The Child Tax Credit and Child Poverty in the Eighth District

Nearly 1 in 7 children lives in poverty in the U.S., and the child poverty rate in the Eighth Federal Reserve DistrictHeadquartered in St. Louis, the Eighth District includes the entire state of Arkansas, as well as parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Because of data limitations, the data used here are for Eighth District states as a whole, with the understanding that parts of these states, such as in Illinois, are outside the District. is higher than in the country at large, according to a recent Regional Economist article.

In the article, St. Louis Fed Economist Hannah Rubinton and Research Associate Maggie Isaacson analyzed the District’s poverty rate, along with income volatility. They also looked at what impact the expanded federal child tax credit (CTC) would have on poverty.

Increases in the Child Tax Credit

The authors first outlined the basic structure of the CTC. The American Rescue Plan Act of 2021 boosted the child tax credit for 2021 up to $3,000 per child between ages 6 and 17 and up to $3,600 per child under 6, with the entire credit being refundable. The CTC, which was introduced in 1998, was previously set at up to $2,000 per dependent under 16 and was refundable up to $1,400.

With the recent changes, if a family has no federal income, it is still eligible to receive the entire tax credit. However, instead of a single payment, half is to paid out over the second half of 2021 and the rest to be claimed on the household tax return, they noted.

With this change to the CTC, the percentage of children living below the poverty threshold will drop an estimated 40%. The boost to benefits and the new way to distribute payments could help families increase and smooth their income over the year, Rubinton and Isaacson explained.

Child Poverty in the Eighth District

The impact of child poverty and income volatility in the St. Louis Fed’s District has historically been pronounced, according to the authors.

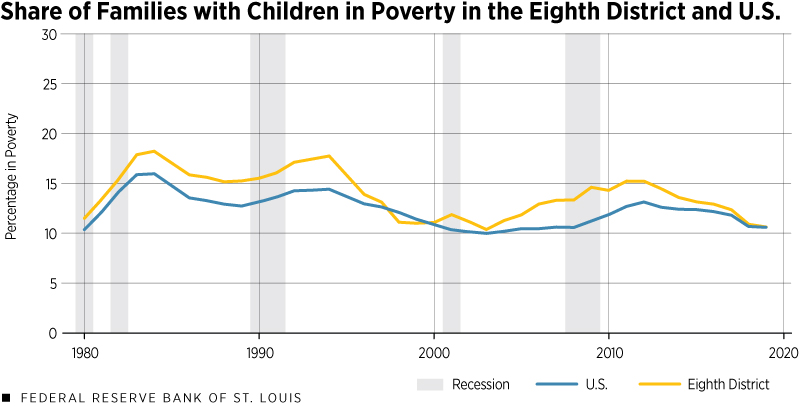

“Since 1980, the share of families with children who are below the poverty threshold has generally been higher in the Eighth District than in the country at large (excluding a brief period in the late 1990s), they wrote. “Further, child poverty rates are cyclical and child poverty in the Eighth District generally increases more during recessions.”

The figure below shows the share of families with children under the poverty threshold for their family size over time, with periods of recession shaded in gray. (The data end before the COVID-19 pandemic began.)

SOURCES: Annual Social and Economic Supplement of the Current Population Survey, Census Bureau and authors’ calculations.

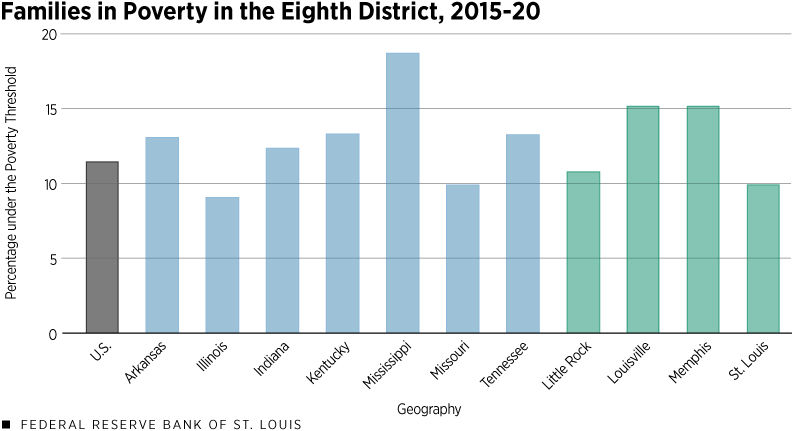

Rubinton and Isaacson then examined the individual states and large metro areas within the Eighth District. The second figure displays the average share of families with children living below the poverty line over the past five years. The dark gray bar represents the average for the entire country, including the Eighth District. The states of Illinois and Missouri and the metro areas of St. Louis and Little Rock, Ark., have child poverty rates below the national average. Mississippi has the highest rate of child poverty in the figure, followed by metro areas Louisville, Ky., and Memphis, Tenn.

SOURCES: Annual Social and Economic Supplement of the Current Population Survey, Census Bureau and authors’ calculations.

The CTC and Income Volatility

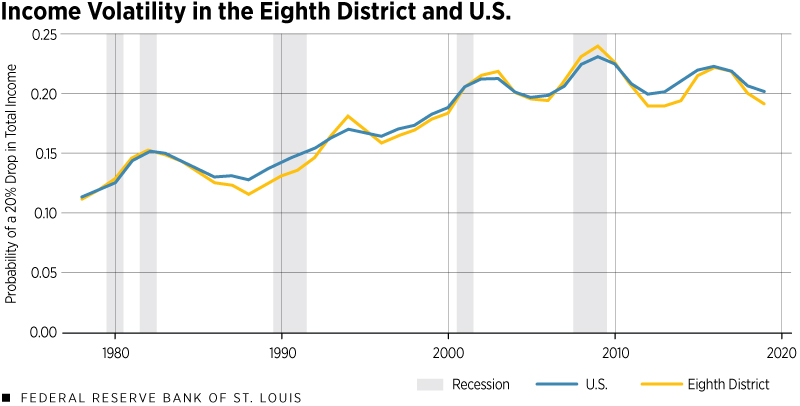

Besides reducing overall levels of poverty, another goal of the American Rescue Plan is to help lower income volatility for families with children. This volatility arises from multiple sources, including irregular working hours, varying wages and changes in employment, Rubinton and Isaacson noted.

To gauge income volatility, the authors calculated the probability of a 20% or greater drop in total family income during a year. The third figure shows the three-year moving average of the probability of a big drop in total family income inside and outside the Eighth District.

While the overall level of income in the Eighth District is lower than outside it, income volatility varies little between the District and the U.S. In periods of economic contraction, however, income volatility tends to increase more in the Eighth District, the authors observed.

SOURCES: Annual Social and Economic Supplement of the Current Population Survey, Census Bureau and authors’ calculations.

Conclusion

Rubinton and Isaacson noted that the boost in the CTC and its payments distribution will lift children out of poverty and help eligible families to smooth their incomes during the year. Given that the share of families with children living in poverty is higher in the Eighth District than in the rest of the country, the enhanced CTC may have a bigger impact in the District, they added.

“While income volatility is roughly the same in the two areas (the U.S. and the Eighth District), in recessions like that caused by the COVID-19 pandemic, the Eighth District struggles more with volatility and poverty,” they concluded. “Thus, the CTC changes will be helpful to District families, even as the economy recovers.”

Notes

1 Headquartered in St. Louis, the Eighth District includes the entire state of Arkansas, as well as parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Because of data limitations, the data used here are for Eighth District states as a whole, with the understanding that parts of these states, such as in Illinois, are outside the District.

Citation

ldquoThe Child Tax Credit and Child Poverty in the Eighth District,rdquo St. Louis Fed On the Economy, Oct. 25, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions