Did the Computer Chip Shortage Affect Inflation?

The scarcity of semiconductors has triggered production bottlenecks in a wide range of goods, from automobiles to laptops. An Economic Synopses essay explored the relationship between the computer chip shortage and rising costs of goods in the U.S.

In their essay, St. Louis Fed Senior Economist Fernando Leibovici and Research Associate Jason Dunn examined the case of computer chips, noting that semiconductor demand rose along with the pandemic-driven demand for electronics.

Semiconductors Are Critical Production Input

The authors explained why semiconductors are a good case study for examining the role of supply chains in inflation. They pointed to the following industry characteristics:

- About 25% of 226 manufacturing industries use semiconductors as a direct input; these industries represent 39% of all manufacturing output, according to the authors’ calculations.

- Chips are a key production component. Though they typically account for a small percentage of total input costs, the scarcity of chips can halt production because they have no close substitutes and chip production capacity is very costly to increase, they noted.

“For instance, modern vehicles cannot be produced without microchips, although each car only uses a few hundred dollars’ worth,” the authors wrote, pointing out that the chip shortage has slowed domestic auto production and spurred higher vehicle prices.

Industries That Depend Heavily on Chips

Using Bureau of Economic Analysis (BEA) data, Leibovici and Dunn divided U.S. manufacturing industries into two distinct groups:

- Those that purchase chips as direct inputs to production

- Those that do not

Then they examined the price dynamics for all these industries, using producer price index data from the Bureau of Labor Statistics (BLS).

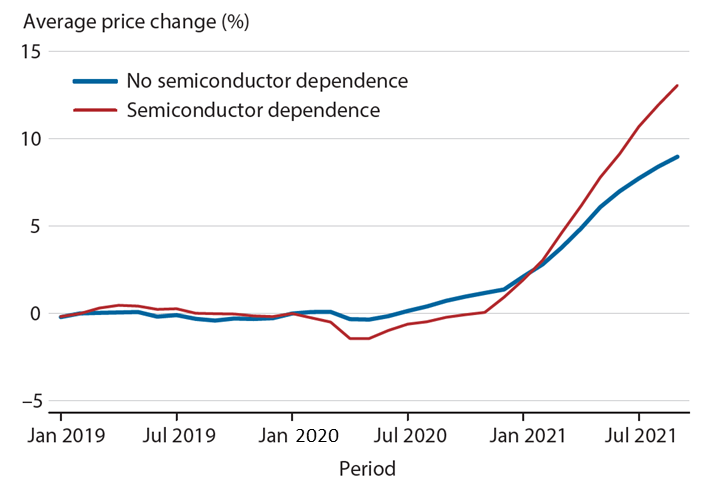

The next figure shows average monthly price changes for the two groups.

Price Changes in U.S. Manufacturing Industries

SOURCES: BEA, BLS and authors’ calculations.

As shown in the figure, the price changes were similar, at around zero, for the two groups through the end of 2020. In 2021, both groups saw increases, but the changes for the chip-dependent group were greater, Leibovici and Dunn noted.

By September 2021, the gap in price changes between the two groups had risen to 4 percentage points, they noted, adding that inflation for these chip-dependent sectors was economically meaningful because they represent roughly 40% of manufacturing production.

Though this example suggests that supply chain disruptions might have helped fuel inflation, Leibovici and Dunn noted there were also other likely factors, such as the unprecedented U.S. fiscal policy response to the pandemic. They concluded that a more rigorous analysis of recent inflation would be needed to account for these factors.

“The case of semiconductors nevertheless shows how disruptions in the production of a key input can affect vast supply chains, affecting prices across the economy—with significant macroeconomic implications,” the authors wrote.

Citation

ldquoDid the Computer Chip Shortage Affect Inflation?,rdquo St. Louis Fed On the Economy, May 10, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions