors also did a more formal econometric analysis and used the results to estimate what PPI inflation in 2021 would have been if global bottlenecks had been the same as in 2019. They found that year-over-year PPI inflation in manufacturing would have been 2 percentage points lower in January 2021 and 20 percentage points lower in November 2021.

“Hence, supply chain disruptions have been an important source of PPI inflation during the COVID-19 pandemic,” they wrote.

Firms Reconsider How They Source Inputs

Supply chain disruptions have caused firms to rethink their global sourcing strategies, the authors noted. However, it can be costly to cut ties with existing suppliers and establish relationships with new ones, Santacreu and LaBelle explained. Plus, some inputs only are available from a single country or just a few.

“As a result, restructuring supply chains may lead to industries being more resilient whenever supply chains are disrupted, but that could occur at the expense of an increase in production costs,” they wrote.

Citation

ldquoHow Supply Chain Disruptions Contributed to Inflation in 2021,rdquo St. Louis Fed On the Economy, Nov. 28, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions