Tail Risk and Its Effect on the Economy

Could the mere fact that the Great Recession happened be weighing on the economy? A recent Economic Synopses series examined tail risk—or the risk that the economy will suffer extreme negative shocks—and how it can impact the economy.

In the first article of the series, St. Louis Fed Economist Julian Kozlowski explained the importance of perception. “For example, if you haven’t seen many bank runs, you think bank runs are very rare,” he wrote. “However, when you see a bank run, you update your estimates and determine that bank runs are not as rare as you previously thought.”

Did the perceived probability of a financial crisis grow after the Great Recession? Kozlowski noted that before the recession, it was thought highly unlikely—if the idea was not outright dismissed—that such an extreme downturn would ever occur. Now that it has, people may believe the odds of it happening again are higher than they actually are.

Seeing the financial crisis “was like seeing a seven come up on what you thought was a six-sided die,” he wrote.

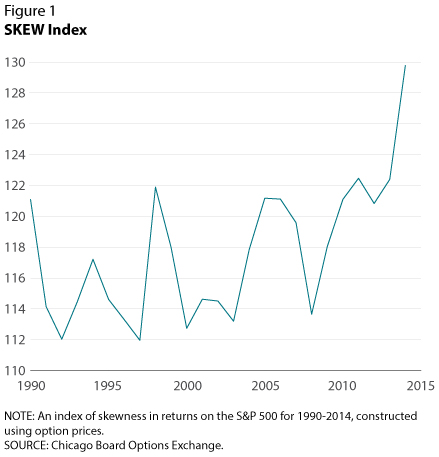

Chicago Board Options Exchange SKEW Index

One way of measuring the perception of the likelihood of another extreme downturn is via the Chicago Board Options Exchange SKEW Index. The index uses option prices to measure tail risk in the S&P 500. The larger the value, the higher implied tail risk. As seen in the figure below, the index has clearly risen since the Great Recession.

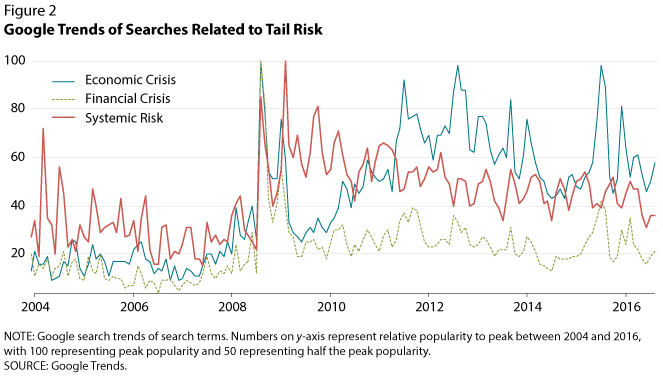

Google Trends

Another simple indicator is how often terms related to tail risk are searched in Google. Kozlowski examined the search trends for three such terms:

- Economic crisis

- Financial crisis

- Systemic risk

As seen in the figure below, searches for these terms rose considerably during the financial crisis and have remained higher than pre-crisis levels.

The next post in this series will examine the costs of the increase in tail risk.

Additional Resources

- Economic Synopses: Tail Risk: Part 1, The Persistent Effects of the Great Recession

- On the Economy: Explaining Price Markups During the Great Recession

Citation

ldquoTail Risk and Its Effect on the Economy,rdquo St. Louis Fed On the Economy, Feb. 24, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions