Staff Pick: Becoming Delinquent and Going out of Business

This blog will periodically rerun posts that were of particular interest. The following is an April 2019 post by Fernando Leibovici and Matthew Famiglietti covering the role credit played in firms going out of business during the Great Recession.

The Great Recession has brought to the forefront the role of financial factors in business cycle fluctuations:

- For households, access to finance affects the extent to which they are able to insure themselves against negative income shocks.

- For firms, access to external sources of finance allows them to grow and achieve their desired scale of operation, while ensuring they are able to pay their workers and suppliers before revenues accrue.

The counterpart to the importance of finance for the economy’s operations is that, when access to finance dries up, households and firms can both be severely affected.

In this blog post, we investigate the role of credit on the extent to which firms have gone out of business during the Great Recession. In particular, we used a novel dataset that contains credit ratings of all rated private firms in the U.S. economy in order to study the role of financial factors in accounting for firm-level exit rates across states during the Great Recession. This article extends the industry-level analysis in a forthcoming Economic Synopses essay.

We used the National Establishment Time Series (NETS) database collected by Dun & Bradstreet (D&B), which provides detailed data on all U.S. firms, including state and commercial credit ratings per D&B’s PAYDEX score. PAYDEX scores reflect the timeliness of firms’ credit payments. Credit delinquency of greater than 90 days implies severe credit problems for firms. We compared state-level delinquency rates with state-level exit rates between 2007 and 2011; we measured the latter as the share of firms in a state that existed in 2007 but ceased to exist by 2011. We studied a 5% random sample of establishments associated with firms that, on average, have more than five employees throughout their lifetime. While the database is organized at the establishment level, we examined firms as a whole by aggregating to the headquarters level, weighting establishments based on their number of employees.

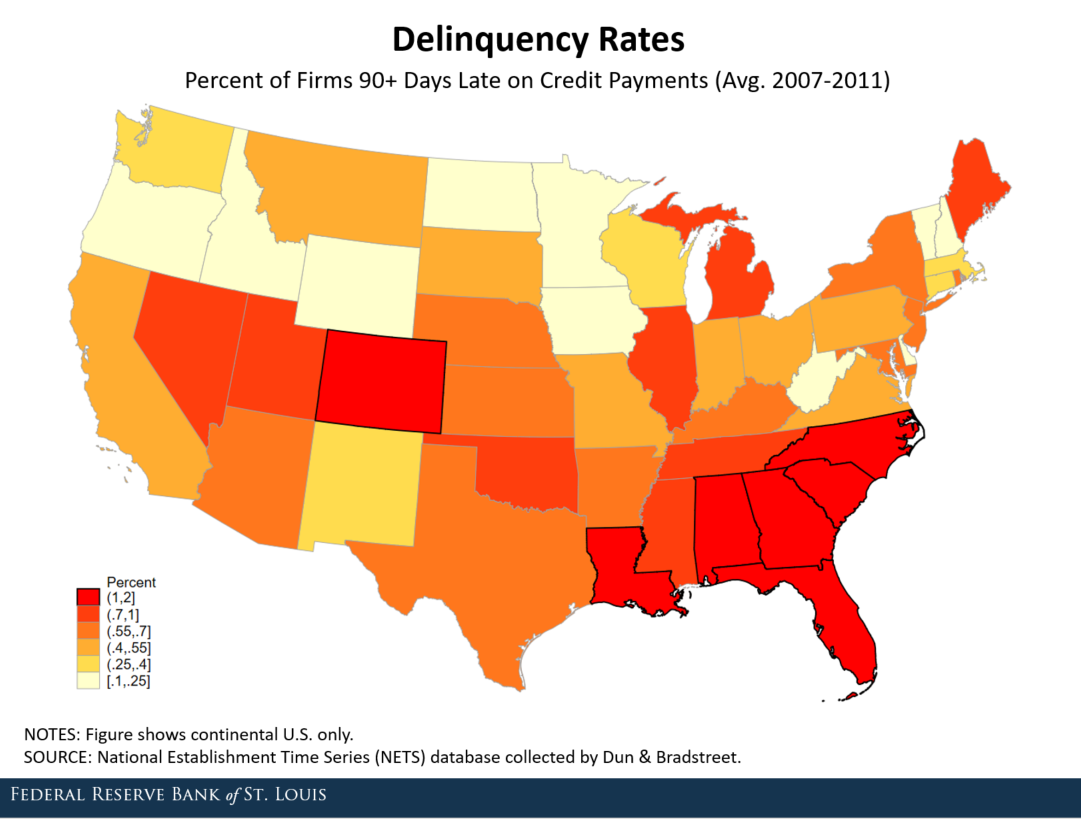

Credit Delinquency Rate by State

The map below plots the credit delinquency rate by state. The reddest states are those that had the highest delinquency rates over the 2007-11 period.

States in the Southeast through the Southwest, known as the Sun Belt, had the highest shares of distressed firms. Given that the Great Recession had large, adverse impacts on this region of the United States along multiple dimensions, it’s notable that this also is captured by firm-level credit delinquency.

The map also shows that the share of firms in each state that were delinquent for more than 90 days over the 2007-11 period was generally low. Even the most delinquent states did not exceed a 2 percent rate, implying that the vast majority of firms were not very delinquent on their credit payments. Nevertheless, we interpret this rate as informative about the overall financial health of firms across states.

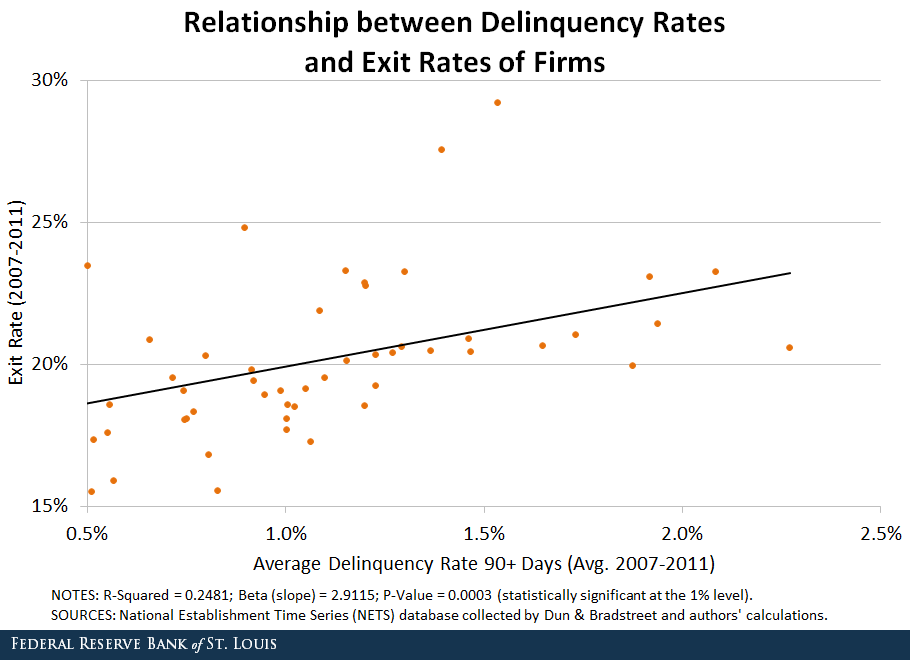

Relationship between Delinquency Rates and Exit Rates

The scatter plot shows the relationship between state-level delinquency rates and exit rates of firms during the Great Recession and early recovery from 2007-11. The share of severely delinquent firms is strongly correlated with the state’s exit rate.

States with many distressed firms experienced a higher exit rate. The coefficient of a best-fit line through the data is 2.91, implying that a 1 percentage-point increase in the delinquency rate is associated, on average, with a 2.91 percentage-point increase in the exit rate. These findings are thus consistent with the relationship between delinquency and firm-level exits across U.S. industries, which we documented in a previous article.

These findings show that firm-level exit decisions are correlated with their credit standing and the extent to which they are able to pay on time. They point to the potentially key role that financial markets might play in the health and survival of firms, particularly during crises.

Notes and References

Gertler, Mark; and Gilchrist, Simon. “What Happened: Financial Factors in the Great Recession.” Journal of Economic Perspectives, Summer 2018, Vol. 32, No. 3, pp. 3-30.

1 This article extends the industry-level analysis in a forthcoming Economic Synopses essay.

2 We studied a 5% random sample of establishments associated with firms that, on average, have more than five employees throughout their lifetime. While the database is organized at the establishment level, we examined firms as a whole by aggregating to the headquarters level, weighting establishments based on their number of employees.

Additional Resources

- Economic Synopses: How Open to Trade Is the U.S. Economy?

- On the Economy: Why Are Business Cycles in Emerging Economies More Volatile?

- On the Economy: How Do People Handle Financial Emergencies?

Citation

ldquoStaff Pick: Becoming Delinquent and Going out of Business,rdquo St. Louis Fed On the Economy, March 3, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions