Industry Concentration May Help Explain Divergent Business Cycles

Research shows that different regions have business cycles that don’t always follow the national trend. U.S. states experience significantly different growth rates, and sometimes they may not even be in the same phase of the business cycle at the same time. An article in the Regional Economist looked at how the varying mix of industries may be influencing these differences.

Charles S. Gascon, regional economist and senior coordinator in the St. Louis Fed’s Research Division, and Research Associate Jacob Haas noted that some states, such as Maryland in the mid-1990s, fell into a recession unconnected with a national recession. Other states were in recession months before the national economy or remained in a recession long after the country entered an expansionary phase, they observed.

State Business Cycles and Industry Mix

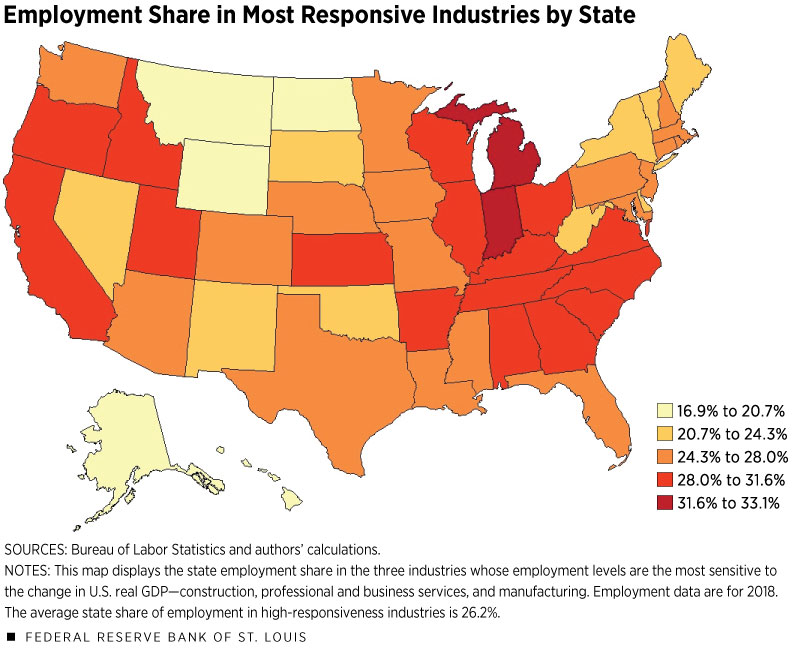

States whose employment levels fluctuate more when overall changes in gross domestic product (GDP) will appear more sensitive or responsive to the national cycle, the authors wrote. Some states in the western and southeastern parts of the country have higher rates of sensitivity to the national business cycle, while many states in the Great Plains seem to be less sensitive, Gascon and Haas found.

What could be affecting the differences in regional business cycles? The authors posited that this may be due to the types of jobs available.

Certain industries are more sensitive to economic fluctuations, they noted. Because industries often cluster by geography, there may be disparities in employment growth between areas with different industry characteristics.

“For example, states with higher employment rates in the energy industry, like Texas, will react differently to oil price shocks than other states, which can result in these states being out of sync with the national economy,” Gascon and Haas wrote.

Since 1990, U.S. employment in construction, professional and business services, and manufacturing tends to be the most responsive to national expansions and recessions, the authors found. Many states in the Southeast and the eastern part of the Midwest have relatively high employment shares of sensitive industries. The figure below shows states’ shares of employment in these three sensitive industries.

Conversely, employment in government, education and health care, and utilities tends to be the least responsive. Such lower sensitivity is most notable in the Northeast, Gascon and Haas found, adding that this may subdue these states’ responses to fluctuations in the national economy.

“Taken together, the employment shares of high-sensitivity and low-sensitivity industries explain about half of the variation in state responsiveness to changes in U.S. real GDP, indicating that industry mix can play a significant part in how states move with the national business cycle,” they wrote.

The authors cautioned that considering the industry mix is only one element of understanding the nation’s diversity and economic composition. They noted that their analysis doesn’t account for other economic factors—such as education levels and housing supply—that can affect local business cycles or their synchronization with the national cycle.

Additional Resources

- Regional Economist: The Role of Industry Mix in Regional Business Cycles

- On the Economy: The Rise of Robots in the Workplace

- On the Economy: Reading the Labor Market in Real Time

Citation

ldquoIndustry Concentration May Help Explain Divergent Business Cycles,rdquo St. Louis Fed On the Economy, Aug. 13, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions