Does a Strong Dollar Slow the Growth Rate of GDP?

Over the past several months, a new episode of appreciation of the dollar began. The dollar spiked noticeably Nov. 9 and 10 (the two days following the U.S. presidential election) and again on Dec. 15 (the day after the Federal Reserve announced its most recent rate hike).

This appreciation has renewed concern of a slowdown in U.S. economic growth through the channel of international trade. The appreciation of the dollar implies that U.S. goods become more expensive abroad, and hence tends to reduce U.S. exports.

Meanwhile, a strong dollar makes foreign goods cheaper to U.S. consumers, which tends to increase imports. The forces of increasing imports and decreasing exports both deteriorate the trade balance and could slow down the growth rate of the U.S. economy. This article reviews the impact a stronger dollar had on gross domestic product (GDP) growth from 2014 to the beginning of 2016, the previous significant episode of appreciation.

Previous Dollar Strengthening Episode

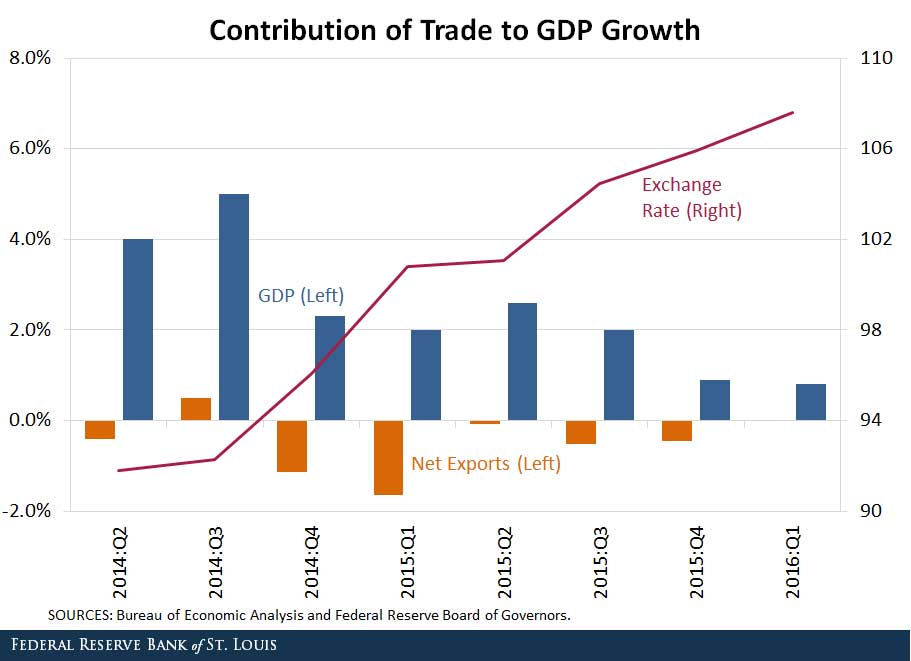

How much does international trade, in conjunction with such a sharp appreciation of the dollar, slow down the GDP growth rate? The Bureau of Economic Analysis reports international trade’s contribution to the GDP growth rate each quarter. The figure below plots the GDP growth rate, the trade component's contribution to GDP growth and the appreciation of the dollar from the second quarter of 2014 to the first quarter of 2016.1

It is clear that a strong dollar is associated with net exports contributing negatively to GDP growth. During the sample period's two-year span, trade contributed positively to GDP growth in only one quarter.

The negative impact was particularly strong over the first half of the appreciation period. For example, during the fourth quarter of 2014 and the first quarter of 2015, the contributions to the GDP growth rate from net exports were -1.14 percent and -1.65 percent, respectively. The negative effects diminished by the end of 2015, standing at -0.5 percent despite the dollar's increase in value of another 10 percent.

Imports and Exports

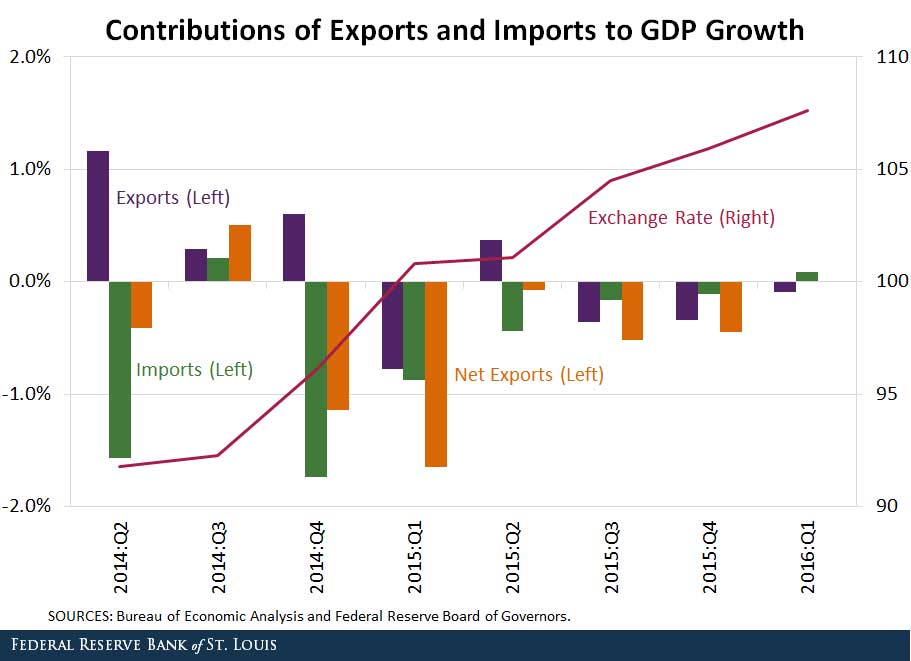

The next figure further decomposes international trade's contribution to GDP growth into exports and imports.

In response to the strength of the dollar, the contributions from imports played a much more significant role than that of exports. The cumulative contribution of imports to GDP growth was -4.6 percent, while the cumulative contribution of exports was slightly positive at 0.85 percent. This suggests an asymmetric reaction between exports and imports in response to increases in the dollar's exchange rate. Thus, it is reasonable to conclude that the slowdown in GDP growth was associated more with the growth of imports rather than the reduction in exports.

In sum, the new episode of appreciation of the dollar that began over the past several months is likely to hurt the current growth rate of GDP through an increase in imports rather than a decrease in exports if the trend from the previous period of appreciation holds.

Notes and References

1 We used the real broad trade weighted U.S. dollar index, indexed to its average over the sample period.

Additional Resources

- On the Economy: How Do Imports Affect Manufacturing Jobs?

- On the Economy: Dissecting the Falling Labor Force Participation Rate

- On the Economy: How Does Terrorism Affect Trade?

Citation

YiLi Chien and Paul Morris, ldquoDoes a Strong Dollar Slow the Growth Rate of GDP?,rdquo St. Louis Fed On the Economy, Jan. 19, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions