Bretton Woods and the Growth of the Eurodollar Market

As World War II raged on, delegates from 44 Allied nations gathered at a hotel in Bretton Woods, N. H., to lay out foundations for the reconstruction of the international financial system. The hope was to prevent a repetition of competitive devaluations in the 1930s and to create a stable economic and financial environment for nations to operate in. This resulted in an agreement for countries to fix their exchange rates to the U.S. dollar and the U.S. to peg the dollar to gold.

The fixed exchange rate system constrained the economic policies of many nations, causing policymakers to adopt capital/exchange control measures to keep their monetary autonomy. However, the control measures were not always effective and economic agents around the world began to find loopholes in the system. Among these was the emergence of the eurodollar market: a market for short-term deposits denominated in U.S. dollars at banks outside U.S. territory (PDF), particularly in London.

The Origins and the Spread of the Eurodollar Market

Although there are many possible factors that contributed to the development of the eurodollar market, numerous accounts cited exchange controls implemented by the U.K. in 1957 as the earliest impetus for this development. In response to a potential drain on reserves caused by higher inflation and the Suez crisis, the British government placed severe restrictions (PDF) on sterling credits to nonresidents and banned the use of sterling to finance third-party transactions. To circumvent this issue, the London banks started using dollar deposits as credit instruments for nonresidents.

Another possible factor that drove the demand for dollar deposits was profitable investment opportunities in the U.K. and the financial innovation that followed. During the period of tight monetary policy in the U.K., Midland Bank was able to seek funds denominated in dollar to obtain sterling at a lower interest rate. The bank had bid 30-day dollar-denominated deposits at an interest rate (1.875%) that was higher than the maximum payable under Regulation Q in the U.S., sold these dollars spot for sterling and bought dollars back at a premium of 2.125%. This method helped the bank obtain sterling at the rate of 4% during a time when Bank Rate was 4.5%, according to a 1998 article by Catherine R. Schenk. With tight monetary policy, relatively relaxed controls on the forward exchange market and opportunities for profitable interest arbitrage, the eurodollar market began to expand rapidly.

Rapid Growth in the Eurodollar

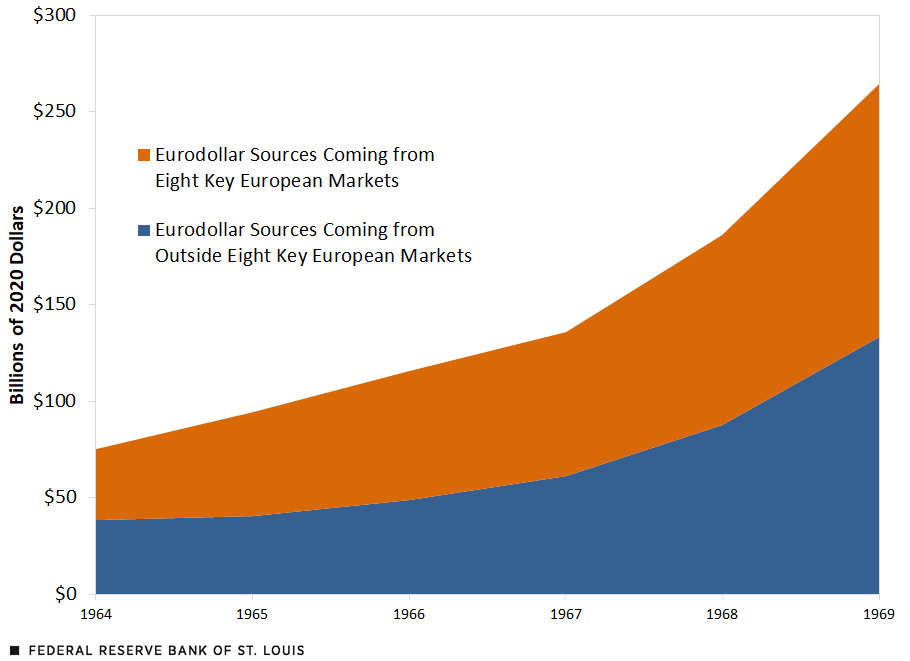

The figure below shows the estimated size of the eurodollar market during the heyday of the Bretton Woods era.

Net Size in the Eurodollar Market

SOURCES: Bank for International Settlements annual reports, FRED and authors’ calculations.

NOTES: The figures are based on the dollar liabilities reported by the banks of the eight reporting European countries (Belgium, France, Germany, Italy, Netherlands, Sweden, Switzerland and the U.K.) vis-à-vis banks and nonbank residents outside their own area and vis-à-vis nonbank residents inside the reporting area. For more information, see the BIS annual report (PDF) for 1969.

We can see that from 1964 to 1969, the estimated market size of eurodollar market grew over 252% from $75 billion of 2020 dollars to $264 billion. As the U.S. administration tried to control the outflow of dollars, multinational corporations, eager to find profitable usage of their surplus dollar balances, and banks, equally eager to accommodate demand, found way to get around the controls.

Following its emergence, the eurodollar market played a big role in the Bretton Woods system and also its breakdown and eventual demise in the early 1970s.

Citation

Paulina Restrepo-Echavarría and Praew Grittayaphong, ldquoBretton Woods and the Growth of the Eurodollar Market ,rdquo St. Louis Fed On the Economy, Jan. 20, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions