China’s Foreign Reserves Are Declining. Why, and What Effects Could This Have?

China has been a net lender to the rest of the world since 1994. However, its current account surplus started to decline 10 years ago. Why is this occurring, and what effects might it have on U.S. assets?

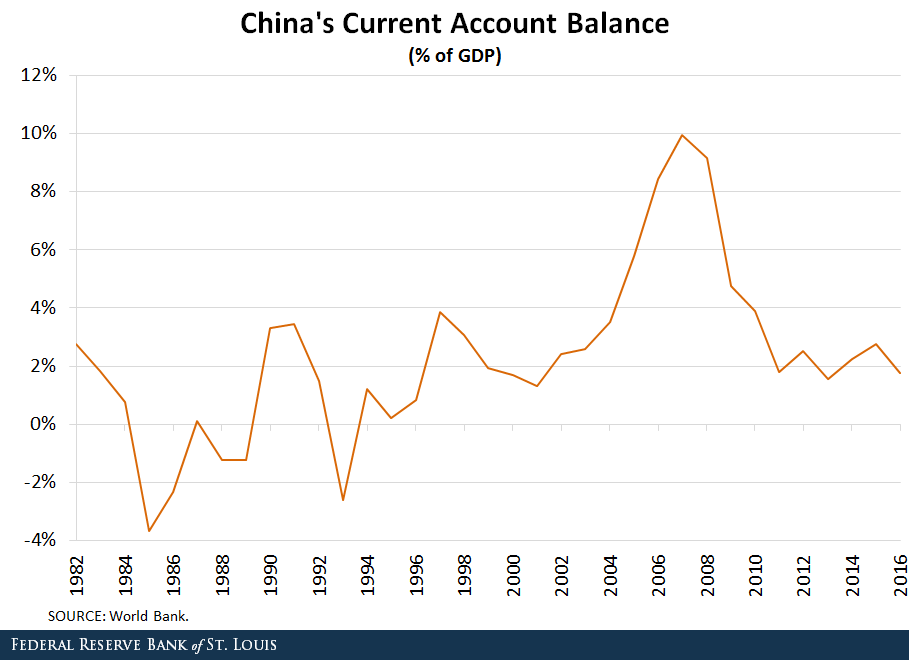

A current account surplus implies that, in a given year, the value of goods and services produced exceeds the expenditures made by consumers, investors and the government in China. The figure below shows China’s current account balance for the past few decades.

The difference between production and expenditures in a country accounts for goods and services that are exported to the rest of the world.

Indeed, China’s large current account has been mainly driven by an increase in exports. China has been financing the excess spending of the rest of the world with its current account surplus. China has also experienced capital flowing into the country (i.e., a capital account surplus).

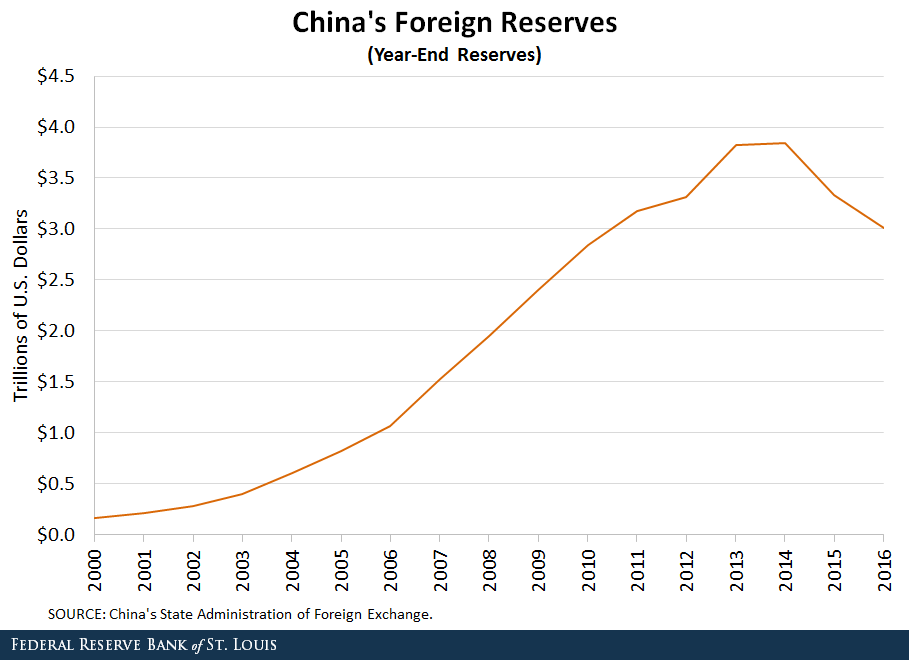

Because of these large current account and capital account surpluses, China has accumulated substantial amounts of foreign reserves. These are composed of cash and other assets denominated in currencies other than China's yuan.

According to the State Administration of Foreign Exchange in China, these reserves have increased substantially since 2000, reaching $3.8 trillion (in U.S. dollars) in 2014, as seen in the figure below.

The Chinese government’s decision to prevent the appreciation of the yuan has been mentioned as one of the factors explaining the large foreign exchange reserves.1

The Decline in the Current Account Surplus

However, the current account surplus in China started declining 10 years ago. The surplus went from a peak of 9.94 percent of GDP in 2007 to only 1.75 percent in 2016.

Even though this decline started in 2008, capital was not in a rush to leave the Chinese market due to the ongoing Great Recession in the U.S. and most advanced economies. Therefore, China’s central bank did not need to sell foreign assets to maintain the value of its currency and attract foreign investments.

However, as the financial market gradually stabilized and economic conditions improved, foreign investors slowly started to seek opportunities elsewhere. Especially after the Federal Reserve announced its plan to increase interest rates, the capital flight combined with a low current account surplus in China led to a plunge in the value of yuan, forcing China’s central bank to sell off foreign reserves to prevent its currency from depreciating too quickly.2

China’s Capital Account Surplus Decline and U.S. Treasuries

Though the exact composition of foreign reserves in China is confidential, it is thought that dollar-denominated assets—especially U.S. Treasury bills, agency bonds and corporate bonds—are its main component. Therefore, large movements of selling or buying can potentially cause the U.S. Treasury yield curve to fluctuate in unwanted directions or magnitudes.3

Notes and References

1 Taylor, Simon. “China’s balance of payments: current and capital accounts now pulling in different directions.” Behind Blue Eyes, Sept. 18, 2012.

2 “China’s Foreign Reserves Drop Most in 10 Months as Yuan Slumps.” Bloomberg News, Dec. 7, 2016. Lopez, Linette. “If This Keeps Up, Trump Won't Have to Do Anything to Punish China's Economy.” Business Insider, Dec. 7, 2016. Reuters. “China’s Foreign Reserves Just Plunged to the Lowest Since 2011.” Fortune, Nov. 7, 2016.

3 Neely, Christopher. “Chinese Foreign Exchange Reserves, Policy Choices and the U.S. Economy.” Federal Reserve Bank of St. Louis Working Paper 2017-001A, January 2017. Amadeo, Kimberly. “How Does China Influence the U.S. Dollar?” The Balance, March 8, 2017.

Additional Resources

- Working Paper: Chinese Foreign Exchange Reserves, Policy Choices and the U.S. Economy

- On the Economy: How Did China Build Up Its Reserves?

- On the Economy: Challenges in Measuring China’s Economic Growth

Citation

ldquoChina’s Foreign Reserves Are Declining. Why, and What Effects Could This Have?,rdquo St. Louis Fed On the Economy, Oct. 3, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions