Millennial Finances: How Do They Stack Up against Gen X at the Same Age?

Research Officer and Economist YiLi Chien and former Senior Research Associate Paul Morris compared millennial household finances in 2016 with those of Gen X in 2001. They found that households headed by millennials held fewer financial and nonfinancial assets and were slightly more indebted on average.

Asset Holdings

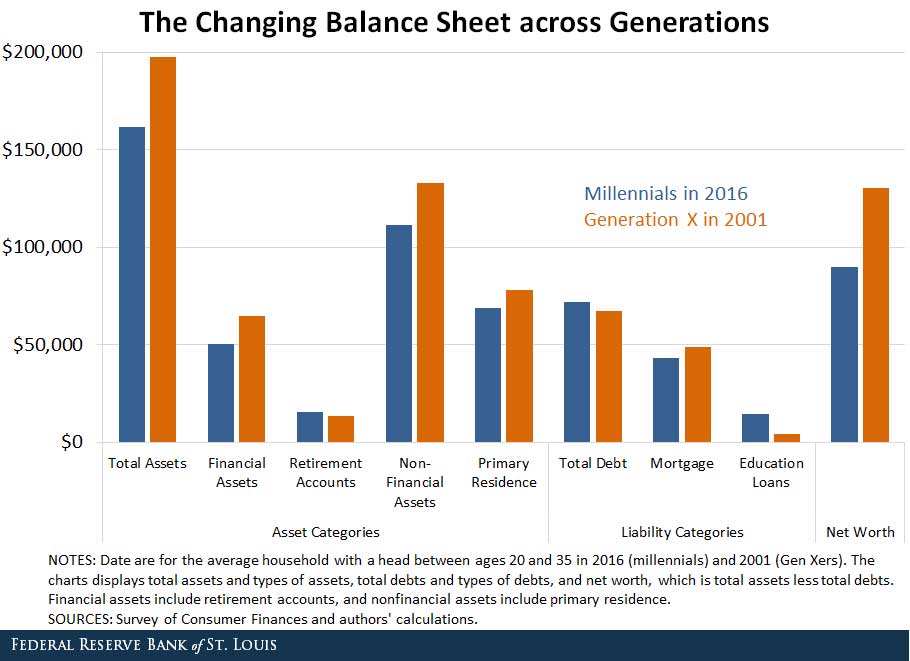

Chien and Morris found that millennials held an average of $162,000 in assets versus Gen Xers holding an average of $198,000, as seen in the figure below. The dollar numbers for both generations have been inflation-adjusted to 2016 dollars and therefore can be compared directly. In this article, dollar amounts of $20,000 and greater have been rounded to the nearest $1,000; those lower than $20,000 have been rounded to the nearest $100.

Regarding financial assets, millennials held about $15,000 less than Gen Xers ($50,000 versus $65,000). However, millennials did hold slightly larger retirement account balances, at $15,500 versus Gen X’s $13,600.

Regarding nonfinancial assets, some of the difference was due to housing. Millennials held an average of $69,000 in their primary residence, while Gen Xers held an average of $78,000.

Debt Holdings

Millennials held slightly more debt than Gen Xers, at $72,000 versus $67,000. “While the average levels of debt were similar across the two generations, the composition was markedly different,” the authors noted.

Student loans were a significant source of the difference between the two groups. Millennials had an average of $14,700, while Gen Xers had an average of $4,200. Working in millennials’ favor in terms of debt were smaller mortgages ($43,000 versus $49,000) and credit card debt ($1,800 versus $2,700).

“In short, we see that millennials’ average asset position was lower, while they held slightly more debt, which led to an average net worth of $90,000 for millennials and $130,000 for Gen X,” Chien and Morris wrote.

Reasons behind the Differences

The fact that millennials had more debt and fewer assets, on average, than Gen Xers did not necessarily reflect millennials’ spending and saving habits, the authors noted. Other factors such as education, living arrangements and marital status may also be contributing to the differences.

Regarding education, the authors noted that the labor force participation rate for 20- to 24-year-olds fell from 77.1 percent in 2001 to 70.5 percent in 2016. At the same time, the share of those ages 25 to 29 with four years of college or more rose from 28.4 percent to 36.1 percent.

Chien and Morris also explained that a higher percentage of young adults are living with their parents, and the median age for first marriage has been increasing for both men and women.

“We observe that millennials have been going to school longer and delaying major life events,” Chien and Morris wrote. “Thus, it makes sense that they hold lower levels of assets. They have had less time in the labor force, and a smaller share of them have moved out on their own, which contributes to the lower levels of residential assets. However, they have shown a higher propensity to save for retirement and to avoid credit card debt.”

Notes and References

1 The dollar numbers for both generations have been inflation-adjusted to 2016 dollars and therefore can be compared directly. In this article, dollar amounts of $20,000 and greater have been rounded to the nearest $1,000; those lower than $20,000 have been rounded to the nearest $100.

Additional Resources

- Regional Economist: Accounting for Age: The Financial Health of Millennials

- On the Economy: Why Were Young Families Hit So Hard by the Recession?

- On the Economy: The College Boost: Why Are Wealth Returns from a Degree Falling?

Citation

ldquoMillennial Finances: How Do They Stack Up against Gen X at the Same Age?,rdquo St. Louis Fed On the Economy, Sept. 27, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions