How Election Surprises Affected Exchange Rates

There are times when elections go as predicted. However, at other times, the results come as a surprise. When election surprises occur, people and markets adjust their expectations, and some financial variables may move around quite a bit.

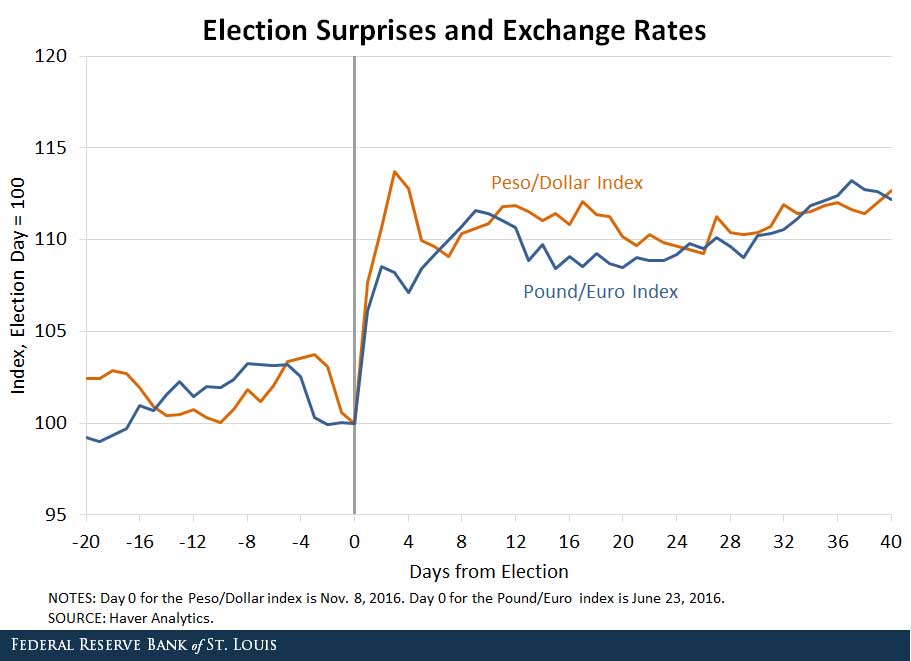

The following figure displays exchange rate data before and after two recent elections whose outcomes didn’t match forecasts or poll predictions:

- The British referendum vote (known as Brexit) on June 23 on whether to stay in the European Union, gauged by the British pound per euro exchange rate

- The recent U.S. presidential election on Nov. 8 gauged by the Mexican peso per dollar exchange rate

Brexit

In the case of Brexit, most polls and political experts predicted that the British would vote to remain in the European Union, which would imply a continuation of their trade agreements with continental Europe.

Trade is a big portion of the U.K.’s economy. Exports and imports make up around 30 percent of gross domestic product, and more than 40 percent of the U.K.’s trade is with the European Union. The Brexit brings substantial uncertainty about the future of the U.K.’s international trade with the eurozone and economy in general.

U.S. Presidential Election

For the U.S. presidential election, most polls predicted that Hillary Clinton would win the election. Her views and proposed policies on international trade and U.S. relations with Mexico were substantially different than the views of President Donald Trump.

The peso declined rapidly in value after the election, reflecting increased uncertainty about the future of trade between the U.S. and Mexico.

Depreciation of Currencies

In each case, the British pound and Mexican peso depreciated between 10 percent and 15 percent following the respective elections.

This depreciation may reflect a negative (or less positive) revision to individuals’ expectations about the future of the U.K.’s and Mexico’s international trade and their economies in general after the respective elections.

Additional Resources

- On the Economy: A Stronger Dollar and the Profitability of U.S. Firms

- On the Economy: The Election’s Effect on Expected Inflation

- On the Economy: The Rise and Fall of Nominal Interest Rates

Citation

ldquoHow Election Surprises Affected Exchange Rates,rdquo St. Louis Fed On the Economy, March 20, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions