The Pandemic’s Impact on Municipal Bonds

A delayed tax-filing deadline, increased state and local government spending in response to the COVID-19 and a general lack of liquidity contributed to the distress in the municipal bond market during the early months of the pandemic, according to a Regional Economist article.

Federal Reserve Bank of St. Louis assistant vice president and economist Juan M. Sánchez and Research Associate Olivia Wilkinson compared all municipal bonds issued in 2019 with a group of 57,401 municipal bonds, or muni bonds, that were issued or planned to be issued by June 9, 2020. These 2020 bonds had a value of slightly more than $200 billion; they were intended for general purpose/public improvements (the largest category, with more than 25% of bonds issued), education, mass transit, housing, health care and several other categories.

COVID-19 and Muni Bond Market

Yield to maturity, or yield, is the return a bond buyer expects to receive if a bond is held until it matures. The authors analyzed muni bond yields using S&P indexes of municipal bonds.

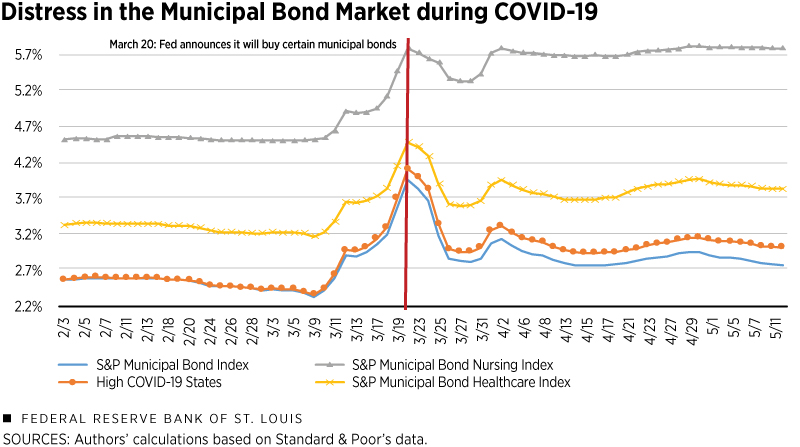

The figure below shows how the muni bond market was affected during the early months of the pandemic.

The performance of the entire municipal bond market is indicated by the blue line above. Beginning on March 9, its yield increased sharply. Such an increase indicates these bonds became less desirable, as the price at which investors were willing to buy them decreased.

The authors cited several possible reasons for the rise:

- A Federal Reserve Bank of New York report noted that the tax-filing deadline was moved from April 15 to July 15, affecting states and cities that rely on income taxes for revenue.

- Increased spending by state and local governments on pandemic-related health services and unemployment benefits, which further burdened their budgets.

- An analysis by the Federal Reserve Bank of Kansas City found that the initial spike in muni yields was probably due to a lack of liquidity in the market, rather than state-specific credit risk. The report cautioned that credit risk issues may cause concerns in the future.

The Fed’s Response

The market roiled further until March 20, when the Federal Reserve announced it would accept municipal bonds as collateral on loans to money market mutual funds. “The reaction was swift,” Sánchez and Wilkinson wrote. “In the following days, yields returned to levels that were only slightly above pre-pandemic values.”

In subsequent weeks, the Fed announced other actions that helped placate the market. They noted that on April 9, the Fed announced it would buy new bonds via its Municipal Liquidity Facility (MLF). Because initial constraints on eligibility excluded some areas in distress, the Fed later expanded the number of local governments that could tap the MLF.

Variations among Muni Bonds

In addition, the authors found that rates of COVID-19 infection had a small impact on yields. For example, the orange line in the figure above represents yields in states with high rates: Colorado, Connecticut, Georgia, Illinois, Louisiana, New Jersey and New York. Although the pattern was similar to the blue line, yields for these states were slightly higher after the first week of March.

The authors also found that the effect of the MLF varied across sectors. The S&P Municipal Bond Health Care Index, represented by the yellow line in the figure above, consists of bonds in the S&P Municipal Bond Index from the hospital, life care, nursing home and other health care sectors. The gray line tracks the S&P Municipal Bond Nursing Index. Both indexes were above the broader index even before the pandemic.

“However, the effect of the Fed announcement seems different,” Sánchez and Wilkinson wrote. “It is apparent in the case of the nursing sector’s index that a week after the announcement, the yields returned to their maximum value.”

The authors concluded that the Fed’s extension of credit to municipalities that met certain conditions returned most of the muni bond market to yields above, but similar to, that before the crisis. Some states and sectors—primarily in health care—continued to grapple with elevated levels of distress through May, they added.

Additional Resources

- Regional Economist: How COVID-19 Has Affected the Municipal Bond Market

- On the Economy: Corporate Bond Spreads and the Pandemic IV: Liquidity Buffers

- On the Economy: The COVID-19 Recession in Historical Perspective

Citation

ldquoThe Pandemic’s Impact on Municipal Bonds,rdquo St. Louis Fed On the Economy, Jan. 4, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions