The Enduring Regional Economic Challenges Associated with the Pandemic

Recent surveys indicate that families living in Missouri and its surrounding states are highly vulnerable as the delta variant of the coronavirus quickly spreads. Until public health concerns are addressed, the pandemic’s economic effects will likely endure—especially for those already struggling to recover.

The U.S. Census’ Pulse Survey for June 23 to July 5, 2021, provides the following insights concerning the states of the Eighth Federal Reserve District.Data are used for seven states that are at least partially contained within the Eighth Federal Reserve District, which is headquartered in St. Louis: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Data from the Chicago metropolitan statistical area (MSA) are omitted.

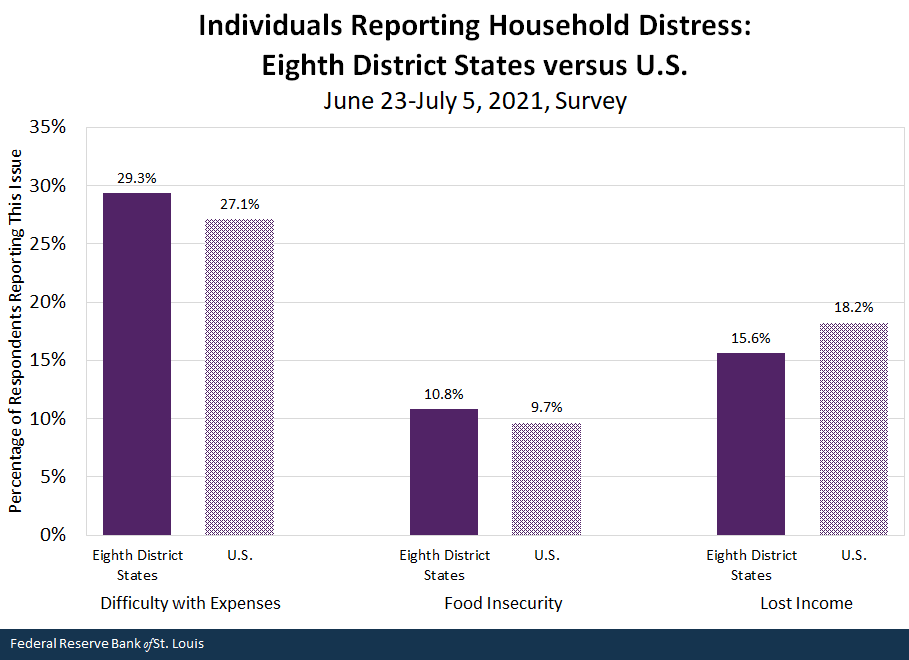

- Compared with individuals in the U.S., residents in the states of the Eighth District face greater difficulty meeting their household expenses, including greater rates of food insecurity, despite fewer losses in income. (See the figure below.)

- People of color in District states are more likely to have greater losses in income and higher rates of food insecurity relative to white residents. These larger challenges are similar to national racial and ethnic comparisons.

NOTES: Data are used for seven states that are at least partially contained within the Eighth Federal Reserve District: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Data from the Chicago metropolitan statistical area are omitted. The percentage of food insecurity is the share of individuals who reported sometimes or often not having enough to eat in the past seven days. Individuals reporting that it was “somewhat” or “very difficult” to pay for usual household expenses (e.g., food, rent or mortgage, medical expenses) in the past week were considered having difficulty with expenses. The percentage of lost income is the share of individuals who reported losing employment income within the past four weeks. Results exclude respondents that did not provide a response to the question.

SOURCES: Census Bureau’s Household Pulse Survey and authors’ calculations.

If COVID-19 cases continue to rise, families in our region—especially households of color—may start to experience greater economic challenges than the nation.

What Are the Economic Consequences of the Pandemic’s Resurgence?

The pandemic’s resurgence threatens the individual and collective economic livelihoods of those living in Missouri and beyond. Disruptions caused by the pandemic have implications for employment, household incomes, and meeting household expenses. The pandemic has caused historic disruption to child care and schools, unlike other economic downturns. These disruptions are likely to continue until the virus has been reined in.

When looking at Census Pulse Survey responses from the spring and summer, for adults 25 to 54 who are parents, child care arrangements in our region were disrupted, and it adversely impacted their income.These estimates pool Household Pulse survey samples for weeks 28 to 33; this encompasses the period from April 14 to July 5, 2021. Estimates are for the seven Eighth District states, excluding data from the Chicago MSA.

- 35% of parents reported lost employment income if their child care was disrupted, compared with 17.5% if they reported no disruption.

- Hispanic and Black families with child care interruptions reported lost employment income at higher rates: Of those experiencing child care disruptions, 57.9% of Hispanic parents and 44.5% of Black parents reported lost employment income. If they did not report a disruption, only 18.4% of Hispanic parents and 30.8% of Black parents reported a loss in employment income.

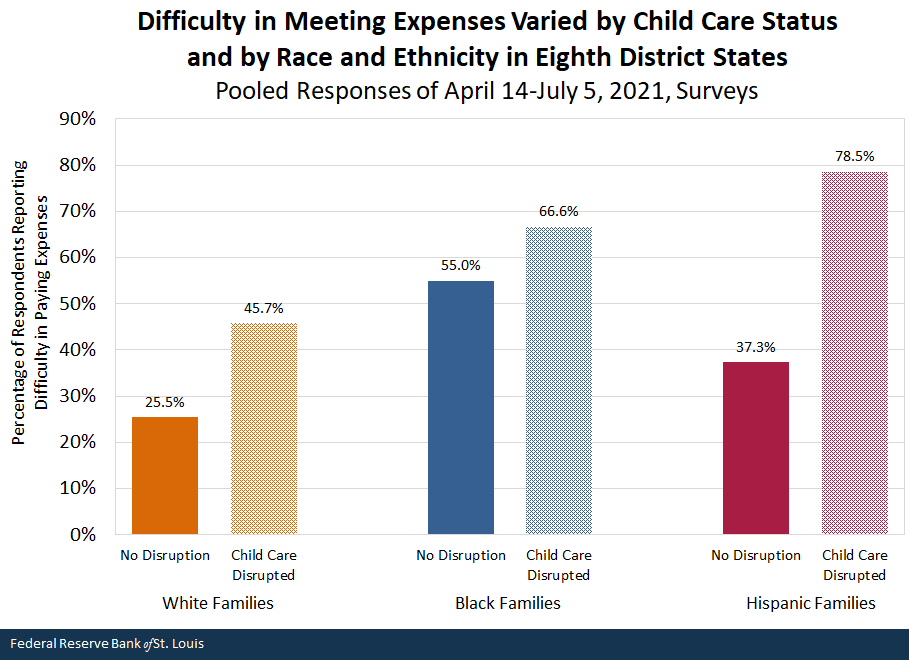

The child care disruptions translated into greater difficulty meeting household expenses.

- 52.5% of parents who faced a child care interruption reported an increased difficulty meeting their expenses. In contrast, 29.8% of parents had trouble meeting expenses despite experiencing no disruption.

- White, Black and Hispanic parents who reported significant child care challenges also reported major difficulty meeting their expenses. Over two-thirds of Black and Hispanic parents reported difficulty meeting their expenses. Almost 46% of white parents reported difficulty meeting their expenses. (See the figure below.)

NOTES: Data are used for seven states that are at least partially contained within the Eighth Federal Reserve District: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Data from the Chicago metropolitan statistical area are omitted. Responses are pooled for weeks 28 through 33 of the Pulse Survey. Sample is restricted to those individuals ages 25-54 who reported children under the age of 18 in the household. Those that reported it was “somewhat” or “very difficult” to pay for usual household expenses (e.g., food, rent or mortgage, medical expenses) in the past week were considered having difficulty with expenses. Results exclude respondents that either did not disclose the status of their child care arrangements or did not answer the question regarding difficulty with expenses.

SOURCES: Census Bureau’s Household Pulse Survey and authors’ calculations.

Because of the spreading delta variant, Missouri was one of three states that accounted for 40% of the coronavirus cases across the nation by mid-July. Within Missouri, southern communities have seen an upward spike in cases and deaths due to the delta variant. It is well documented that our physical and economic health are intertwined.For research on this issue, see Sergio Correia, Stephan Luck and Emil Verner’s 2020 paper “Pandemics Depress the Economy, Public Health Interventions Do Not: Evidence from the 1918 Flu”; and Asli Demirgüç-Kunt, Michael Lokshin and Ivan Torre’s 2020 working paper, “The Sooner, the Better: The Early Economic Impact of Non-Pharmaceutical Interventions during the COVID-19 Pandemic.” Until the public health crisis in Missouri is addressed, the economic effects of the pandemic are likely to endure—especially for those already struggling to participate in the economy.

Notes and References

- Data are used for seven states that are at least partially contained within the Eighth Federal Reserve District, which is headquartered in St. Louis: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Data from the Chicago metropolitan statistical area (MSA) are omitted.

- These estimates pool Household Pulse survey samples for weeks 28 to 33; this encompasses the period from April 14 to July 5, 2021. Estimates are for the seven Eighth District states, excluding data from the Chicago MSA.

- For research on this issue, see Sergio Correia, Stephan Luck and Emil Verner’s 2020 paper “Pandemics Depress the Economy, Public Health Interventions Do Not: Evidence from the 1918 Flu”; and Asli Demirgüç-Kunt, Michael Lokshin and Ivan Torre’s 2020 working paper, “The Sooner, the Better: The Early Economic Impact of Non-Pharmaceutical Interventions during the COVID-19 Pandemic.”

Additional Resources

- On the Economy: Labor Day Reflections on the COVID-19 Recovery

- Open Vault: The Institute for Economic Equity’s Work and Its New Director

Citation

William M. Rodgers III and Lowell R. Ricketts, ldquoThe Enduring Regional Economic Challenges Associated with the Pandemic ,rdquo St. Louis Fed On the Economy, Sept. 9, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions