How Changing Interest Rates Affect Variable-Rate Loans to U.S. Firms

The Federal Open Market Committee (FOMC) recently raised the federal funds rate 75 basis points on two occasions this summer. These were the highest rate increases since 1994. The Fed raising rates is important for households and firms for many reasons. One of the main reasons is that interest rates on new loans will now be higher, inducing some to borrow less. At the same time, some households and firms may have already contracted credit at variable interest rates that tend to move together with policy rates. This can increase monthly expenses on interest payments for households and firms.

In this blog post, we document some facts regarding the type of interest rate indexation on loans that major U.S. bank holding companies offer to U.S. firms. The data is taken from the FR Y-14Q data set, which contains balance sheet information for major bank holding companies (BHCs) that are subject to the Fed’s stress tests. The FR Y-14Q data accounts for a majority of commercial and industrial lending to U.S. firms. We looked at quarterly data from the third quarter of 2012 to the first quarter of 2022. There were between 27 and 36 reporting banks, depending on the quarter.

Lending Breakdown

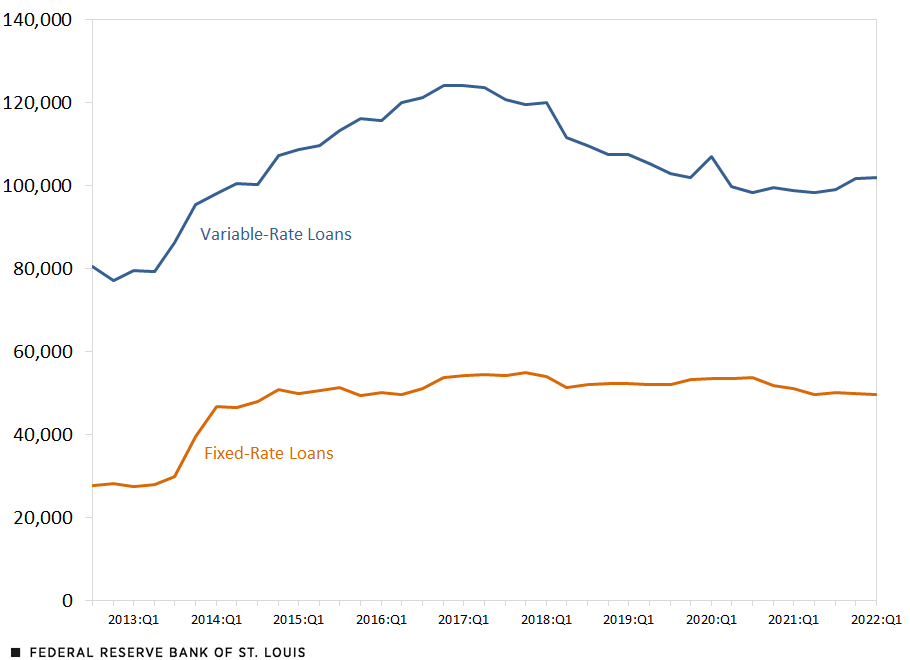

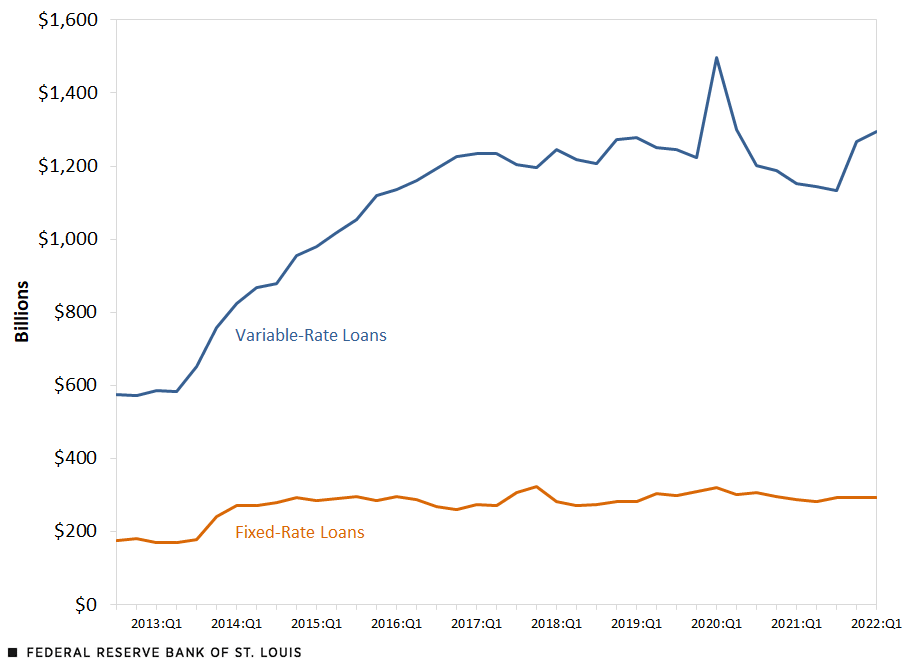

The two figures below plot the number and volume of loans to US businesses with fixed and variable interest rates outstanding at each point in time in our sample.These loans are primarily composed of term loans and credit lines. We include only the utilized portion of credit lines in our plots and calculations.

Number of Loans to U.S. Businesses, by Type

Value of Loans to U.S. Businesses, by Type

SOURCES FOR THE TWO FIGURES: Federal Reserve’s FR Y-14Q data set and authors’ calculations.

NOTE FOR THE TWO FIGURES: Data are from a sample of between 27 and 36 large bank holding companies, depending on the quarter.

The figures show a sharp uptick in the quantity and value of variable-rate loans. Between 2012 and 2017, the quantity of variable-rate loans increased sharply, before tapering off after 2017. The value of variable-rate loans continued to grow throughout the sample, with a noticeable spike at the beginning of the COVID-19 pandemic.

The value and quantity of fixed-rate loans were relatively consistent over time, aside from a large increase in quantity at the start of 2014. At the end of 2021, variable-rate loans made up 67% of the sample and accounted for 81% of the value of loans in the sample.

Indexing Variable-Rate Loans

What are these variable-rate loans indexed to? The following table shows the number and value of loans in the fourth quarter of 2021. The London Interbank Offered Rate (LIBOR) is by far the most used index for variable-rate loans, at 62%.The LIBOR is currently in the process of being discontinued and replaced by the Secured Overnight Financing Rate (SOFR). For example, see “Interest rates on secured and unsecured overnight lending,” FRED Blog, March 28, 2022. After that, other indexes and the prime rate combined to total 36.9% of loans, with only 1.1% of variable-rate loans tied to Treasury rates.

However, when you look at the value of loans, the relative shares change: Prime loans dropped from 15.4% of loans to just 5% of loan value. The LIBOR and other rates account for 70.5% and 24.2% of the value, respectively.

| Loan Index | Number of Loans | Share of Loans | Loan Value (Billions) |

Share of Loan Value |

|---|---|---|---|---|

| LIBOR | 56,452 | 62.0% | $819.5 | 70.5% |

| Other | 19,612 | 21.5% | $281.6 | 24.2% |

| Prime | 14,042 | 15.4% | $58.1 | 5.0% |

| Treasury | 981 | 1.1% | $3.4 | 0.3% |

| SOURCES: Federal Reserve’s FR Y-14Q data set and authors’ calculations. | ||||

Lending Behavior

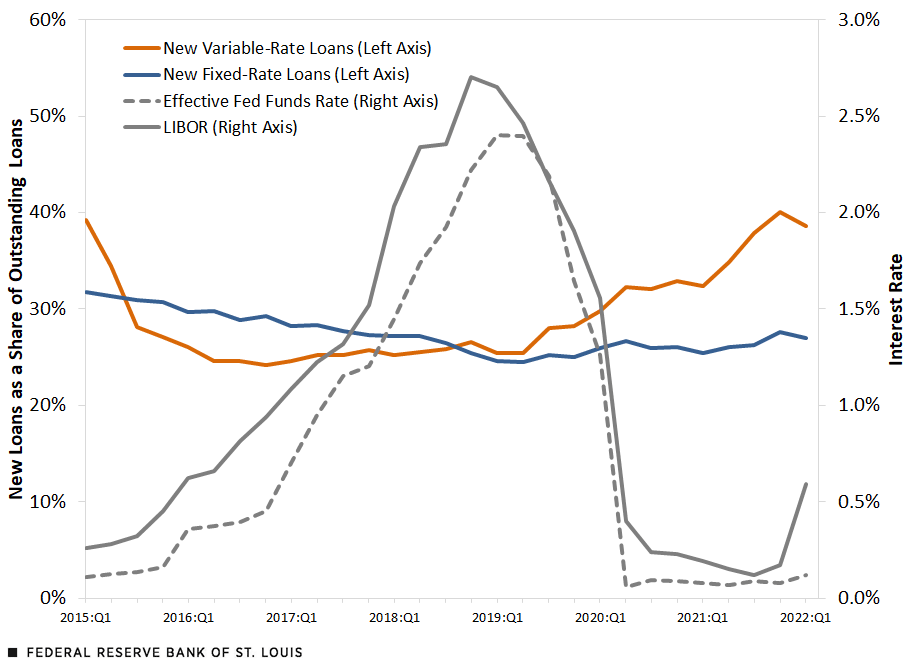

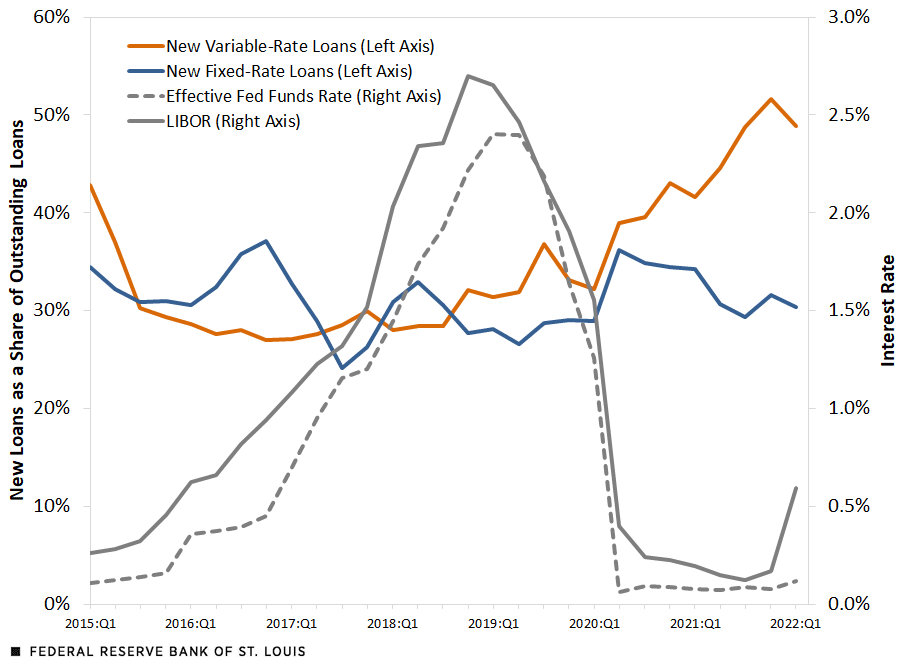

Does the growth rate of each type of loan depend on the path of interest rates? In the next two figures, we plotted the quantity and value of new loans from the past year, divided by the number of existing loans in the sample. We also plotted the paths for two benchmark rates: the federal funds rate and the LIBOR.

Change in the Composition of Loans, By Type

Change in the Composition of Loan Value, By Type

SOURCES FOR THE TWO FIGURES: Federal Reserve’s FR Y-14 data set and authors’ calculations.

NOTE FOR THE TWO FIGURES: These figures were created using only data from the 27 banks that were present through the entire sample period.

The two figures show some interesting patterns regarding both the number and volume of new loans with different interest rate indexations. First, the number of new loans tends to fall relative to outstanding loans when interest rates rise and then tends to rise when interest rates drop. This is a normal and intended effect of the traditional mechanism of transmission of monetary policy.

Second, this pattern seems to be stronger for variable-rate loans, with new loans’ shares of outstanding loans and loan value responding more strongly to rising and falling benchmark interest rates. The new loans’ shares, especially among variable-rate loans, began to rise after the Fed dropped the federal funds rate to near zero in response to the pandemic.

Conclusion

Standard theories of asset pricing and financial intermediation suggest that, under reasonable conditions, borrowers should be indifferent between variable- and fixed-rate loans. This is because the financial intermediaries that set the rates on loans should adjust the rates on fixed-rate loans so they earn the same return as they would by offering an equivalent variable-rate loan.

This presumes, however, that lenders have perfect information about the path of future interest rates and are thus able to set fixed-rate loans exactly such that they earn the same return as variable-rate loans. In practice, there can be significant uncertainty about the path of macroeconomic and monetary policy variables, which can interfere with these calculations and thus make one type of loan more attractive under certain conditions.

Our analysis in this blog post, while not a formal econometric and statistical analysis, suggests that this is the case when it comes to firms borrowing from major U.S. banks.

Notes

1 These loans are primarily composed of term loans and credit lines. We include only the utilized portion of credit lines in our plots and calculations.

2 The LIBOR is currently in the process of being discontinued and replaced by the Secured Overnight Financing Rate (SOFR). For example, see “Interest rates on secured and unsecured overnight lending,” FRED Blog, March 28, 2022.

Citation

Miguel Faria-e-Castro and Samuel Jordan-Wood, ldquoHow Changing Interest Rates Affect Variable-Rate Loans to U.S. Firms,rdquo St. Louis Fed On the Economy, Aug. 16, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions