What Can Be Done to Promote Black Entrepreneurship?

KEY TAKEAWAYS

- Data from 1968 to 2015 show that Black men and women between ages 25 and 58 were less likely to be self-employed than their white peers.

- The racial gap in entrepreneurship stems from differences in wealth, education and funding, along with racial discrimination.

- Equalizing the returns for Black and white businesses would close the majority of the self-employment gap.

Entrepreneurship helps lift individuals and communities out of poverty and improve the overall economy.See Fritsch (2008). New businesses often create jobs and improve productivity, and they can facilitate social mobility by increasing an entrepreneur’s wealth.See Quadrini (1999) and Cagetti and DeNardi (2006).

However, entrepreneurship is not found equally across racial groups; Black individuals are much less likely to be entrepreneurs than their white counterparts. Part of the explanation is that for centuries, Black Americans were prevented from becoming business owners through violence as well as racist regulations and unofficial rules.See Albright et al. (2020). In this article, we focus on economic mechanisms that explain the racial gap in entrepreneurship.

The Entrepreneurship Gap Defined

Our data consist of Black and white individuals from the Panel Study of Income Dynamics (PSID), which collects information on demographic characteristics, income, employment and wealth. We defined entrepreneurs as those in the survey who reported being exclusively self-employed. We restricted our analysis to people between ages 25 and 58 to exclude those who were still pursuing their education and those who retired early. We present the analysis separately for men and women.

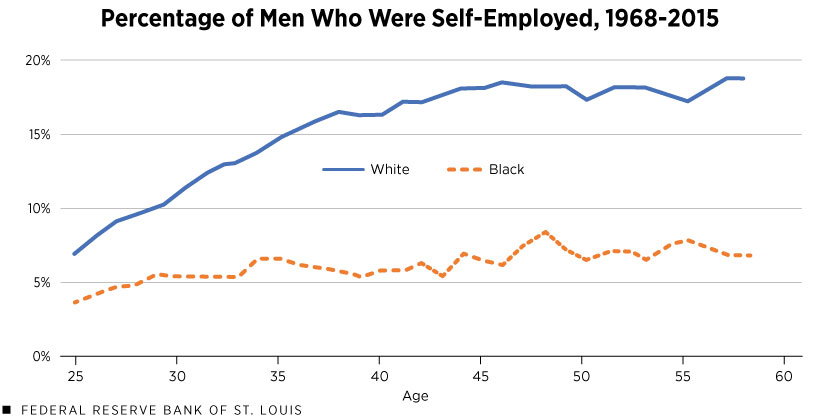

While 15% of white men in our sample were self-employed, only 6% of Black men in the same age range were, which represents a 150% difference.Expanding the age range to 18 to 60 years did not change the gap: 14.4% of white men were self-employed compared with 5.7% of Black men, resulting in a 150% difference. This gap is not uniform over the life cycle, however. The figure below displays the proportion of white and Black men who declared themselves in the PSID to be exclusively self-employed.We used PSID data for the years 1968 to 2015 (yearly from 1968 to 1997 and biennially after).

While white men were consistently more likely to be self-employed at all ages, the racial gap widened with age. At age 25, white men were about 3.3 percentage points more likely to be self-employed than Black men; by age 58, this gap had widened to 12.1 percentage points, with 18.9% and 6.8% of white and Black men, respectively, being self-employed.

SOURCES: The Panel Study of Income Dynamics and authors’ calculations.

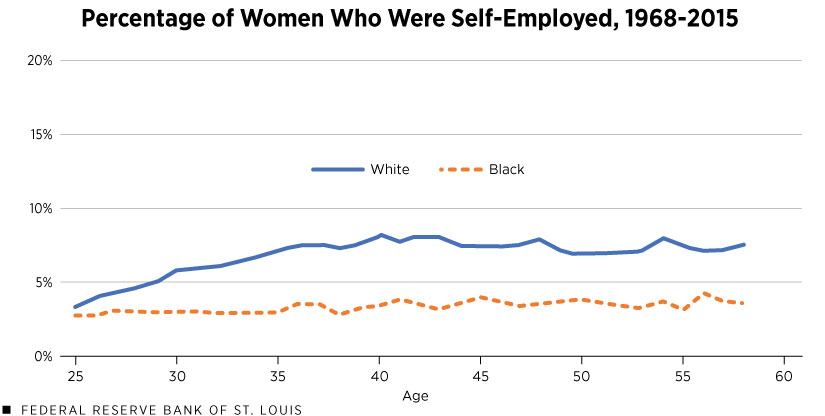

A similar trend is seen for women, in which 2.7% of Black women in our sample were self-employed, compared with 6.2% of white women, which represents a 130% difference. The second figure below shows the proportion of white and Black women who identified themselves in the PSID as being self-employed.

SOURCES: The Panel Study of Income Dynamics and authors’ calculations.

Overall, women in the PSID were less likely to be self-employed at all ages than their male counterparts. At age 25, white women were only 0.6 percentage points more likely to be entrepreneurs than Black women of the same age. However, the female entrepreneurship gap widened quickly and considerably—by the time they were 35, white women were 4.2 percentage points more likely to be self-employed. At the end of their working-age years, 7.2% of white women were entrepreneurs compared with 3.0% of Black women.

Possible Causes of the Entrepreneurship Gap

The racial gap in entrepreneurship stems from many structural and individual barriers—differences in wealth, educational disparities, borrowing constraints and discrimination in many forms. We focused on economic mechanisms, since those are the ones we can measure in our data and that are often fixable with targeted policy responses.

Our sample reflects a well-documented fact: Black people possess lower wealth than white individuals at all stages of the lifecycle. For instance, 30% of Black households between the ages of 25 and 58 had zero or negative wealth compared with 13.8% for whites. Lower wealth makes starting a business more difficult and hurts a Black entrepreneur’s ability to obtain financing.

However, not all financing challenges stem from differences in wealth or creditworthiness. The 2021 Small Business Credit Survey shows that even among firms with good credit scores, Black-owned firms were half as likely as white-owned firms to secure the financing they sought.See Page 28 of the Small Business Credit Survey, 2021 Report on Firms Owned by People of Color. These financial barriers make it more difficult for Black individuals to start and scale up their businesses, compromising the profitability of their enterprises and raising the rate at which they close.See Green (2021).

Individual characteristics, education and labor market experience also play a role in entrepreneurship. For decades, literature on labor economics has shown that education and job experience raise individual earnings.See Katz and Murphy (1992) and Mincer (1974). The same holds for self-employment income, suggesting that human capital is likely to influence the profitability of business ideas.See Hincapié (2020). In our sample, only 14% of Black individuals ages 25 to 58 years had a college education or higher, compared with 34% of white individuals, which further widened the gap in terms of job opportunities. Moreover, close to one-fifth of Black men were unemployed between the ages of 25 and 58, hindering their ability to accumulate skills and job experience. This gap in education and employment experience can lead to fewer Black entrepreneurs and higher closure rates of Black-owned businesses.

Policy Analysis: How to Help Close the Gap

Recent research by economists Barton H. Hamilton, Andrés Hincapié, Prasanthi Ramakrishnan and Siddhartha Sanghi present two key results regarding racial differences in self-employment in a sample of adult men.Incorporating women, in addition to men, and their labor supply decisions would imply that both fertility and marriage decisions will need to be modeled rigorously (Killingsworth and Heckman, 1986)., See Hamilton et al. (2021). Using a dynamic model of entrepreneurship, they show that the return on each dollar invested for Black entrepreneurs was lower, and that while borrowing constraints appeared to be similar for Black- and white-owned businesses, Black businesses were particularly constrained due to lower wealth. Focusing on these results, the authors explored several potential avenues to help close the Black entrepreneurship gap.

What would the level of Black entrepreneurship be if these entrepreneurs had the same return on each dollar invested in their businesses as whites? The authors found that equalizing business returns would close 97% of the gap between Black and white men, in terms of self-employment rates. Of course, closing the gap in business return on investment is not simple. Movements such as #ShopBlack, as well as National Black Business Month, encourage demand for Black-owned businesses. Mentoring has often been shown to be a key factor in helping develop a business and ensuring its profitability.See Blake-Beard et al. (2006) for an analysis of race and mentoring.

In the past few years, business accelerators have provided new entrepreneurs with mentoring from seasoned CEOs and have helped in securing funding. Initiatives like the Black Business Accelerator by Amazon might help in providing these services to Black entrepreneurs. Preventing discrimination in the loan market and building better relationships between the Black community and banks also would help ease the barriers for Black entrepreneurs.

As mentioned earlier, the gaps in human capital suggested by gaps in education and labor market experience can constitute a barrier for Black entrepreneurship. What would be the impact on labor market choices if Black men had the same level of human capital as white men? The authors found a net decline in unemployment caused by a rise in paid employment of 9 percentage points, with no rise in self-employment. This increase in paid employment revealed that, given low returns in the self-employment sector, highly educated and highly experienced Black would-be entrepreneurs are better off by staying in paid employment. Higher participation in paid employment could lead to higher rates of self-employment in the long term, provided some of the human capital and wealth can be used in future businesses or transferred to future generations.See Hincapié (2020).

Exploring the various economic mechanisms behind the Black-white entrepreneurship gap is a first step in providing a roadmap for policymakers interested in closing it. Removing the barriers for Black entrepreneurs, while potentially difficult to implement, would encourage Black entrepreneurs and could have far-reaching consequences on inequality, social mobility, job creation and economic output. More work is needed on the gender gap in self-employment to better understand barriers related to female labor force participation, some of which is being undertaken by the same authors.

Endnotes

- See Fritsch (2008).

- See Quadrini (1999) and Cagetti and DeNardi (2006).

- See Albright et al. (2020).

- Expanding the age range to 18 to 60 years did not change the gap: 14.4% of white men were self-employed compared with 5.7% of Black men, resulting in a 150% difference.

- We used PSID data for the years 1968 to 2015 (yearly from 1968 to 1997 and biennially after).

- See Page 28 of the Small Business Credit Survey, 2021 Report on Firms Owned by People of Color.

- See Green (2021).

- See Katz and Murphy (1992) and Mincer (1974).

- See Hincapié (2020).

- Incorporating women, in addition to men, and their labor supply decisions would imply that both fertility and marriage decisions will need to be modeled rigorously (Killingsworth and Heckman, 1986).

- See Hamilton et al. (2021).

- See Blake-Beard et al. (2006) for an analysis of race and mentoring.

- See Hincapié (2020).

References

- Albright, Alex; Cook, Jeremy A.; Feigenbaum, James A.; Kincaid, Laura; Long, Jason; and Nunn, Nathan. “After the Burning: The Economic Effects of the 1921 Tulsa Race Massacre,” National Bureau of Economic Research, Working paper No. 28985, 2021.

Audretsch, D. B. “The Dynamic Role of Small Firms: Evidence from the U.S.” Small Business Economics, 2002, Vol. 18, pp. 13-40. - Blake-Beard, S.; Murrell, A. J.; and Thomas, D. A. “Unfinished Business: The Impact of Race on Understanding Mentoring Relationships.” Harvard Business School, Working Paper, No. 06-060, 2006.

- Cagetti, M.; and De Nardi, M. “Entrepreneurship, Frictions, and Wealth.” Journal of Political Economy, 2006, Vol. 114, No. 5, pp. 835-70.

- Fairlie, R.W. “Racial Inequality in Business Ownership and Income.” Oxford Review of Economic Policy, 2018, Vol. 34, No. 4, pp. 597-614.

- Fritsch, M. “How Does New Business Formation Affect Regional Development? Introduction to the Special Issue.” Small Business Economics, 2008. Vol. 30, pp. 1-14.

- Green, D. “Why Black-Owned Businesses Are Struggling to Stay Afloat.” CNBC, 2021.

- Halek, M.; and Eisenhauer, J. G. “Demography of Risk Aversion.” Journal of Risk and Insurance, 2001, Vol. 68, No. 1, pp. 1-24.

- Hamilton B.H.; Hincapié, A.; Ramakrishnan, P.; and Sanghi, S., “Entrepreneurship in Black and White,” Working Paper, 2021.

- Hincapié, A. “Entrepreneurship Over the Life Cycle: Where Are the Young Entrepreneurs?” International Economic Review, 2020, Vol. 61, No. 2, pp. 617-81.

- Hvide, H. K.; and Panos, G. A. “Risk Tolerance and Entrepreneurship.” IZA Discussion Paper No. 7206, 2013.

- Katz, L.F.; and Murphy, K.M. “Changes in Relative Wages, 1963–1987: Supply and Demand Factors.” The Quarterly Journal of Economics, 1992, Vol. 107, No. 1, pp. 35-78.

- Killingsworth, Mark R.; and Heckman, James J. “Female Labor Supply: A Survey.” Handbook of Labor Economics, 1986, Vol. pp. 103-204.

- Mincer, J. Schooling, Experience, and Earnings (Human Behavior and Social Institutions), National Bureau of Economic Research, 1974.

- Quadrini, V. “The Importance of Entrepreneurship for Wealth Concentration and Mobility.” Review of Income and Wealth, 1999, Vol. 45, No. 1, pp. 1-19.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us