Forbearance during COVID-19: How Many Borrowers Used It, and for How Long?

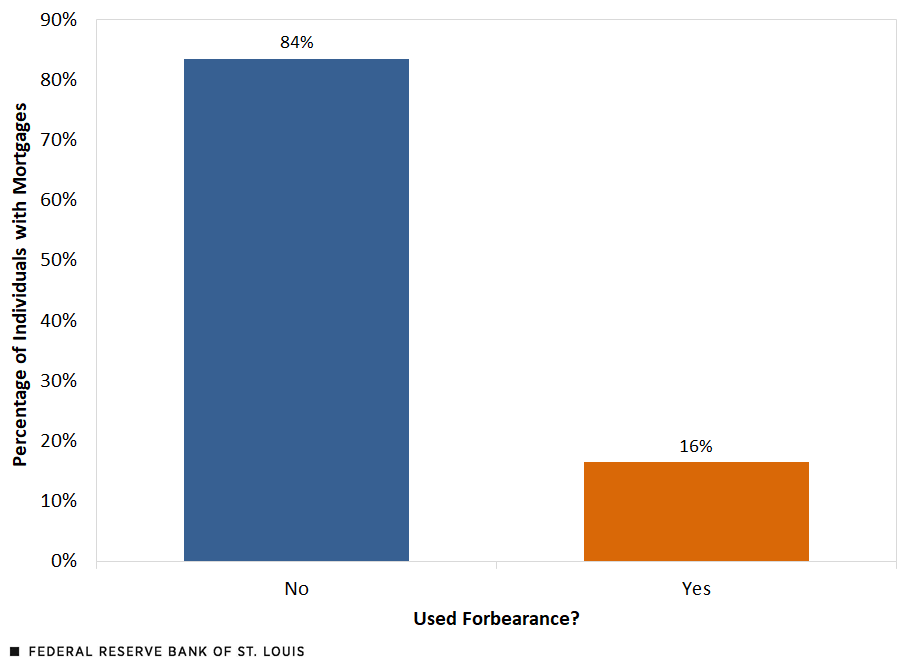

Enacted on March 27, 2020, the Coronavirus Aid, Relief and Economic Security (CARES) Act allowed homeowners with federally insured mortgages to request forbearance if they were experiencing financial hardship due to the COVID-19 pandemic. Although 16% of individuals with mortgages used forbearance at some point since April 2020, most of them did it for three months or less.

How Does Forbearance Work?

Forbearance allows borrowers to pause or reduce their mortgage payments for a specified period; upon exiting forbearance, borrowers have options to restructure their payment plans.For more information on forbearance, see the Consumer Financial Protection Bureau’s “Learn about forbearance” overview. Importantly, forbearance is not equivalent to loan forgiveness: Borrowers must resume payments at the end of the program. Nevertheless, forbearance is useful for borrowers whose income is temporarily lessened or halted altogether, such as for those experiencing short-term unemployment.

In this blog post, we used monthly data from the New York Fed Consumer Credit Panel/Equifax to estimate the percentage of borrowers with housing debt who had mortgages in forbearance between April 2020 and December 2021. The number of loans in forbearance is an estimate because loan servicers do not directly report whether a loan is in forbearance. We were able to determine which loans were likely in forbearance by tracking their payment history along with other indicators provided in the data.

Mortgage Relief Participation and Duration

The first figure shows that 16% of individuals with mortgage loans entered forbearance at some point between April 2020 and December 2021.

Rate at Which Individuals Participated in Forbearance (April 2020-December 2021)

SOURCES: FRBNY Consumer Credit Panel/Equifax and authors’ calculations.

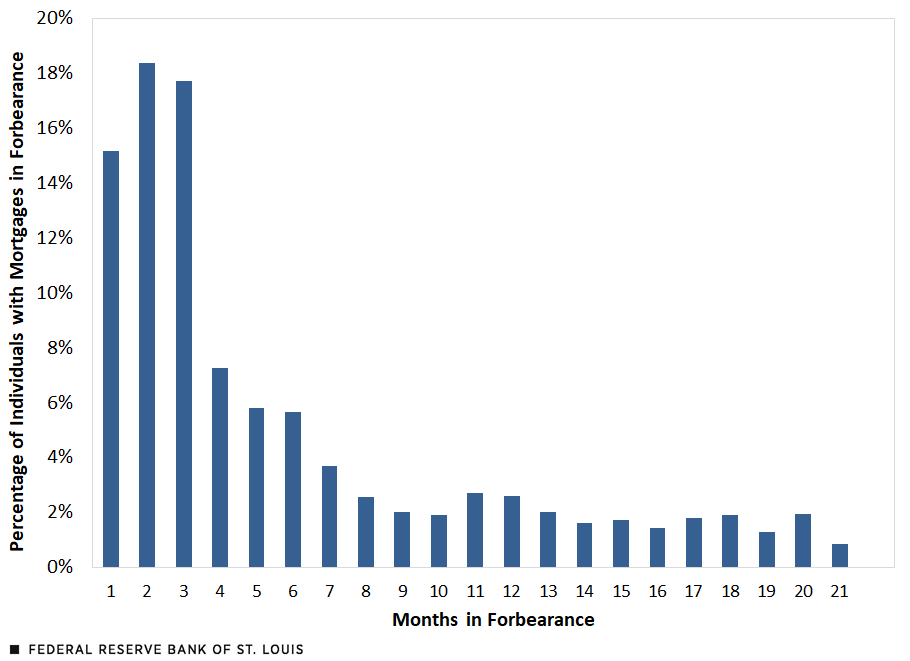

The next figure looks at how long borrowers kept their loans in forbearance.

- The y-axis shows the percentage of individuals with mortgages in forbearance at any point from April 2020 to December 2021.

- The x-axis shows the number of months these borrowers’ loans were in forbearance. (The maximum number of months we can track is 21, because our sample ends in December 2021. To be included in our sample, the borrower must have been continuously in the sample from April 2020 to December 2021.)

We can see that 85% of these borrowers had loans in forbearance for a year or less, and about half (51%) of borrowers had loans in forbearance for three months or less.

Majority of Borrowers Had Loans in Forbearance for Three Months or Less

SOURCES: FRBNY Consumer Credit Panel/Equifax and authors’ calculations.

In conclusion, although many mortgage borrowers used forbearance during the past two years of the pandemic, our estimation suggests that most used it for a very short duration, i.e., three months or less. This finding is in sharp contrast with the long duration of loan delinquency—another way borrowers can enter nonpayment status—reported in Kartik Athreya, José Mustre-del-Río and Juan M. Sánchez’s 2019 article. This apparent contradiction suggests that more research is needed to understand the differences between borrowers in forbearance and borrowers in delinquency.

Notes and References

1 For more information on forbearance, see the Consumer Financial Protection Bureau’s “Learn about forbearance” overview.

Citation

Juan M. Sánchez and Olivia Wilkinson, ldquoForbearance during COVID-19: How Many Borrowers Used It, and for How Long?,rdquo St. Louis Fed On the Economy, May 31, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions