Who Has Equity in Their Homes? Who Doesn't?

Homes are an important source of wealth for U.S. families. According to the 2016 Survey of Consumer Finances (SCF)—a database of household wealth in the U.S.—the median household had 68 percent of its wealth in its primary residence. In this post, we explore the substantial heterogeneity among households in how much of their wealth they hold in the form of residences.

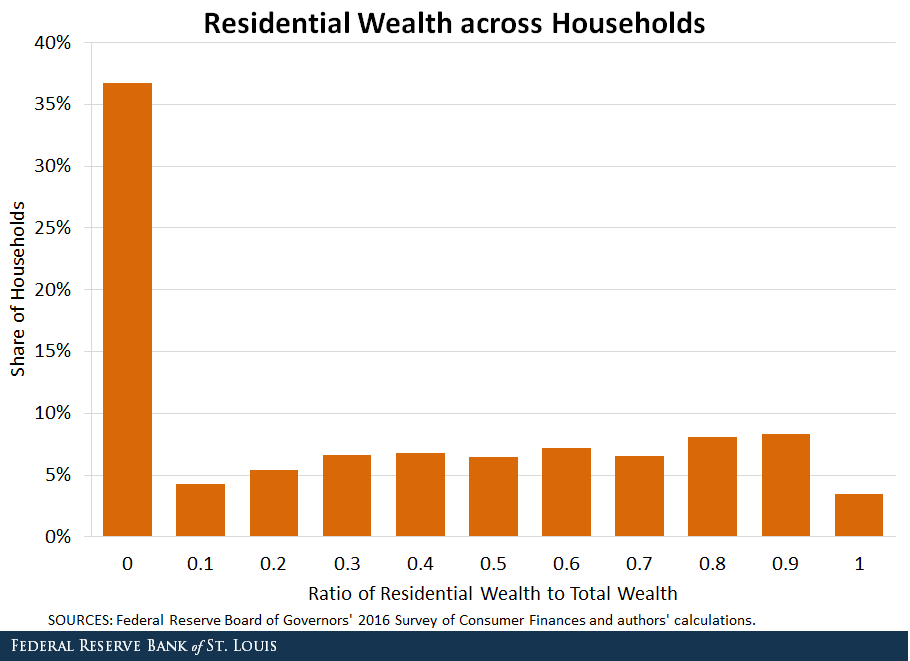

For each household in the SCF, we calculated the residential share of the household’s total wealth. The figure below reveals that more than 35 percent of families reported having zero residential wealth.

For families without any residential wealth, liquidity holdings (checking, savings and money market accounts) and vehicles (such as cars, RVs and boats) accounted for 25 percent and 43 percent of total wealth, respectively.

For families with residential wealth, liquidity holdings and vehicle holdings comprised much smaller shares: 5 percent and 8 percent, respectively. Primary residences accounted for more than half of total wealth for this group.

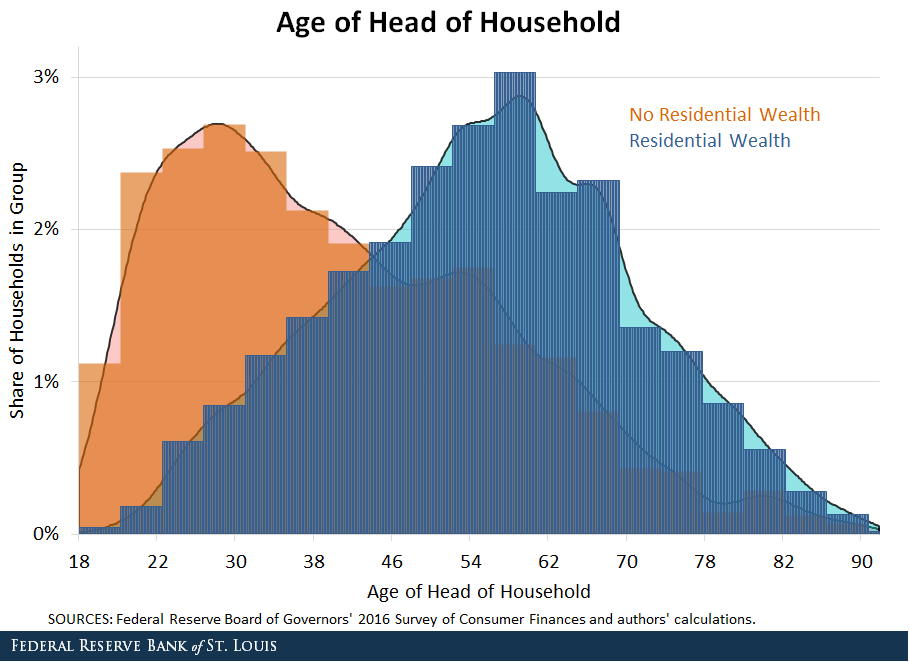

Age

One major difference between those with and without residential wealth was age. The figure below shows that households with residential wealth in 2016 tended to be headed by older individuals. The median ages of the two groups were 58 years and 41 years, respectively.

Income Levels

Levels of household income also differed dramatically between the two groups. Median income was approximately $71,000 in 2016 for families with residential wealth compared to $31,000 for families without such wealth, a ratio of more than 2 to 1.

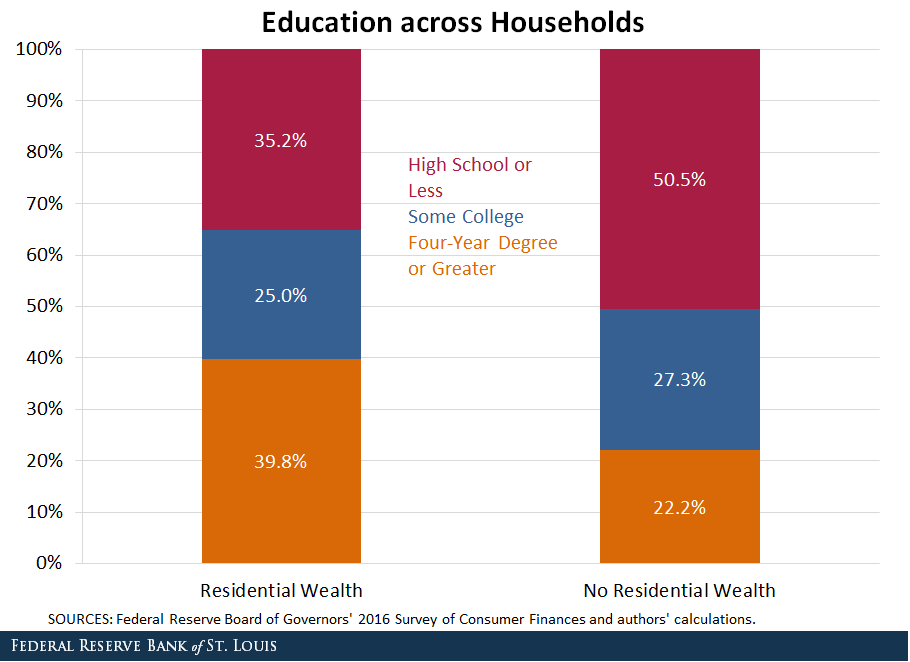

Education

Families with residential wealth displayed higher levels of education as well, as seen in the figure below.

In 2016, 40 percent of families with residential wealth were headed by individuals with bachelor’s degrees or greater, in contrast to 22 percent for households without any such wealth.

Race/Ethnicity

Finally, households headed by black or Hispanic persons made up disproportionately large fractions of families without residential wealth.

In 2016, black families accounted for 22 percent of households without residential wealth and 11 percent of those with such wealth. The corresponding shares for Hispanic households were 17 percent and 8 percent, respectively.

Citation

B. Ravikumar and Evan Karson, ldquoWho Has Equity in Their Homes? Who Doesn't?,rdquo St. Louis Fed On the Economy, Oct. 4, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions