Social Security Disability Rate Rose while Unemployment Declined

There's a strong positive relationship at the county level between the unemployment rate and the Social Security Disability Insurance (SSDI) rate, or the percentage of the working-age population receiving SSDI benefits. Yet, as a recent Economic Synopses essay points out, the national SSDI rate continued to rise as the unemployment rate decreased over the past several years.

“SSDI receipt is becoming more concentrated and is highest in places with the worst economic prospects,” Economist David Wiczer explained.

A Stronger Relationship

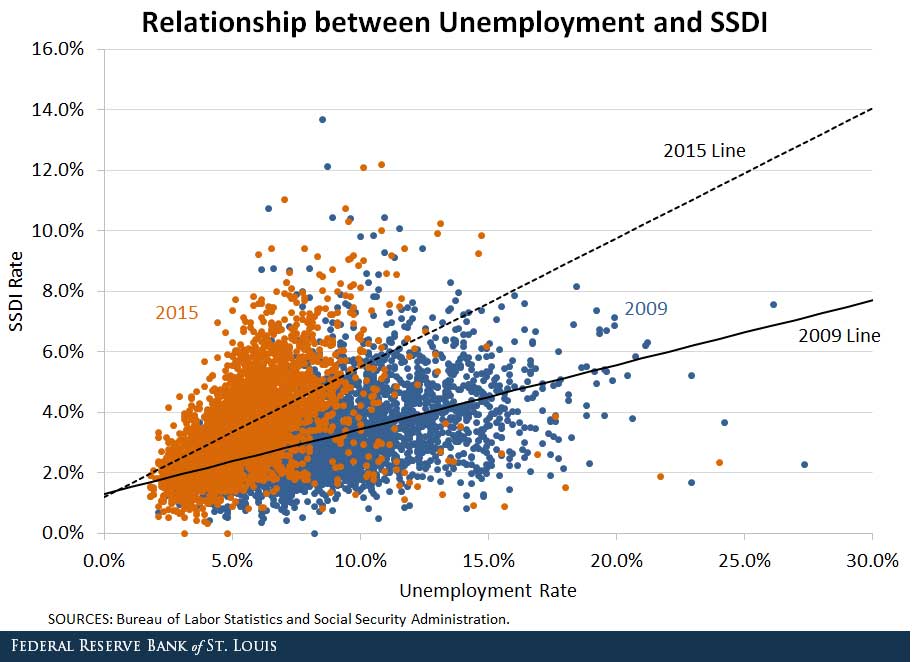

The figure below shows the strong, positive relationship between the two rates at the county level.

Interestingly, the relationship got stronger from 2009 to 2015, as can be seen by the regression lines. Wiczer pointed out that the unemployment rate did indeed fall in most counties as it dropped nationally. However, the association between unemployment and SSDI receipt changed.

“There were fewer counties with high unemployment rates in 2015, but those with high unemployment had even more SSDI recipients,” he wrote.

Change in SSDI Rate Density

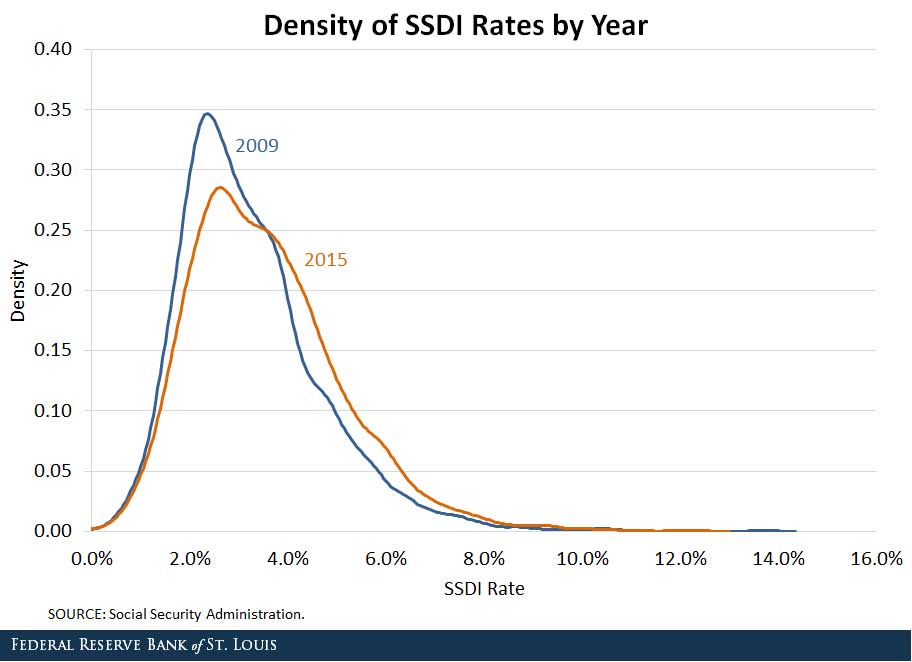

This shift in the distribution of SSDI rates can be seen in the figure below.

Wiczer noted that the peak shrunk from 2009 to 2015, meaning there were fewer counties with low SSDI levels. “Instead, that mass has shifted to the tails, and counties with very high rates of disability now have even higher rates,” he wrote.

Wiczer concluded that “the two figures suggest that SSDI is associated with economic hardship, but its rise is not a result of increased hardship on average. Instead, the counties that are doing poorly along one economic indicator—unemployment—now fare even worse along another—receipt of SSDI. It is not unreasonable that SSDI should respond to economic conditions: SSDI is actually designed with a set of job-related criteria, and these vocational considerations have been growing as a share of new benefit recipients.”

Additional Resources

- Economic Synopses: The Connection Between Social Security Disability Insurance and High Unemployment

- On the Economy: Why Do Social Security Disability Rates Differ Across Regions?

- On the Economy: The Growing Skill Divide in the U.S. Labor Market

Citation

ldquoSocial Security Disability Rate Rose while Unemployment Declined,rdquo St. Louis Fed On the Economy, June 13, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions