The Dynamics of International Shipping Costs

A salient feature of the rebound of economic activity in 2021 has been the rise of international shipping costs. For instance, the average global market price of shipping a 40-foot container increased eightfold from an average of $1,331 in the week of Feb. 28, 2020, to a peak of $11,109 in the week of Sept. 10, 2021.Values correspond to the Freightos Baltic Index (FBX). See the index’s webpage for more details.

These sharp changes in international shipping costs are partially in response to the COVID-19 economic environment. Unprecedented levels of fiscal stimulus, combined with a sharp reallocation of demand from services into durable goods, have been straining supply chains, leading to the resurgence of inflation across developed economies. Given that durable goods are particularly likely to be traded internationally, these developments have led to the increased demand for international shipping services and, thus, to the rise of international shipping costs.

There is also a sense that the international shipping industry is facing unprecedented disruptions that extend beyond the COVID-19 economic developments. For instance, health and containment policies introduced to combat COVID-19 have limited the availability of workers to process cargo in ports as well as their work arrangements, leading to a slowdown of container processing. The unexpected nature of these disruptions may be leading countries and firms to rethink their reliance on international trade for a wide variety of critical goods by reorganizing their structure of production.

In this article, we investigate the extent to which the recent rise of international shipping costs is indeed unprecedented. To do so, we contrast the dynamics of international shipping costs recently observed vis-à-vis their historical dynamics.

Tracking Shipping Costs

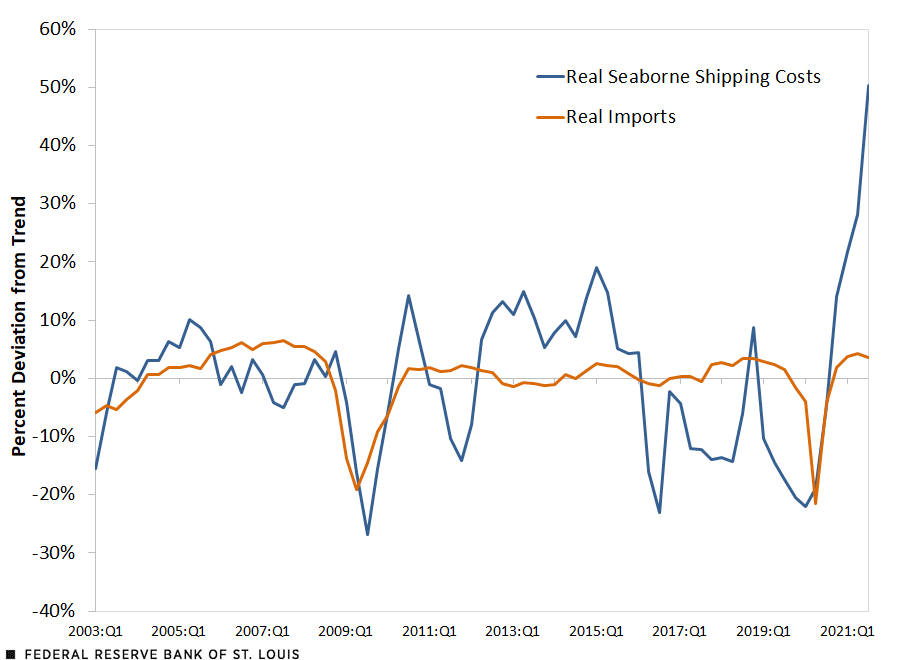

We used data on shipping costs and international trade volumes for the U.S. from 2003 to 2021. We focused on seaborne shipments and measured international shipping costs for the U.S. using an index of freight rate costs between China and the U.S. West Coast, obtained from Clarksons Research, a British provider of shipping services.Specifically, we focus on the China Containerized Freight Index (CCFI) from China to the West Coast of North America. We measured the level of international trade using real imports from the Bureau of Economic Analysis. All data are measured on a quarterly basis and are seasonally adjusted. The figure below plots each of the two series as percent deviations from trend.We detrend the series using a Hodrick-Prescott filter with smoothing parameter 1600.

International Shipping Costs and Import Volumes for the U.S.

SOURCES: Clarksons Research, U.S. Bureau of Economic Analysis and authors’ calculations.

NOTE: Data are from the first quarter of 2003 to the third quarter of 2021.

Shipping Costs Are Volatile and Pro-Cyclical

Our first observation is that international shipping costs are volatile. Their deviations from trend prior to COVID-19 range from -26.8% to 19.0%, with a standard deviation of 12.8%. Thus, even though recent changes of international shipping costs stand significantly above this range, it is important to note that seaborne shipments typically feature significant price swings even outside crisis episodes.

Our second observation is that international shipping costs are pro-cyclical. The figure shows that international shipping costs are positively correlated with international trade volumes, with a correlation equal to 0.39. This suggests that international shipping costs are likely to be a function of standard demand and supply forces. In periods in which the volume of international trade is lower, so is the demand for international shipments—thus, shipping costs decline. And vice-versa.

Contrast with 2007-08 Financial Crisis

Given these two observations, we next evaluate the extent to which the recent rise of international shipping costs reflects the increased demand for goods or whether it additionally reflects abnormal disruptions faced by the shipping industry. To do so, we contrast the collapse and subsequent recovery of international shipping costs during two episodes and their subsequent recoveries: (1) the financial crisis of 2007-08, and (2) the COVID-19 recession.

As pointed above, international shipping costs are pro-cyclical, so it is to be expected that these costs decline during economic downturns while increasing as the economy recovers. Thus, given that real imports declined similarly in both episodes, we interpret the dynamics of international shipping costs observed during the financial crisis as capturing the dynamics we would expect to observe in an economic environment without disruptions in international shipping. In turn, we interpret the difference between the dynamics of international shipping costs across these two episodes as capturing the role of disruptions on the dynamics of these costs.

We observe that international shipping costs increased by 41.0 percentage points in the aftermath of the global financial crisis, from a trough of -26.8% below trend in the third quarter of 2009 to a peak of 14.2% above trend in the third quarter of 2010. Under the assumptions described above, we would expect international shipping costs to increase by a similar amount as the economy recovers from the COVID-19 recession. However, we observe that international shipping costs increased by 72.3 percentage points, from a trough of -22.0% below trend in the first of 2020 to a peak of 50.3% above trend in the third quarter of 2021. Then, we conclude that slightly more than half of the 72.3 percentage point increase of international shipping costs in the aftermath of COVID-19 recession is the result of standard demand and supply forces, while the remaining is the result of disruptions in international shipping.

This evidence shows that, while it is certainly the case that international shipping costs have entered unprecedented territory due to ongoing disruptions in international shipping, a nontrivial portion of the dynamics of international shipping costs observed in recovery from the COVID-19 recession appears to be consistent with the standard dynamics of international shipping costs. These costs are volatile and pro-cyclical, so it is not unusual that they increase significantly when economic activity rebounds after a recession.

The figure in this post was updated to clarify that the y-axis represents the percent deviation from trend.

Notes and References

- Values correspond to the Freightos Baltic Index (FBX). See the index’s webpage for more details.

- Specifically, we focus on the China Containerized Freight Index (CCFI) from China to the West Coast of North America.

- We detrend the series using a Hodrick-Prescott filter with smoothing parameter 1600.

Citation

Fernando Leibovici and Jason Dunn, ldquoThe Dynamics of International Shipping Costs,rdquo St. Louis Fed On the Economy, Jan. 3, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions