Holiday Shopping: Should You Expect to See Inflation?

Thanksgiving is approaching; the holiday season will soon begin. Analysts expect holiday spending to be particularly strong this year,For instance, the National Retail Federation expects record-breaking retail sales—8.5% to 10.5% greater than 2020, the previous high. despite pandemic-related concerns—particularly inflation, a recent topic of anxious interest. Prices were 6.2% higher this October than the year before, according to the consumer price index (CPI)—the largest increase in decades. See this FRED chart. With this in mind, we thought it worth asking: How have prices of holiday gifts changed historically, and how have these prices changed going into the 2021 season?

Historical Price Trends

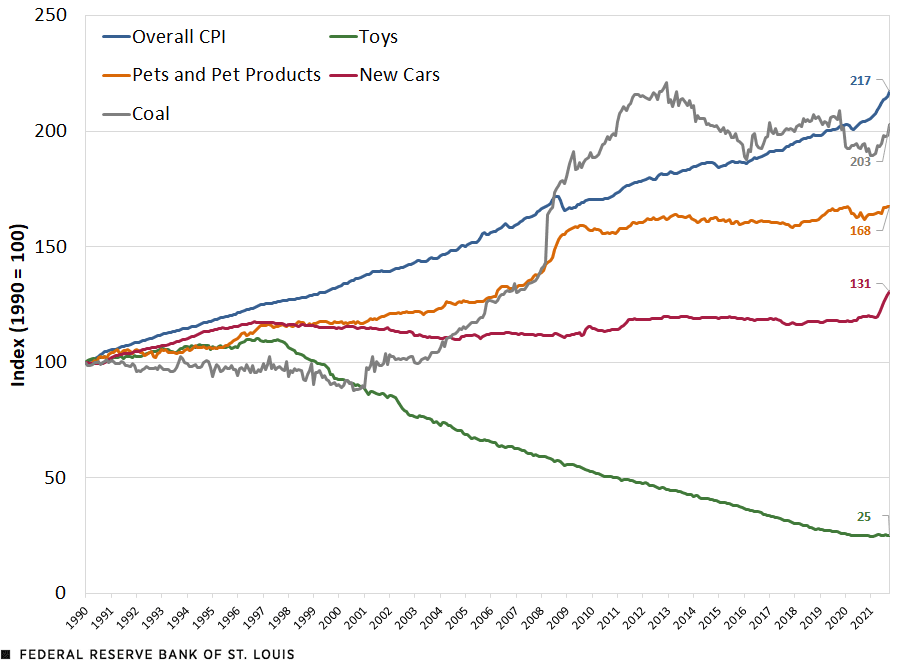

The Bureau of Labor Statistics (BLS) publishes more than just an aggregate CPI—it publishes price indices for hundreds of goods and services. The figure below shows four such goods, chosen for being quintessential holiday gifts: toys, pets, new cars and, of course, coal.The authors admit to having never purchased or received any pets, cars or coal for the holidays, and assume their experiences are fairly normal in this regard. But it is hard to think about “holiday gifts” without envisioning puppies emerging from presents, new cars tied up with bows or naughty children receiving their just desserts.

Price Indexes for Selected Holiday Gifts

NOTES: Indexes are seasonally adjusted. The BLS does not calculate coal prices for the CPI; we instead report the “producer price index” (PPI), which measures the average prices received by domestic manufacturers for their output.

SOURCES: Bureau of Labor Statistics and authors’ calculations.

All prices in the figure are indexed to a value of 100 in 1990, which makes interpretation straightforward. If someone spent $100 on a pet and some pet products in 1990, buying the same kind of pet and products should cost $168 today—whereas $100 worth of coal in 1990 would now cost $203. The figure immediately reveals one interesting fact about our selected gifts: Since 1990, their prices have grown more slowly than overall prices. In relative terms, the holidays (or, at least, these specific components of the holidays) have become more affordable in the last three decades!

Toys, Pets, Cars and Coal

Toy prices have even declined since the mid-1990s—likely driven by globalization, since domestic manufacturers’ prices for “toys, games, and children’s vehicles” increased over the same period. Prices in the last two years have remained stable, however, perhaps reflecting global supply chain issues.

Pet prices, meanwhile, have hewn more closely to overall CPI and show no recent change in trends, with animal adoption and care apparently less affected by supply chain issues or other idiosyncrasies.In fact, pet prices declined slightly in 2020, despite an early pandemic surge in demand.

New car prices, on the other hand, have spiked noticeably this year after remaining flat for decades—likely driven by the semiconductor shortage, which has left nearly finished vehicles sitting idle in parking lots, awaiting their final chips. For example, see this Vox article.

Coal prices show a similar uptick, coinciding with a number of supply chain, weather and demand factors.For example, see this Wall Street Journal article on the subject. Notably, our measure of coal prices does not show record highs, whereas other measures—like the European spot prices used in the linked article—do. The qualitative story remains similar in either case. This increase stands in contrast to the last decade or so, when prices trended downward as natural gas and renewable energy slowly chipped away at demand for coal after previously strong coal price increases in the 2000s.For example, see this Wall Street Journal article.

| Average (1990-2019) |

2019 | 2020 | 2021 (Annualized) |

|

|---|---|---|---|---|

| Overall CPI | 2.3% | 2.3% | 1.3% | 7.0% |

| Toys | -4.5% | -7.3% | -3.8% | 0.2% |

| Pets & Pet Products | 1.7% | 3.1% | -1.8% | 2.7% |

| New Cars | 0.5% | 0.1% | 2.1% | 10.6% |

| Coal | 2.7% | -2.2% | -4.7% | 6.7% |

| Men's Clothes | -0.1% | -2.1% | -3.5% | 4.3% |

| Women's Clothes | -0.6% | -2.2% | -6.0% | 1.2% |

| Airline Travel | 1.9% | 1.6% | -18.3% | -6.8% |

| Other Intercity Travel | 0.2% | -1.6% | 2.6% | -0.9% |

| Milk | 1.8% | 5.2% | 6.0% | 2.4% |

| Cookies | 2.3% | -1.3% | 4.3% | 1.0% |

| Sugar & Sweets | 1.9% | 2.6% | 4.6% | 2.4% |

| SOURCES: Bureau of Labor Statistics and authors’ calculations. | ||||

| NOTES: 2021 values are annualized year-to-date rates; that is, we show how much 2021 inflation will have increased year-over-year if the year’s inflation rate so far continues through December. We rely on seasonally adjusted series, so our extrapolations aren’t affected by normal seasonal price changes. | ||||

The table above summarizes prices changes for our stereotypical “gifts,” along with other holiday-related items. Prices have clearly jumped in 2021, especially for some categories. If 2021 inflation remains constant through December, new cars will cost 10.6% more than they did last year. Airline prices, meanwhile, are on track to decline 6.8%, depressed by low travel demand and widespread COVID-19 restrictions.

Overall, though, it is clear the holidays will be more expensive than we might have expected two years ago, even if most gift prices are growing more slowly than general prices. It is also worth emphasizing that higher prices for essential goods and services—such as food, gasoline, or rents—will likely erode households’ ability to go holiday shopping. At least the price disparity between toys and coal has continued to grow—good news, at least, for the naughty kids.

Notes and References

- For instance, the National Retail Federation expects record-breaking retail sales—8.5% to 10.5% greater than 2020, the previous high.

- See this FRED chart.

- The authors admit to having never purchased or received any pets, cars or coal for the holidays, and assume their experiences are fairly normal in this regard. But it is hard to think about “holiday gifts” without envisioning puppies emerging from presents, new cars tied up with bows or naughty children receiving their just desserts.

- In fact, pet prices declined slightly in 2020, despite an early pandemic surge in demand.

- For example, see this Vox article.

- For example, see this Wall Street Journal article on the subject. Notably, our measure of coal prices does not show record highs, whereas other measures—like the European spot prices used in the linked article—do. The qualitative story remains similar in either case.

- For example, see this Wall Street Journal article.

Citation

Charles S. Gascon and Devin Werner, ldquoHoliday Shopping: Should You Expect to See Inflation?,rdquo St. Louis Fed On the Economy, Nov. 22, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions