Dollar-Denominated Public Debt in Asia and Latin America

In 2020, governments around the globe started debt-financed spending to battle COVID-19 and to keep economies afloat. Although fiscal responses to this pandemic varied dramatically among countries, together, they added $24 trillion to global debt according to the Institute of International Finance (IIF).

Debt issuance helps cover the gap between how much a government wants to spend and the revenue it expects to receive that year. When issuing new debt, the government may decide to issue it in a local currency or a foreign currency. Foreign currency borrowing can help some countries attract diverse funding sources, mitigate investor fears of local currency fluctuations and reduce financial frictions. For those reasons, many emerging market economies issue a portion of their debt in U.S. dollars.

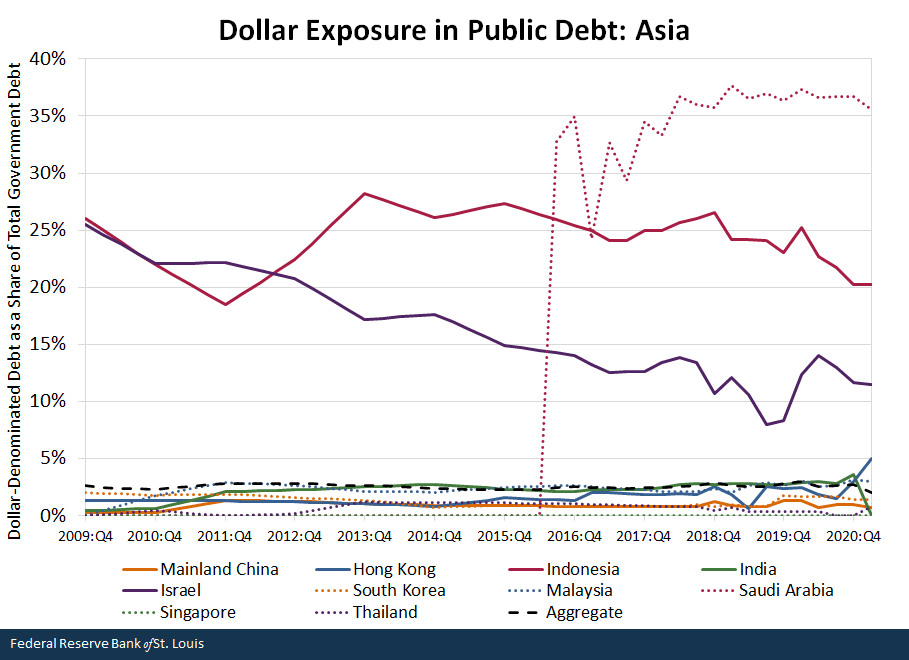

Dollar-Denominated Debt in Asia

The figure below shows dollar-denominated debt as a percentage of total government debt in select Asian economiesThe economies are mainland China, Hong Kong, Indonesia, India, Israel, Malaysia, Saudi Arabia, Singapore, South Korea and Thailand. over the past 11 years. Although only a small portion (less than 5%) of government debt is denominated in U.S. dollars for most of these economies, it is not the case for Israel, Indonesia and Saudi Arabia.Saudi Arabia entered the international bond markets for the first time in 2016. For these three countries, over 10% of their government debt is dollar denominated. The share of dollar-denominated debt has steadily declined over time in Israel and Indonesia, while it has increased modestly in Saudi Arabia. Hong Kong is one with a notably increasing share of dollar bonds.

NOTE: The aggregate is an average based on the combined government debt of the select countries.

SOURCES: Institute of International Finance and authors’ calculations.

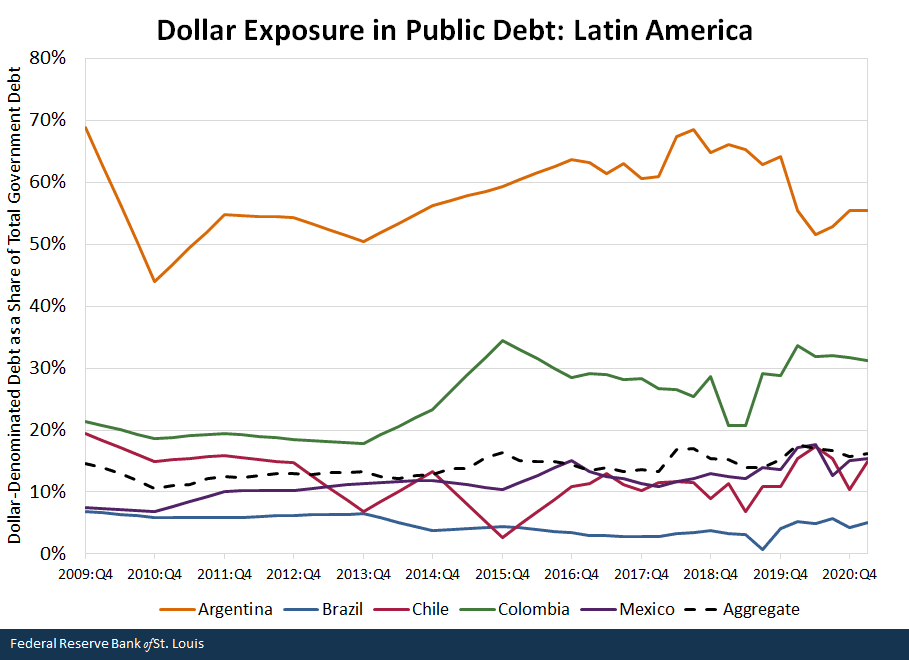

Dollar-Denominated Debt in Latin America

Compared with Asian countries, countries in Latin America have a much higher proportion of U.S. dollar-denominated debt. At the aggregate level, issued dollar-denominated debt makes up around 17% of total government debt in select Latin American economies,These economies are Argentina, Brazil, Chile, Colombia and Mexico. which far outstrips the 3% in select Asian economies. Moreover, for some countries, such as Colombia and Argentina, the share of dollar-denominated debt is even higher: Over 30% of government debt in Colombia and 55% of government debt in Argentina were issued in dollars.

NOTE: The aggregate is an average based on the combined government debt of the select countries.

SOURCES: Institute of International Finance and authors’ calculations.

Potential Exchange Rate Risks

Despite the advantages we previously mentioned, issuing foreign debt is a double-edged sword, as it also exposes issuers to exchange rate risks by making international debt payments more expensive when their local currencies depreciate. Because economic conditions in the U.S. have improved significantly since last year and there are many signs of inflationary pressures, the situation in some emerging economies could become worrisome.

If the Federal Open Market Committee, the Federal Reserve’s main monetary policymaking body, decides to raise interest rates at some future date, this could spark capital flight from emerging economies to the U.S. and thus depreciate their currencies. Under this scenario, the currency composition of debt in countries like Argentina, Colombia and Saudi Arabia might put them at a disadvantage and further slow down their economic recovery.

Notes and References

- The economies are mainland China, Hong Kong, Indonesia, India, Israel, Malaysia, Saudi Arabia, Singapore, South Korea and Thailand.

- Saudi Arabia entered the international bond markets for the first time in 2016.

- These economies are Argentina, Brazil, Chile, Colombia and Mexico.

Additional Resources

- On the Economy: Marshall Plan May Not Have Been Key to Europe’s Reconstruction

- On the Economy: The COVID-19 Recession in Historical Perspective

Citation

Paulina Restrepo-Echavarría and Praew Grittayaphong, ldquoDollar-Denominated Public Debt in Asia and Latin America,rdquo St. Louis Fed On the Economy, Aug. 3, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions